If you'd invested in: The Gym Group and Card Factory

Budget gym operator The Gym Group reported a 24.3% rise in revenue for 2017, while retailer the Card Factory's profits slid by 14.1%

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

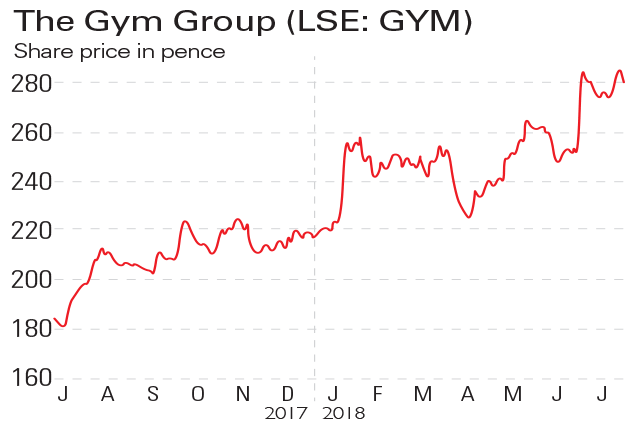

The Gym Group (LSE: GYM) operates a chain of budget gyms in the UK. Its shares jumped in January as the group reported a 24.3% rise in revenue for 2017, which was due largely to a 44% increase in the number of branches. This, however, also racked up debt, which stood at £37.5m in January, compared with £5.2m at the end of 2016. The share price then dipped in May as the group's founder John Treharne announced he was stepping down as CEO, but quickly recovered last month as the company reported it had raised £24m to buy 13 easyGym sites.

Be glad you didn't...

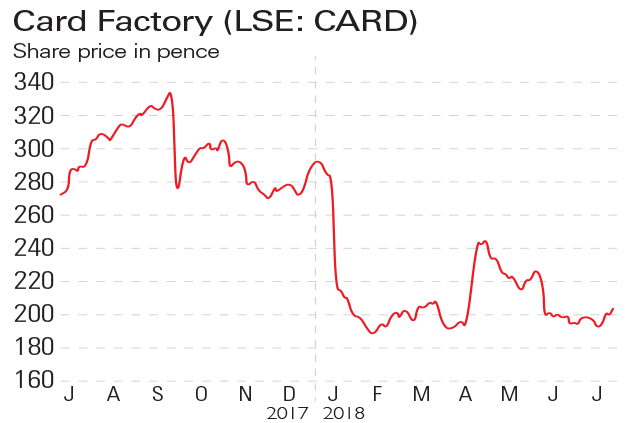

Card Factory (LSE: CARD) is a chain of greeting-card and gift stores. Its shares tumbled in September as the firm reported a 14.1% fall in pre-tax profits to £23.2m in the six months to 31 July, a consequence of the weaker pound which raised import prices and higher wage costs. The shares plummeted a further 20% in January as the firm delivered another profit warning. In April, Card Factory posted a 12.3% drop in pre-tax profits on the previous year, down to £76.2m, and said it would not return to profit growth until 2019.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King