The charts that matter: it’s all about the US dollar

As the US dollar continues to bully the currency markets, John Stepek looks at all the other charts that matter to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:Oil producers are pumping harder but don't expect oil prices to slide

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:Expect global trade tensions to get worse before they get better

Wednesday:Don't panic this is a time for sitting tight, not selling fast

Thursday:Is China's bear market a major threat to your portfolio?

Friday:Is value investing finally set to see a long-overdue comeback?

We haven't recorded a new podcast this week, but if you haven't listened to the most recent one yet, then you'll find it here.

Now over to this week's charts.

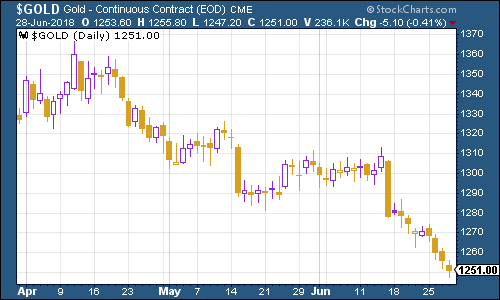

Gold is having a miserable time of it. Bearishness on the yellow metal is pretty high and despite various bits and pieces of geopolitical turmoil it can't catch a break at least, not against the US dollar. As I always say, it's worth having some in your portfolio. It's a good diversifier, and it's decent insurance against most of the things that could potentially go wrong in the financial world right now.

(Gold: three months)

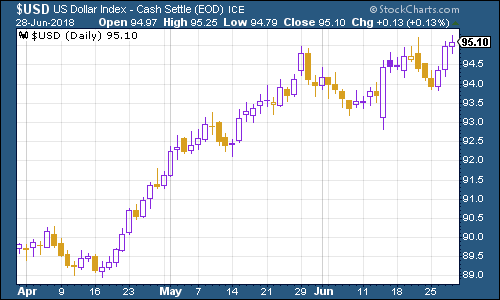

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners continues to be strong.

(DXY: three months)

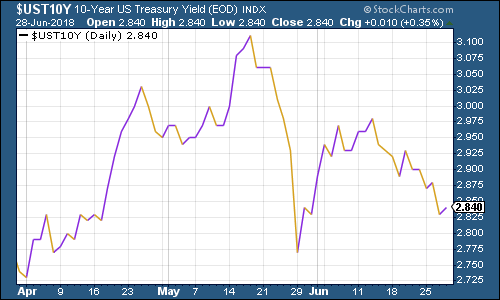

The yield on the ten-year US Treasury bond was again, little changed this week.

(Ten-year US Treasury: three months)

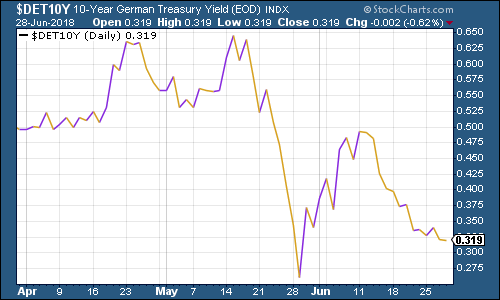

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate slipped a little, along with the US yield.

(Ten-year bund yield: three months)

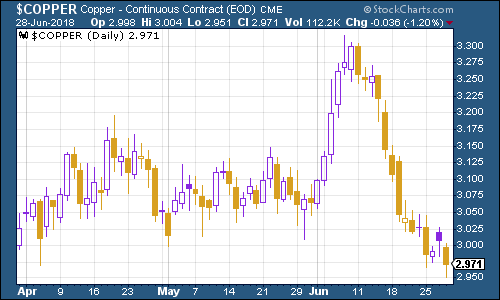

Copper continued to slide, partly due to fears over Chinese growth but mostly due to the strengthening US dollar.

(Copper: three months)

Bitcoin is steadily heading lower. It's definitely not the must-have asset anymore. The only question seems to be: how low can it go?

(Bitcoin: three months)

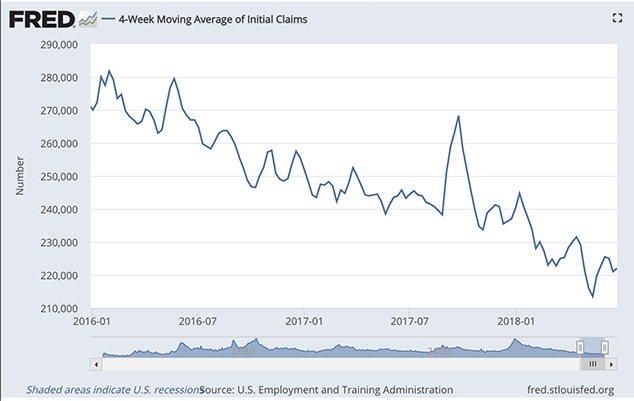

On US employment, the four-week moving average of weekly US jobless claims rose slightly to 222,000 this week, while weekly claims rose to 227,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough last month, so if there's anything to Rosenberg's observations (which are of course drawn from a limited pool of past cycles), then we should see the stock market hit new highs before this cycle is out.

(US jobless claims, four-week moving average: since January 2016)

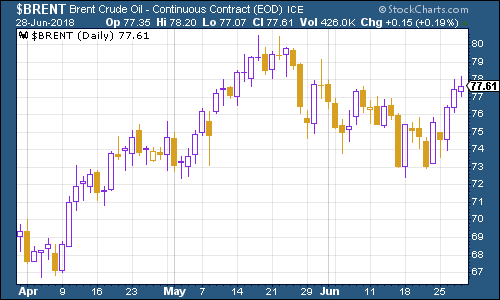

The oil price (as measured by Brent crude, the international/European benchmark) has jumped this week. Oil cartel Opec agreed to raise production. However, it looks as though the increase will not be enough to meet both growing demand, and to deal with the supply that will be lost due to Iranian sanctions.

(Brent crude oil: three months)

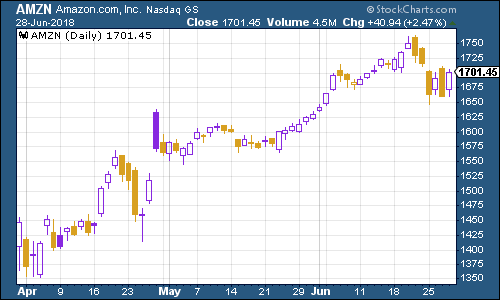

The arch-disruptor Amazon continues to bestride the US stockmarket. The company announced this week that it is buying an online pharmacy, called PillPack. Signs of Amazon taking another step into the healthcare market battered the share prices of other pharmacy groups. No one wants their industry to be disrupted although consumers love it.

(Amazon: three months)

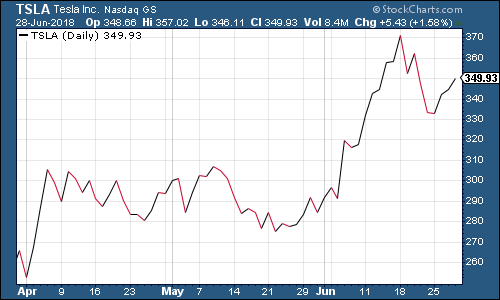

Electric car group Tesla had a remarkably quiet week, share-price-wise. This week, Elon Musk got into a Twitter spat over a farting unicorn.

No, seriously.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King