Don’t panic – this is a time for sitting tight, not selling fast

With virtually every world stockmarket pointing downwards – at least for now – how seriously should you take the threat of a trade war, and what should you do next?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's all starting to look a bit wobbly in stockmarket land.

Today we take a whistle-stop tour of the world as we attempt to understand what to make of it all.

And we ask whether it's time to get out or to wait for further information.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Stockmarkets across the globe are wobbling

It doesn't seem to matter much where you are in the world if there's a stockmarket, it's staring down the barrel of squeaky-bum time.

In the good old US of A, they'll no doubt be blaming Donald Trump and his tariff talk. That blame wouldn't be entirely misplaced, I'd say. But there is also the fact that for more than a year the American indices had been making their way from the bottom left of the chart to the top right. They were long overdue a shakeout.

Having been both up and down in 2017, the Dow is now slightly down on the year. The S&P 500 is slightly up. The Nasdaq is up around 10% (having been up around 15%). And the small caps in the Russell 2000 having had a blistering May and June are giving the Nasdaq a good run for its money.

But every single US index was hit hard on Monday.

Here in Blighty, no doubt Brexit gets the blame in what has been a very volatile year for the FTSE 100. At one stage earlier in the year, the market looked like it wanted to give us a repeat of the 2008 crash.

Then, in the spring, it confounded the bears by breaking out to all-time highs, before pulling back quite strongly over the past few weeks. Today it sits down a little on the year. The mid-caps followed a similar trajectory, but today sit a few points up on the year.

So to the continent. In Germany, I imagine it's the migrant crisis or perhaps southern Europe or perhaps trade wars which are getting the blame but the DAX, which broke out to all-time highs in January, is now down 5% on the year and, to my eyes at least, is looking decidedly weak.

As France's CAC is more or less flat on the year, there is no blame or credit to give. Italy, where there is a lot of potential blame to dish out, is only down a little on the year, having flirted with all-time highs.

Japan too is down a little on the year. Hong Kong and China, however, may also be pointing the finger of blame Trump-wards. Both started the year very well the former broke out to all-time highs. Now both are down by more than 20% from their highs and are "officially" in bear markets.

Australia, meanwhile, has been impressively strong. Canada has been very volatile (that's prime minister Justin Trudeau's fault, I imagine).

And so we complete our whistle-stop tour of the globe. One thing everywhere has in common is that just about wherever I look whether the market is up or down on the year, and no matter what the explanation given, or who is to "credit" or "blame" stockmarkets are now pointing downwards.

This seems to be particularly the case with large caps presumably because they are the stocks that will suffer most in the event of trade wars, as they tend to have the most international exposure.

The USA's largest trading partners China, Canada, Mexico (which is also now in official bear market territory), Japan and Germany are all among the weaker markets. No surprise, really, as the US runs a trade deficit with all of them: tariffs will hurt them most. (In fact, the only one of its top ten trading partners against which the US runs a surplus is the UK.)

So the question is, how seriously do we take this talk of trade wars?

Markets lack conviction right now but that doesn't mean a crash is coming

It's especially difficult to interpret current probabilities, given Trump's tendency towards hyperbole. And that appears to be what markets are thinking too the world is getting nervous about trade wars, but it can't seem to decide quite how bad they'll be.

So we have one those environments in which clear, medium-term trends are hard to define and narratives are hard to formulate. No doubt it will all look obvious in the rear-view mirror.

Those who like to trade on a daily basis might have enjoyed the whipsawing assuming they have been on the right side of the markets (no easy feat) but I must say I'm finding it all rather difficult to fathom.

Ambivalence and indecision seem to be everywhere. The inflation trade, which looked set to return, has disappeared thanks to the strong US dollar, and so the metals are looking a little jittery.

Oil, meanwhile, looked set to fall with oil cartel Opec's threats to cut production. But then the oil producers didn't cut by as much as feared, so the oil price shot up. Now it looks like it has shot up too much.

The strong US dollar took many by surprise after its weakness in 2017, but now that it's rallied, indecision has taken over once again. The euro has put in a "W-shaped" bottom (to use the technical term) and now it could be set to rally.

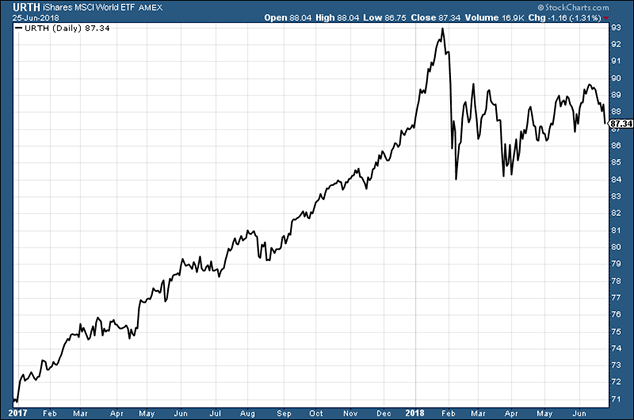

We can take the MSCI World Index as a global benchmark although note that the pattern it has mapped out is almost identical to the S&P 500. The story, as told by the chart below, is as follows.

The trend of the last week or two is down. But is that trend enough to warrant aggressive selling of core portfolio positions? I don't think so. The pattern of the past six months is that we have been stuck in a very wide range after a stellar 2017.

Markets go through these kinds of periods consolidation, indecision, range-trading whatever you want to call them.

I don't think this is a time to be running for the hills. I don't think it's a time to be buying aggressively. I'd suggest it's a time to be doing nothing. Does the reason you bought whatever you bought still apply? If not, has another good reason emerged to keep it? If not, then perhaps there is good reason to let it go.

But often such periods of weakness or lack of clarity are best negotiated by inaction. Don't know what to do? Then do nothing and let the markets resolve themselves.

It sounds like I'm giving licence to indecision. I'm not. Actively doing nothing not being drawn in and indecision are quite different.

As the ill-fated but legendary US trader Jesse Livermore said, "It was never my thinking that made the big money for me, it always was sitting."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how