The charts that matter: investors are bored with gold, but they like copper

As investors fall out of love with gold, John Stepek looks at what's happened in the last week to the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:Let's hope the gentle slowdown in house prices continues for a long time

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:What Trump's trade war means for your money

Wednesday:Which should you buy bitcoin or bitcoin cash?

Thursday:Why it can pay to follow the local press when making investment decisions

Friday:Money printing in the eurozone will soon be over what happens then?

The podcast will be back next week (sorry, I know I said that last week but we'll be recording the new one on Monday).

Now over to this week's charts.

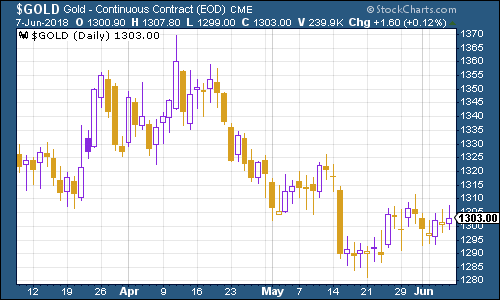

Gold is still meandering around $1,300 an ounce. Investors are notably bored with gold a piece of news from BullionVault this week crossed my desk, stating that Google searches for investing in gold have hit an 11-year low. I have to say, this is the sort of thing I'd normally take as a pretty decent contrarian signal.

(Gold: three months)

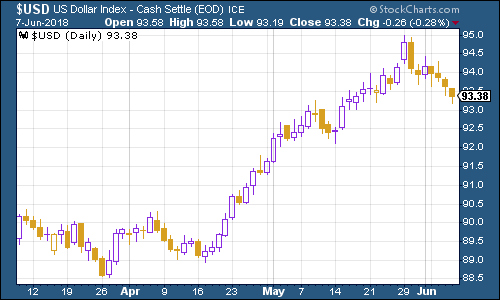

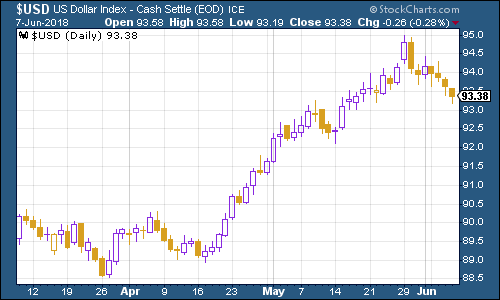

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners slid back as the euro toughened up, as Italy slipped off the front pages and the European Central Bank suggested that it might start talking about withdrawing quantitative easing as early as next week (talking that is, not actually stopping money printing).

(DXY: three months)

The yield on the ten-year US Treasury bond rebounded somewhat this week after the Italian government managed to pull a coalition together. There's still plenty to worry about on that front, but investors have put it to the back of their minds again.

(Ten-year US Treasury: three months)

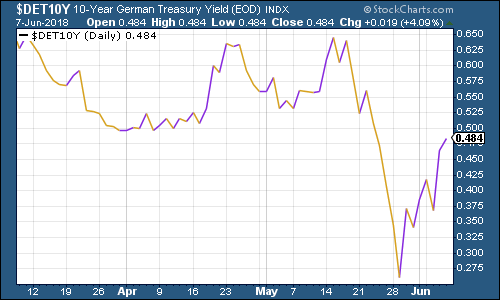

Similarly, the yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate rebounded from the low it hit amid the global panic over Italy.

(Ten-year bund yield: three months)

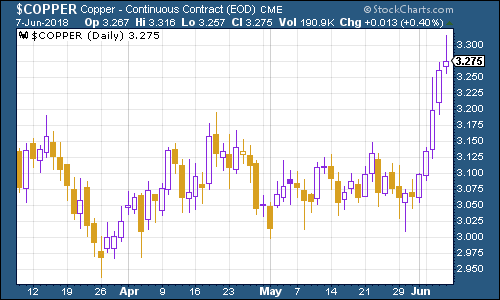

Copper surged this week, partly due to concerns of a strike at the world's biggest copper mine, Escondida, in Chile. Apparently workers in Chile are looking for a one-off bonus of $34,000 per worker. That would be the largest such bonus in Chilean history, notes The Motley Fool.

On a tangentially related note, I was reading that the US shale boom now means that workers are in such serious demand in parts of Texas that it's almost impossible to get people to fill less well-paid roles. According to Bloomberg, truck drivers are managing to make around $140,000 a year.

Is this going to spread to the rest of the world's workers? Some variation if not quite as extreme would certainly be the healthiest outcome. It would still be tricky for investors to navigate, but probably not as painful as the alternatives.

(Copper: three months)

Bitcoin had an unusually calm week, biding its time between around $7,300 and $7,800. That is a very tight range for this asset. Indeed, bitcoin volatility is close to a record low. Will that last long? When it comes to cryptocurrencies, I have nothing useful to add I still can't get the hang of what drives the price.

But my colleague Dominic Frisby pays a lot more attention to this than I do you can get his view on both bitcoin and bitcoin cash right here.

(Bitcoin: ten days)

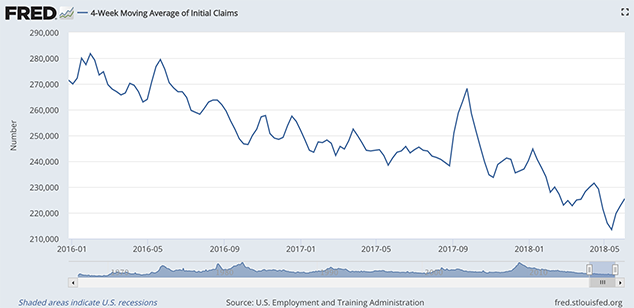

On US employment, the four-week moving average of weekly US jobless claims rose a little to 225,500 this week, while weekly claims came in at 222,000, down a little from 223,000 last week (this latter figure was revised up from the original reading of 221,000).

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough three weeks ago, so if there's anything to Rosenberg's observations (and of course, they are drawn from a limited pool of past cycles), then we should see the stockmarket hit new highs before this cycle is out.

(US jobless claims, four-week moving average: since January 2016)

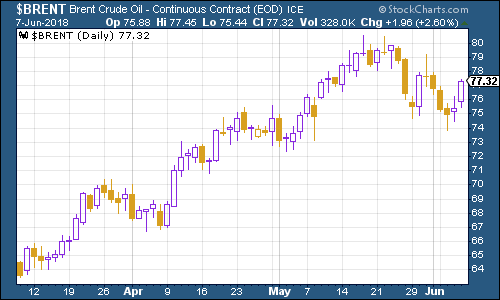

The oil price (as measured by Brent crude, the international/European benchmark) had a rebound this week amid news that while US inventories are increasing, Venezuelan production is a month behind schedule.

(Brent crude oil: three months)

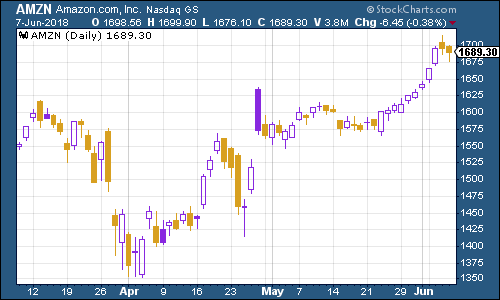

Internet giant Amazon is still the stock that no fund manager will get fired for owning, which is why everyone owns it. Interesting piece of news this week on that front Amazon has bought the rights to show 20 Premier League football matches a season between 2019 and 2022.

If you're a Prime subscriber (and if you use Amazon much, you probably are), then you'll be able to watch those matches as part of your subscription.

I'm not a footie fan so I couldn't care less from an entertainment point of view but I can see why football obsessives might get a bit fed up, as they're now looking at susbcriptions to Sky, BT and Amazon if they want to watch all the matches.

To be fair though, we're only talking ten matches on Boxing Day and ten bank holiday matches for now.

As far as investing goes I don't think this matters much for Amazon's share price this is a drop in the water as far as the company goes. As a Sky or BT investor it's not something to worry about now, as it's a minor deal. But it does show the way ahead. If Amazon likes what this does to Prime subscriptions, then it may come in at the future bidding rounds in a much more aggressive manner. And maybe the likes of Netflix will be more interested at that point too.

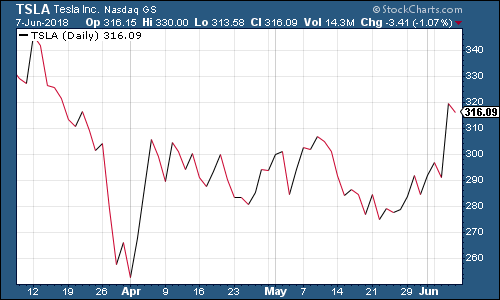

A big rally for electric car group Tesla this week. It's another good lesson to us all you can sneer at faith-based stocks all you want, but you'd better not short them while the power of belief stays strong (and interest rates stay low). Far better to remember that discretion is the better part of valour than to pick a pointless fight with a speeding luxury car.

Tesla is the most-shorted stock in the US apparently (that's according to Teslarati.com, which appears to be a news site dedicated to Tesla), and those shorts were left licking their wounds yet again this week, as Tesla boss Elon Musk put on another great performance at the AGM on Wednesday.

Musk was pretty upbeat among other things, he reckons that Model 3 production will hit 5,000 a week by the end of this month. As a result, the stock shot higher this week never mind that Musk's promises have a habit of being optimistic.

Is Tesla going to turn out to be the next Ocado? A high-tech company that appears to have no chance of ever making money, yet manages to float along on a raft of investor cash and enthusiasm until finally, something turns up?

Maybe. That doesn't make it a good investment, but like I said, don't be tempted by mere logic and reason to make a tilt at this windmill.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?