Why it can pay to follow the local press when making investment decisions

Keeping an eye on the local news can pay off for investors. Here, a tale of drug gangs, intimidation and the risky business of mining leads Dominic Frisby to an adventurous silver trade.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It seems there is a very serious situation at one of Mexico's most prominent silver mines.

Drug violence in the region is escalating, and the mine appears to have been threatened by narco gangs.

So far, the company involved denies any significant effect on its operations. And perhaps this is just "business as usual" in the one of the trickier parts of the world in which mines are located.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But what if things deteriorate? What if the English-speaking world has not understood the seriousness of what is going on?

Pan American's Mexican problem

Let me get this out of the way up front. This piece came as a result of reading renegade mining blog, IKN, and its associated newsletter. The author, who goes by the name of Otto Rock, is based in Peru and his finger is probably closer to the pulse of Latin American mining than anyone else's.

Pan American Silver (TSX: PAAS/NASDAQ: PAAS) is the world's second-largest primary silver producer. (For those who like their stats, UK-listed Fresnillo (LSE: FRES) is the largest).

Pan American has a market cap of around US$2.7bn and all sorts of mining projects dotted around the Americas, which include six producing mines and eight advanced-stage or development projects.

This year it is projected to produce over 25 million ounces of silver at around $7 an ounce, and 175,000 ounces of gold. Its balance sheet is strong with, according to its latest presentation, over $500m of "total available liquidity". It paid out a quarterly cash dividend of 3.5c earlier this year.

If you want to buy a large-cap silver miner, Pan American would probably be the first name on any Canadian broker's lips, along with First Majestic (TSX: FR/NYSE: AG). It is a firm favourite out in Toronto and Vancouver.

Pan American's largest producing mine is La Colorada. Its second largest but most valuable is Dolores, in the Chihuahua region of Mexico, which accounts for about 20% of its silver production, and, calculates the IKN Weekly newsletter, 30% of its revenue, over 40% of the company's total assets, over 60% of its mineral assets and 43% of its book value.

And that's where it has a problem. The problem is narcos.

Joaqun "El Chapo" Guzmn has been described by Forbes magazine as the "biggest drug lord of all time". The US Department of the Treasury called him "the most powerful drug trafficker in the world", while the federal government called him "the most ruthless, dangerous, and feared man on the planet". You get the picture.

In January this year, he was extradited to the US. What he left behind in the northern Mexican states of Sinaloa, Baja California, Durango, Sonora and Chihuahua is a power vacuum. Now there is horror story after horror story as the struggle for power between rival narco gang factions is spiralling out of control not for the first time in Mexico's history.

The fall out is directly affecting Dolores.

The press MoneyWeek aside, of course will always want to sensationalise a drama; a corporation will always want to underplay it. It seems we have an example of that here.

On 25 May, local papers reported that Pan American had "ordered the closure of operations and the immediate eviction of the mine" due to "narcoviolencia". An "unknown number" of private security personnel had been murdered, according to one report. The roads nearby are not safe and traffic to and from the mine has been suspended. The company was trying to fly its employees out, but the narco gangs have threatened to shoot down planes leaving the site with surface-to-air missiles. It is frightening stuff.

On 28 May, Pan American issued a news release titled "Pan American Reduces Certain Activities at the Dolores Mine". The company stated that "with the recent incidents that have occurred along the access roads, we have determined the prudent course of action is to suspend personnel movements to and from the mine until the roads are safe for our employees."

Since then there have been some 20 or so light aircraft flights a day getting workers out (six or eight at a time), according to the local rag, El Diario de Chihuahua. Even if the journey is just to the local city Madeira, they are flying rather than use the roads.

Workers who have managed to get away reported to the Associated Press that there have been beatings, threats and shots fired, that they are afraid the gangs are going to enter the premises. Some have vowed never to go back. The situation started to deteriorate about a month ago, they say.

Pan American issued no further releases until 4 June, when it provided an update, saying that the "security situation on the access roads" had improved, "following increased patrol and enforcement by the Mexican authorities".

This has enabled "road transport of diesel fuel, cement and other supplies to the mine" to be resumed. The company did not previously mention, as far as I can see, that these had been stopped. It only mentioned personnel. The local press also notes that these these supply trains were accompanied by heavily armed police convoys.

As far as staffing goes, Pan American adds that it will "increase the use of its private, secured airstrip to transport people to and from the mine site until the situation normalises."

The release also reassures investors that production has been able to continue during the slowdown, because of its large stockpiles of ore. As a result, "at this time, the company does not expect a material impact to its annual production guidance for 2018".

All in all, the company seems to be spinning this as a temporary problem. And maybe it is. Certainly, that's the way the market sees it.

Here's a trade that could pay off, regardless of what happens next

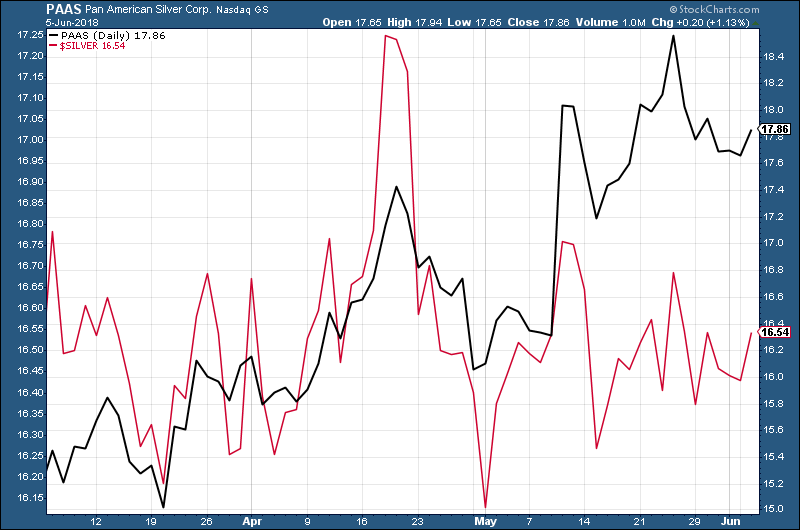

Here we see Pan American over the course of this year, with silver behind in red. While silver has been flat, Pan American has risen. It is as though nothing is the matter.

The company is, I expect, hoping that the issue can be resolved before those stockpiles of ore can are run down and production is affected. According to another local story, the mine is currently running at 70%. I've spoken to other miners I know who operate in Mexico and they have said this is "normal for Mexico".

The gap in the tone between the corporate press releases and the rather more sensational local news stories is only to be expected. But what if the situation fails to resolve, but deteriorates?

Dolores is the company's most valuable asset. It cannot sit idle. If it does, the impact could be considerable.

If you buy the local newspapers' version of events, or something closer to it, the obvious trade here is to short Pan American. However, this is risky. The situation could pass and Pan American could emerge unscathed. Silver could rally (and I see that as a possibility), which could also carry Pan American up.

Another method is to buy silver and sell Pan American. If silver falls, Pan American should too anyway. It's possible that they will both rise or both fall in which case you are hedged. For me assuming these issues escalate then the most likely is that silver rises or stays flat, while Pan American falls.

Over to you, Mr Market

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?