Games Workshop: the gaming giant makes a comeback

Wargamers love Games Workshop, but investors have had the most fun recently. Richard Beddard explains what behind the company's turnaround in fortunes.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wargamers love Games Workshop, but investors have had the most fun recently

Games Workshop (LSE: GAW), a manufacturer and retailer of models for collectors and wargamers, has emerged from a decade of turmoil to achieve astonishing growth. Can it keep going?

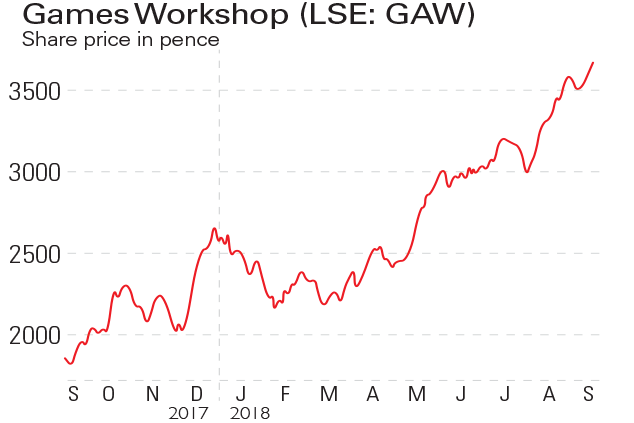

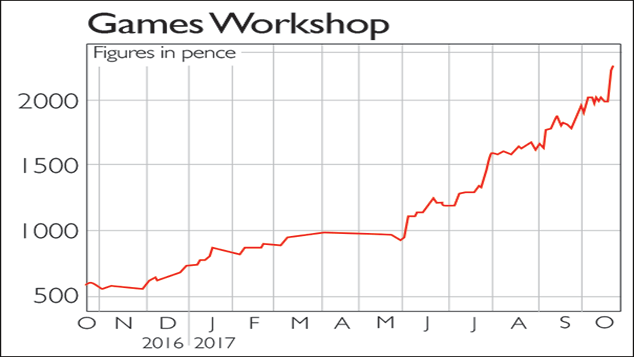

Being a Games Workshop shareholder for the last two years has been an exhilarating experience. In the year to May 2017, the company earned 34% more revenue and a little more than twice as much profit as it did the previous year. Earlier this month, it announced that in the 11 months to the end of April 2018, revenue and profit were higher than already high expectations set earlier in the year. The company's broker thinks it will almost double profit again (the firm publishes results for the full year in July).

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you'd asked me, a long-term shareholder, whether I thought revenue and profit would explode so dramatically, I'd have probably said something flippant. Anything is possible, but over the previous decade, Games Workshop had barely grown revenue at all and although highly profitable, profitability fluctuated quite wildly.

For those lucky or prescient enough to own the shares, or contemplating buying them now, the big question is whether Games Workshop is experiencing a blip in demand that will subside, a one-off surge in profitability that will level off, or the beginning of asustained expansion.

This time is different

It's true that Games Workshop has flattered to deceive in the past. A decade ago it launched a Lord of the Rings game to tie in with the popular films. A surge in growth encouraged the firm to expand rapidly, but the interest in the game didn't last much longer than interest in the films did, and the company was left with more stores, staff and products as well as higher costs.

This time is different. Then the film franchise, a force outside Games Workshop's control, drove revenue and profitability up and down although management errors exaggerated the effect. Its recent transformation is the result of a large number of good decisions made within the firm, many of them unpopular with customers at the time.

Games Workshop changed its raw material from metal to resin, which reduced costs and increased the fidelity of the models. It scaled many of its stores down to low-cost one-man operations, axed an entire layer of middle management, and closed most overseas sales offices, preferring to run things from its Nottingham HQ. It relaunched the long-running Warhammer game system as Warhammer Age of Sigmar, which essentially wiped the slate clean. The new system is simpler, more exciting, and free to start, which, along with more attractive pricing, encouraged people to buy more models. Warhammer 40,000, the more popular futuristic sibling to Warhammer, has also been updated.

What's more, the company's highly commercial culture has been tempered. This culture had been alienating fans in recent years, but the firm now seems to have made peace with its customers (see box below).

Cheap if growth lasts

Adjusting for debt, the shares trade at around 31 times profit in the year to May 2017, which looks expensive. However, the results for the year to May 2018 are all but in, and we already know profit has grown substantially. The shares now probably cost about 17 times the profit that will be earned in the year to May 2018.

Volatile results like these expose the weakness of the price/earnings (p/e) ratio as a valuation metric. The p/e ratio pegs value to just one year's profit, and one year's profit could easily be anomalous.If Games Workshop achieves the forecasts and grows only modestly from there, the shares are unambiguously cheap. If it doesn't, they may not be.

In the short term, there is a risk to profit. Profit growth has outstripped revenue growth because Games Workshop's factory is more efficient at pumping out models in higher volumes. If gamers and modellers become satiated with new products and demand declines, the effect will reverse. There's no sign of that yet though, and Games Workshop stands ready with the second edition of Age of Sigmar, new stories, new rules and new models. This launches in June.

Above all, in Warhammer, Games Workshop is the monopoly producer of a gaming and modelling hobby that has stood the test of time. It controls almost every aspect of the business, from manufacture to the books and magazines that promote it. It has a lucrative sideline licensing Warhammer stories and characters to computer and smartphone games companies.

These qualities have always been apparent to shareholders, but other aspects of the business have changed for the better recently. Whatever the next few years bring, my money is on long-term growth.

Kicking the tyres talk to the fans

Launched 35 years ago, Warhammer serves fans around the world online and through nearly 500 Warhammer stores, plus independent retailers. This makes it easy to kick Games Workshop's tyres. The stores are operated by enthusiasts and they're incredibly forthcoming if you catch them at a quiet moment. Gamers and modellers are keen to post their views all over the internet.

My local store confirms a story I've seen written in Games Workshop's results and talked about in YouTube fan videos. The company is giving them what they want. Three years ago, the buzz around Games Workshop was much more negative. Fed up with price increases, and a focus on increasingly intricate models costing hundreds of pounds, they petitioned the company to refocus on the games. Online forums filled with criticism and, save for its online store, Games Workshop had all but removed itself from the internet.

Now it's easier and cheaper to start playing the games, which are gateways to the hobby. Games Workshop is operating a new Warhammer community website, produces more than one video a day for hobbyists, and boasts of rapidly increasing traffic on its social media sites. It's amazing the difference it makes when a company listens to its customers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

If you'd invested in: Games Workshop and Connect Group

If you'd invested in: Games Workshop and Connect GroupFeatures Nottingham's Games Workshop has doubled its share price in the last year, while that of newspaper distributor and logistics firm Connect Group has slumped by two-thirds.

-

If you’d invested in: Games Workshop and Imperial Brands

If you’d invested in: Games Workshop and Imperial BrandsFeatures Games Workshop makes and retails tabletop war games. Last week the Nottingham-based company said strong sales had boosted its profit expectations.