If you'd invested in: Motorpoint and Low & Bonar

Revenue is rising at vehicle retailer Motorpoint, while materials manufacturer Low & Bonar has seen profits slide.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

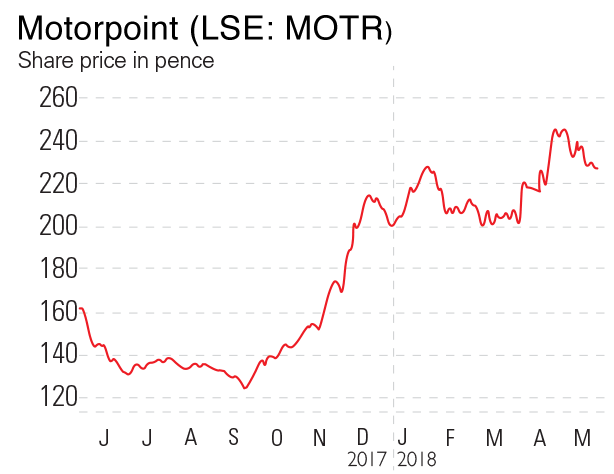

Motorpoint (LSE: MOTR) retails vehicles in the UK. The firm's shares rose in November as it reported a 18% rise in revenue in the six months to September 2017, up to £483.2m. Pre-tax profits also rose from £2.4m in 2016 to £9.7m this year. In April, its shares rose again after it said that full-year profits should be "at the upper end of market expectations". The UK's car market has seen declining demand for new cars this year and that has boosted Motorpoint's division selling nearly new vehicles, the majority of which are up to two years old and have covered fewer than 15,000 miles.

Be glad you didn't buy...

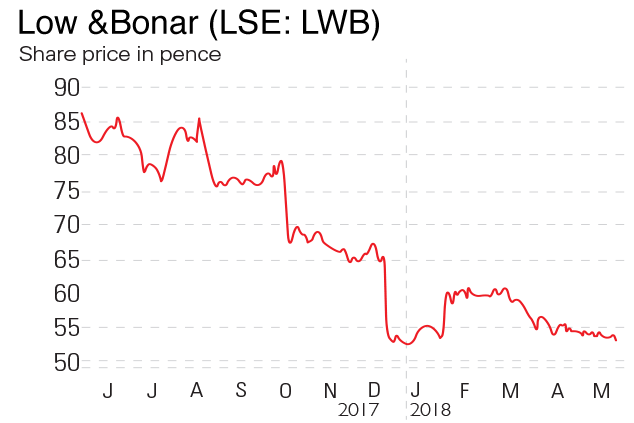

Low & Bonar (LSE: LWB) manufactures materials such as floors, fabrics and plastics. Its shares plunged 19% in October after the firm warned that ongoing problems at its civil-engineering arm were compounded by rising material costs, leading it to a loss this year. The shares tumbled a further 23% in December on the news that the CEO who had been with the firm for three years had resigned to join polymer technology firm Fenner. Low & Bonar said that full-year profits would be £30m-£31m, lower than the expected £32.18m, due to a weak final quarter.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King