Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

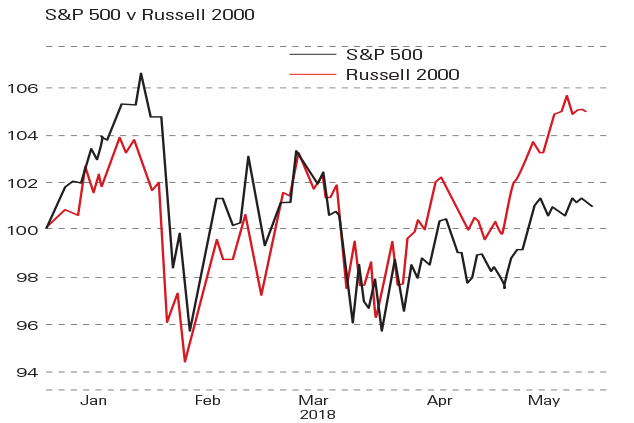

The Russell 2000 small-cap index has gained 6% since 1 January; the S&P 500 index of blue-chips is barely in the black. The prospect of higher interest rates often sends investors back into large caps, as they are solid firms that tend to cope better with dearer money. But several factors are now fuelling demand for higher-risk, higher-reward small caps. The recovery in the dollar squeezes the large-caps' foreign earnings, while smaller firms are more domestically orientated; their import costs are now lower. The US economy has looked sprightlier than its major counterparts recently. Small caps also stand to benefit more from the corporate tax cut, which will represent a bigger proportion of their earnings.

Viewpoint

"[Even] the weak pace of growth that Britain has experienced recently appears to have been driven by personal consumption and households are financing that consumption with their savings rather than with income If Britain is to prosper, growth needs to come from getting companies to invest and from selling more goods and services [overseas]... uncertainty over Brexit is affecting business investment, and for good reason. Investing in plant and equipment or engaging in hiring plans is a long-term commitment. It can't be switched on and off. [Firms]... rationally are waiting to judge what opportunities are available when Britain has left the European Union. So long as the government is unclear on this point, the economy is likely to continue [stagnating], save only for further consumption driven by... savings. That's no basis for a healthy economy."

Oliver Kamm, The Times

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King