If you'd invested in: BHP Billiton and Medica Group

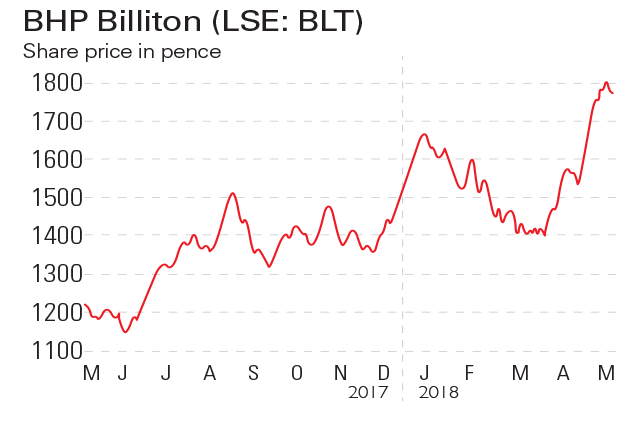

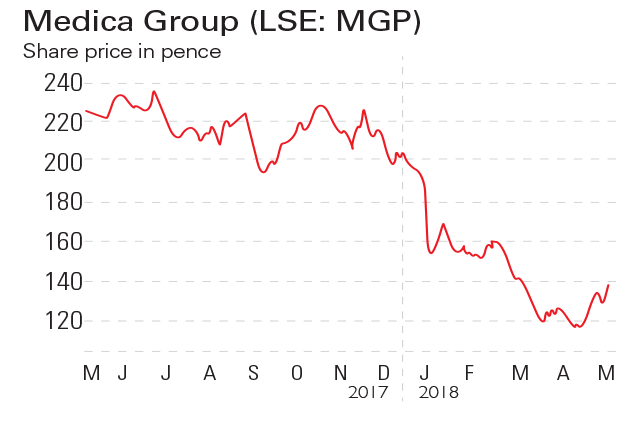

Mining giant BHP Billiton has seen its share price more than double since the beginning of 2016, while radiology services provider Medica has seen its own price plunge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

BHP Billiton (LSE: BLT) is an Anglo-American mining, metals and petroleum company headquartered in Australia. Its share price has more than doubled since the beginning of 2016. In August last year, the firm reported a surge in annual profits, up from $1.2bn to $6.7bn, as it benefited from a 32% rise in iron ore prices, as a result of greater demand from Chinese steelmakers. It also slashed net debt by nearly $10bn from $16.3bn. Earlier this year, the mining giant reported a 25% rise in underlying half-year profit to $4.05bn, and handed an extra $800m to shareholders.

Be glad you didn't buy...

Medica Group (LSE: MGP) provides radiology services in the UK. Its share price plunged at the start of the year as it warned that full-year results would be "slightly behind market expectations", which it partly blamed on capacity constraints. Despite positive annual results since, the shares have not recovered. For 2017, Medica reported an 18.2% rise in group revenue, as its NightHawk out-of-hours remote radiologist service delivered sales growth of 24.1%. This contributed to a 51% jump in adjusted profit after tax to £7.52m, up from £4.98m for 2016.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

No one cares about the oil market – that’s why it’s a good time to invest

No one cares about the oil market – that’s why it’s a good time to investFeatures The best time to invest in a market is when things are quiet. And right now, there’s no market quieter than oil. Dominic Frisby picks the best way to buy in.

-

BHP Billiton struggles with the diet

BHP Billiton struggles with the dietFeatures The mining giant navigated a commodities slide by shedding baggage. Is it in good enough shape for the uphill climb to come? Alice Gråhns reports.

-

BHP Billiton doubles down on its mining strategy

BHP Billiton doubles down on its mining strategyFeatures As commodities prices rise, the giant miner is ramping up production. Is that the right strategy, asks Alex Williams.

-

Painful changes at the miners

Painful changes at the minersNews Mining company Anglo American scrapped its dividend after overtaking commodities giant Glencore as the worst-performing stock in the FTSE 100 this year.

-

BHP Billiton hit by disaster in Brazil

BHP Billiton hit by disaster in BrazilNews Shares in BHP Billiton plunged after a collapse in a mine in Brazil left four dead and 22 missing.

-

Is the gloom overdone on mining stocks?

News As China-related panic spread this week, the mining sector slid. BHP Billiton, Anglo American and Glencore all fell by more than 7% on Monday.

-

BHP dismantles the empire

News Mining giant BHP Billiton is to spin off some assets into a separate company, allowing it to focus on its most profitable businesses.

-

Shares in focus: Should you buy this mining behemoth?

Shares in focus: Should you buy this mining behemoth?Features Investors have rightly been nervous of miners. Is BHP Billiton different? Phil Oakley investigates.