Shares in focus: Should you buy this mining behemoth?

Investors have rightly been nervous of miners. Is BHP Billiton different? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Investors have rightly been nervous of miners, but BHP Billiton is different, says Phil Oakley.

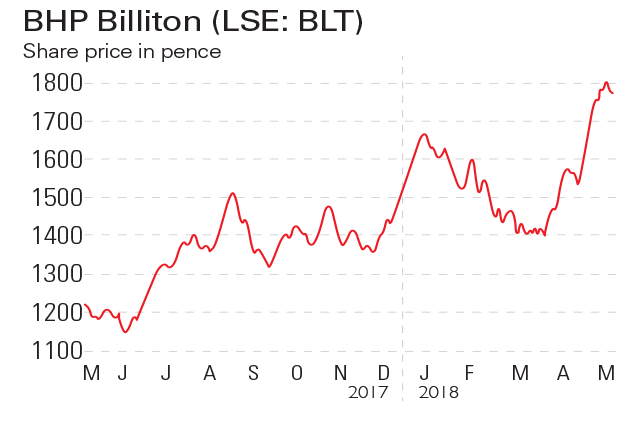

It might not feel like it, but anyone who has owned shares in miner BHP Billiton for the last ten years has done very nicely. With all dividends reinvested, the shares have returned 445% over the last decade, compared with 135% for the FTSE All-Share index on the same basis.

The last five years have not been as kind. You'd still have made money, with total returns of 88%, but a stock-market tracker fund would have been a better investment (up 104%).

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How times have changed. Before the financial crisis, mining companies such as BHP were the kings of the stock market.

The stunning growth of the Chinese economy and other emerging markets, combined with investors putting more of their money into commodities, saw their profits and share prices soar. But like most things in life, what goes up quickly can come down just as fast if not faster.

The sensitivity of profits to changes in commodity prices is a double-edged sword. Having been burned after the commodity bubble burst, it seems that many investors lost faith in mining companies. They have no idea what profits will be from one year to the next and find them difficult to value.

For many, the miners have become trading stocks to buy and sell, depending on whether people think China's economy is roaring away or going to the dogs.

These are legitimate concerns it is quite understandable why many people give mining stocks a wide berth. However, should all mining shares be tarred with the same brush?

How the company has fared

BHP and most of the mining sector has been guilty of thinking and acting in this way. During the last five years just over $107bn of cash has come in to the business from selling commodities such as oil, iron ore, copper and coal.

The trouble is that BHP has been spending more money on new projects, paying interest on its debt, and shelling out for taxes. So there's been no cash left over. Although it has been paying a rising dividend, this is ultimately unsustainable if the amount of cash going out keeps on being more than the amount of cash coming in.

Why BHP stands out

As long as commodity prices don't take a steep nose dive, this should mean that the amount of surplus cash generated by the company (known as free cash flow) could increase significantly and boost future dividend payments.

However, what makes BHP arguably more attractive than perhaps many other mining companies is that its profits are spread out across different types of commodities, which makes it more diversified and therefore less risky than single-product miners. Sure, iron ore still accounts for around half of its profits, but for now the outlook here is quite positive.

The Chinese government is currently cracking down on pollution, forcing steelmakers to buy higher-grade iron ore for their smelters. This is good news for the likes of BHP, which produces and sells what they need.

Unlike other mining companies, though, BHP also has a significant oil business that provides a good source of cash flow while adding some welcome stability to the company's profits. Last year its oil business accounted for more than a quarter of BHP's total trading profits a proportion that could well grow in the years ahead.

The company has some solid oil assets in Australia that underpin the business, and it is hoping to boost growth by investing heavily in US shale gas.

Some oil companies, such as Shell, have failed to make their investments in shale gas pay off, but BHP reckons that in a few years' time its investments could be churning out $3bn of cash flow a year. Time will tell.

Should you buy the shares?

The relatively stable oil profits arguably make this dividend a lot safer than many on offer elsewhere, and provide a decent tangible return from owning the shares. This should make the shares less risky than other miners, where returns are more reliant on their share prices going up.

If the company can stay disciplined with its investments and keep a tight rein on costs, there's the possibility for some dividend growth too. The company is in good shape financially and has a sensible amount of debt, which means that interest payments aren't eating too much of the shareholders' lunch right now.

Miners are not for the nervous, but with the shares trading on just over 11 times June 2014 earnings, BHP doesn't look particularly expensive just now. A decent yield and diversified profit stream makes BHP the pick of the big mining companies to own.

Verdict: buy for the dividends

BHP Billiton (LSE: BLT)

What the analysts say

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

No one cares about the oil market – that’s why it’s a good time to invest

No one cares about the oil market – that’s why it’s a good time to investFeatures The best time to invest in a market is when things are quiet. And right now, there’s no market quieter than oil. Dominic Frisby picks the best way to buy in.

-

BHP Billiton struggles with the diet

BHP Billiton struggles with the dietFeatures The mining giant navigated a commodities slide by shedding baggage. Is it in good enough shape for the uphill climb to come? Alice Gråhns reports.

-

If you'd invested in: BHP Billiton and Medica Group

If you'd invested in: BHP Billiton and Medica GroupFeatures Mining giant BHP Billiton has seen its share price more than double since the beginning of 2016, while radiology services provider Medica has seen its own price plunge.

-

BHP Billiton doubles down on its mining strategy

BHP Billiton doubles down on its mining strategyFeatures As commodities prices rise, the giant miner is ramping up production. Is that the right strategy, asks Alex Williams.

-

Painful changes at the miners

Painful changes at the minersNews Mining company Anglo American scrapped its dividend after overtaking commodities giant Glencore as the worst-performing stock in the FTSE 100 this year.

-

BHP Billiton hit by disaster in Brazil

BHP Billiton hit by disaster in BrazilNews Shares in BHP Billiton plunged after a collapse in a mine in Brazil left four dead and 22 missing.

-

Is the gloom overdone on mining stocks?

News As China-related panic spread this week, the mining sector slid. BHP Billiton, Anglo American and Glencore all fell by more than 7% on Monday.

-

BHP dismantles the empire

News Mining giant BHP Billiton is to spin off some assets into a separate company, allowing it to focus on its most profitable businesses.