No one cares about the oil market – that’s why it’s a good time to invest

The best time to invest in a market is when things are quiet. And right now, there’s no market quieter than oil. Dominic Frisby picks the best way to buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Boring is good, when it comes to investing.

Buy when markets are quiet, when they're asleep, when nobody cares. You'll get a better price. Your investment decision will more likely be informed than emotional. You can buy on your terms at your speed.

Buy right, sit tight, and wait for markets to catch alight. Then sell. Boss the damn thing.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So which market is asleep at the moment?

I'll tell you which market's asleep.

Oil...

The market couldn't care less about oil

Who cares about oil? Who's even talking about it? This could be a reflection of my own little echo chamber, of course, but in all that I'm reading, in all my social media and news, oil is very much not the sujet du jour.

I only noticed that oil had not entered my thinking for weeks or more when on Monday, it popped up on my Twitter feed that there had been an oil discovery of elephantine proportions in the United Arab Emirates: seven billion barrels of crude oil and 58 trillion standard cubic feet of conventional gas.

The UAE's Supreme Petroleum Council revealed the discovery at a meeting in Abu Dhabi on Monday. And it brings the UAE's total reserves to 105 billion barrels of crude and 273 trillion cubic feet of conventional gas, moving it from seventh to sixth place in terms of global oil and gas reserves.

To put that discovery in some kind of perspective, the world's biggest oil field, Ghawar in Saudi Arabia, has some 70 billion barrels of reserves (more than all but seven other countries, according to the Energy Information Administration) and produces five million barrels a day (5% of global daily demand). Burgan in Kuwait also has around 70 billion barrels of reserves, but its production is "only" 1.1 million to 1.3 million barrels per day.

However, Ghawar and Burgan are extraordinary. Slide down the rankings and you find the world's fourth biggest field, Rumaila in Iraq, has just 18 billion barrels. The fifth biggest, West Qurna-2, has 13 billion.

So this seven billion addition to Abu Dhabi's reserves (the discoveries seem to have taken place across multiple fields) is by no means insignificant.

So you might have expected the oil price to sell off a little on the news. It didn't it shrugged and rose a percentage point or two.

Global oil consumption stands at around 100 million barrels per day, or 36 billion per year. Oil demand has risen by something like 15% over the past decade. (It was 86 million barrels per day in 2010).

You might have expected consumption to have fallen or at least flatlined with all the research and subsidies that have gone into alternative energy, but that hasn't been the case. The bottom line is that around 85% of the world's energy comes from burning hydrocarbons.

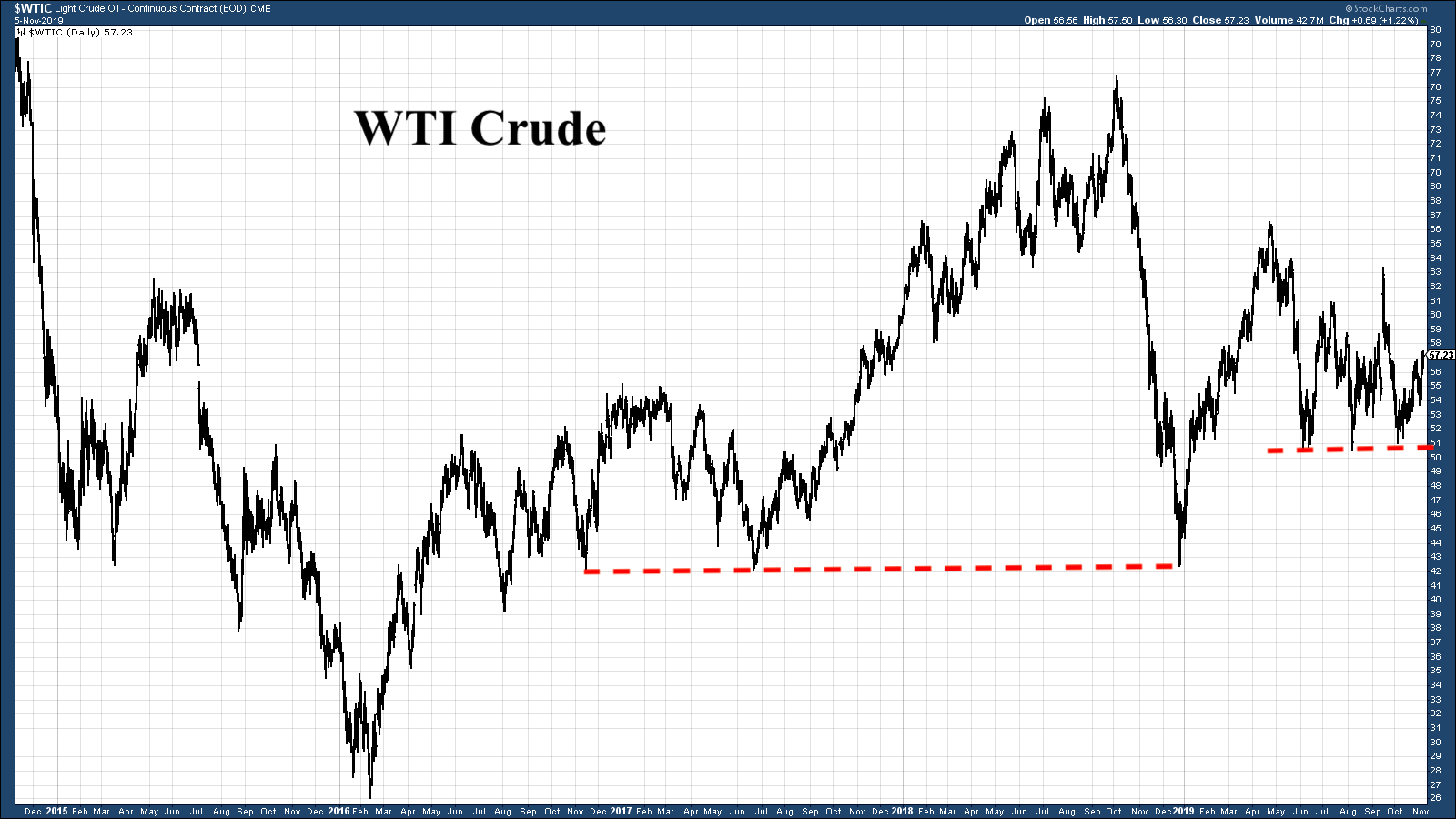

Here, so you can see the price action, is the price of WTI crude oil over the past five years. It's currently sitting around $57 a barrel. Brent follows the same trajectory but sits a few dollars higher at just shy of $63.

I've drawn those two dashed red lines to show what look like fairly strong areas of support at around $40, or just above. And more recently the latter part of 2019 seems to have given us another base around $51.

While oil has been in a mini uptrend since early October, on an intermediate term basis it is still in a downtrend which goes back to the highs of October 2018 at $78 a barrel. However, looked at over a five-year basis, oil is somewhere in the middle of a fairly broad range.

It's amazing to think that in 2008, speculative frenzy took oil to $147 a barrel. In many ways that move precipitated the financial crisis. At $57, we are a long way from that now. Given all the money-printing that has gone on since then, you have to say that if oil goes off on one of its runs, $57 will look pretty cheap.

We still use a lot of oil

Look at long-term charts of global consumption. Sure, you might see that one year is down on another by a few percent, but the broader trend is very much up. It grows incrementally year by year.

For all the breakthroughs in alternative energy, oil is still by far and away the best energy source we have. In five or ten years' time, global oil consumption will be another 15% higher than it is today.

It really won't take that much disruption to spark a rally. Trade wars, conflict or most likely of all in my view some kind of organised environmental activism.

What really drove the bull market of the 2000s was the Peak Oil narrative. This idea that we had passed peak production, that the world's oil supplies were running out. A combination of the 2008 financial crisis and then improved extraction techniques in North America killed that narrative.

But the truth remains there is not an infinite supply of oil. Even if we get better at extracting it, with every day that passes resources get smaller.

The Peak Oil narrative could come back. Or some new story will come along to drive another rally. A bull market needs a story, and oil doesn't really have one at the moment. That won't be the case forever.

The US posts its first petrol trade surplus in over 40 years

By the way, a little bit of trivia for you: for the first time since 1978, the US just recorded a surplus in the petroleum trade. US government data yesterday showed a $252m surplus for September.

Petroleum exports were $14.966bn and imports were $14.714bn. As a result, although both exports and imports were lower than in August, the US got its first oil trade surplus in 41 years.

As for how to buy oil, the conventional portfolio manager's answer is BP or Shell. The dividends are attractive, but strangely you don't always get the upside when oil goes on one of its runs.

I don't like the exchange-traded funds (ETFs). Those that track the oil price get hit by the vagaries of the futures markets backwardation and contango and those that track the companies such as the iShares Oil and Gas Exploration and Production ETF (LSE:SPOG) give you all the downside of a falling oil price and not enough of the upside.

So you find yourself taking on individual company risk, when what you really want is exposure to the oil price.

As mentioned before on these pages, my preferred vehicle is not actually known as an oil producer, but as a miner, even though oil happens to be its single biggest product. BHP (LSE: BHP) does what the ETFs should do. The risk is that when metals prices take a hit, so will BHP.

If you know of a better vehicle please let me know on Twitter!

Dominic Frisby's new book Daylight Robbery How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere. If you want a signed copy and what could make a nicer Christmas pressie? you can order one here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

The markets say sell, but should investors listen?

The markets say sell, but should investors listen?Analysis As fear grips markets around the world, investors need to have an honest conversation about what they’re comfortable with owning.

-

As global powers fight it out, commodity prices are set to rocket

As global powers fight it out, commodity prices are set to rocketAnalysis Commodity prices have been held down by globalisation. This trend is now rapidly reversing.

-

Is gold cheap relative to equities?

Is gold cheap relative to equities?Analysis Dominic Frisby looks at the Dow-gold ratio and explains why gold is starting to appear inexpensive compared to equities.

-

Are we heading for a commercial property crash?

Are we heading for a commercial property crash?Analysis The pandemic has reduced the demand for office spaces and permanently changed the office environment. But John Stepek says rising interest rates are a bigger threat to commercial property right now.

-

Is the oil market heading for a supply glut?

Is the oil market heading for a supply glut?Analysis Many people assume that the high oil price is here to stay – and could well go higher. But we’ve been here before, says Max King. History suggests that supply will increase to more than meet demand.

-

Why has the Terra stablecoin broken its US dollar peg and should you care?

Why has the Terra stablecoin broken its US dollar peg and should you care?Analysis The Terra stablecoin is supposed to match the value of the US dollar – but its value has crashed. John Stepek explains what it means for you and your investments.

-

Alphabet and Microsoft look like gems in the rubble of the tech sector

Alphabet and Microsoft look like gems in the rubble of the tech sectorAnalysis Tech stocks have fallen hard this, with the Nasdaq index down 22% since November. But both Alphabet and Microsoft are still both worth a look, says Rupert Hargreaves.

-

The UK’s new energy strategy has been revealed – here’s how you can profit

The UK’s new energy strategy has been revealed – here’s how you can profitTips The UK has just released details of its long-term energy strategy, which emphasises offshore wind power. Rupert Hargreaves explains how you can invest.