Is the gloom overdone on mining stocks?

As China-related panic spread this week, the mining sector slid. BHP Billiton, Anglo American and Glencore all fell by more than 7% on Monday.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As China-related panic spread this week, the mining sector slid. BHP Billiton, Anglo American and Glencore all fell by more than 7% on Monday, and have each slumped by between 33% and 60% over the past year as base-metal prices have crashed.

China buys 45% of the world's industrial metals. Glencore reported a 56% fall in earnings in the first half. Sliding prices wiped 71% off Rio Tinto's first-half profits. This week Antofagasta saw profits plunge by 49% as it announced more cost-cutting. BHP Billiton impressed the markets by vowing to maintain or grow its dividend despite a 61% drop in operating profits to £8.7bn.

What the commentators said

Cost cuts are a key reason the likes of BHP have been able to keep growing payouts, said John Foley on Breakingviews.com. "But for how long? Growth must come from somewhere." BHP, Anglo and Rio all yield around 8%, far more than the FTSE 100's 4%. That suggests investors are sceptical they can keep it up. Note that Australian miner Fortescue has just cut its payout. The big miners could take on debt or reduce investment, but in the longer term, committing to ever-increasing dividends "makes sense only if prices rise with time".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But that's perfectly plausible, said Julian Jessop and Mark Williams of Capital Economics. In the past year, commodity prices have slumped by almost as much as they did in 2009, when we were in a global recession. Yet the economic data have been nowhere near as bad the pessimism in raw materials is overdone. Surely, agreed Frik Els on Mining.com, the slowdown in China as it shifts from investment to consumption-led growth has been priced in by now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

No one cares about the oil market – that’s why it’s a good time to invest

No one cares about the oil market – that’s why it’s a good time to investFeatures The best time to invest in a market is when things are quiet. And right now, there’s no market quieter than oil. Dominic Frisby picks the best way to buy in.

-

BHP Billiton struggles with the diet

BHP Billiton struggles with the dietFeatures The mining giant navigated a commodities slide by shedding baggage. Is it in good enough shape for the uphill climb to come? Alice Gråhns reports.

-

If you'd invested in: BHP Billiton and Medica Group

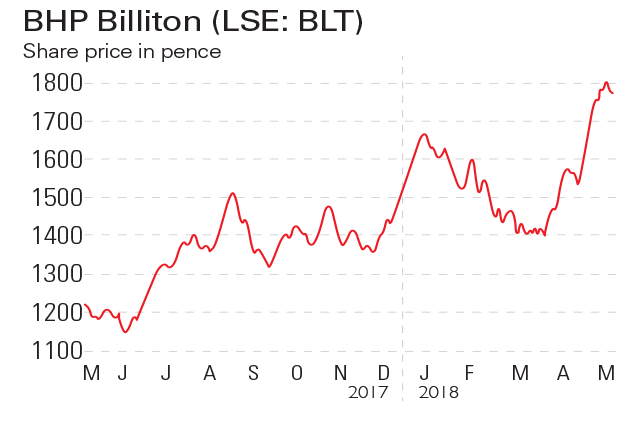

If you'd invested in: BHP Billiton and Medica GroupFeatures Mining giant BHP Billiton has seen its share price more than double since the beginning of 2016, while radiology services provider Medica has seen its own price plunge.

-

If you'd invested in: Anglo American and Northgate

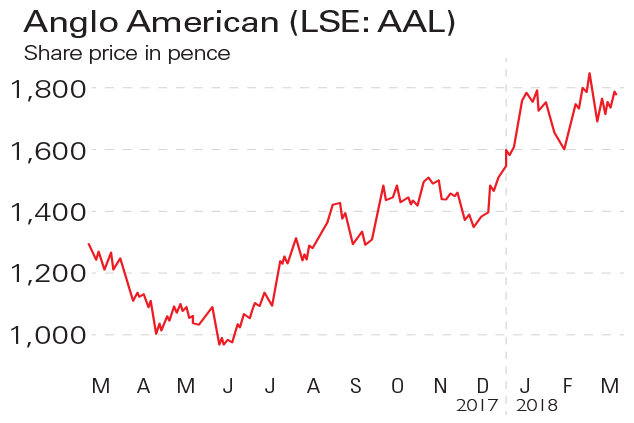

If you'd invested in: Anglo American and NorthgateFeatures Miner Anglo American has seen its share price quadruple, while vehicle-hire firm Northgate has suffered a slide in profits.

-

BHP Billiton doubles down on its mining strategy

BHP Billiton doubles down on its mining strategyFeatures As commodities prices rise, the giant miner is ramping up production. Is that the right strategy, asks Alex Williams.

-

Painful changes at the miners

Painful changes at the minersNews Mining company Anglo American scrapped its dividend after overtaking commodities giant Glencore as the worst-performing stock in the FTSE 100 this year.

-

BHP Billiton hit by disaster in Brazil

BHP Billiton hit by disaster in BrazilNews Shares in BHP Billiton plunged after a collapse in a mine in Brazil left four dead and 22 missing.

-

Metal prices could be set to bounce back – here’s how to profit

Metal prices could be set to bounce back – here’s how to profitFeatures Metal prices have been battered, and with them mining stocks. But they could both be about to bounce back. Dr Matthew Partridge explains why.