If you'd invested in: Anglo American and Northgate

Miner Anglo American has seen its share price quadruple, while vehicle-hire firm Northgate has suffered a slide in profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

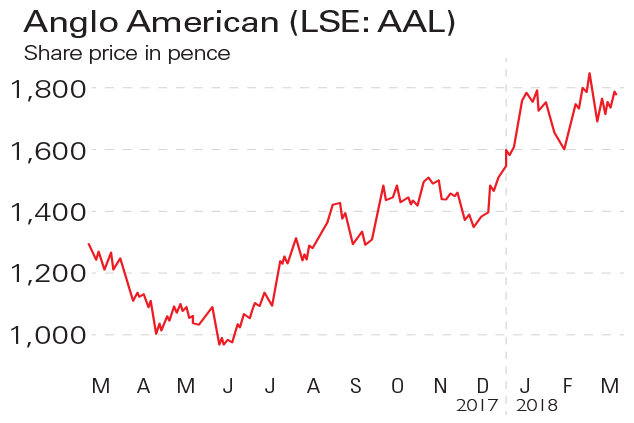

Anglo American (LSE: AAL) is a mining firm with operations on all continents. Its share price has almost quadrupled in the past two years. Last month the firm announced results for 2017. In that year it generated $5bn of free cash flow, allowing it to declare a full-year dividend of $1.02 a share, its highest level in a decade, and to halve net debt to $4.5bn. It also saw a 45% rise in underlying earnings before interest, tax, depreciation and amortisation to $8.8bn, which led to a doubling in earnings per share to $2.48. The shares dipped slightly as investors were expecting a bigger dividend.

Be glad you didn't...

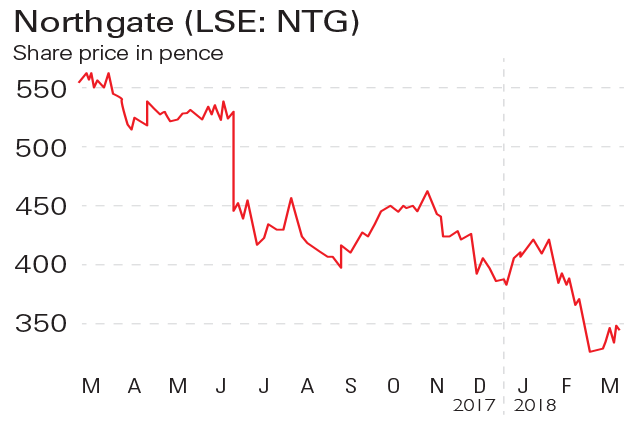

Northgate (LSE: NTG) is a commercial vehicle-rental business operating in the UK and Spain. In June last year its share price plunged after results for the year ending 30 April showed a 7% decrease in profits from £77.6m to £72.2m. It was blamed on a drop in rented vehicles to 39,500, down from 42,400 vehicles the year before, causing major shareholders to push for the firm to sell itself for £800m. Half-year results to the end of October showed revenues up by 10% at £349m, but much of this came on the back of the recovering Spanish economy. Pre-tax profits slumped by 16% to £33m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Painful changes at the miners

Painful changes at the minersNews Mining company Anglo American scrapped its dividend after overtaking commodities giant Glencore as the worst-performing stock in the FTSE 100 this year.

-

Is the gloom overdone on mining stocks?

News As China-related panic spread this week, the mining sector slid. BHP Billiton, Anglo American and Glencore all fell by more than 7% on Monday.

-

Metal prices could be set to bounce back – here’s how to profit

Metal prices could be set to bounce back – here’s how to profitFeatures Metal prices have been battered, and with them mining stocks. But they could both be about to bounce back. Dr Matthew Partridge explains why.

-

The best place to go hunting for value in the UK stock market

The best place to go hunting for value in the UK stock marketFeatures You can still find value in some UK stocks, says Ed Bowsher. Here, he explains where you should be looking, and picks three of the best stocks to buy now.