If you'd invested in: Anglo American and Northgate

Miner Anglo American has seen its share price quadruple, while vehicle-hire firm Northgate has suffered a slide in profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

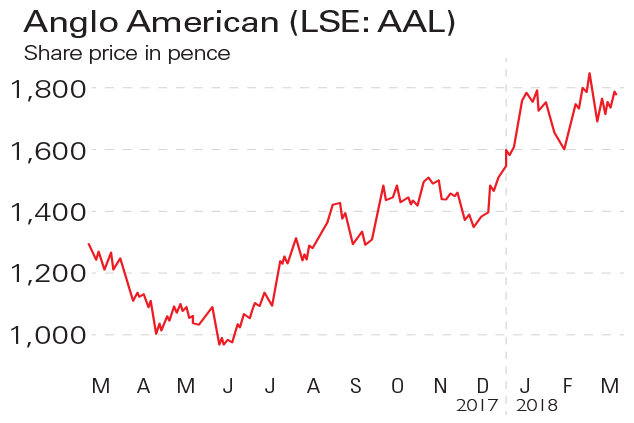

Anglo American (LSE: AAL) is a mining firm with operations on all continents. Its share price has almost quadrupled in the past two years. Last month the firm announced results for 2017. In that year it generated $5bn of free cash flow, allowing it to declare a full-year dividend of $1.02 a share, its highest level in a decade, and to halve net debt to $4.5bn. It also saw a 45% rise in underlying earnings before interest, tax, depreciation and amortisation to $8.8bn, which led to a doubling in earnings per share to $2.48. The shares dipped slightly as investors were expecting a bigger dividend.

Be glad you didn't...

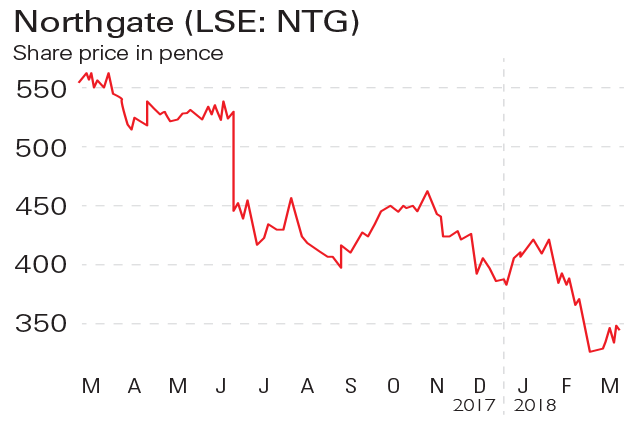

Northgate (LSE: NTG) is a commercial vehicle-rental business operating in the UK and Spain. In June last year its share price plunged after results for the year ending 30 April showed a 7% decrease in profits from £77.6m to £72.2m. It was blamed on a drop in rented vehicles to 39,500, down from 42,400 vehicles the year before, causing major shareholders to push for the firm to sell itself for £800m. Half-year results to the end of October showed revenues up by 10% at £349m, but much of this came on the back of the recovering Spanish economy. Pre-tax profits slumped by 16% to £33m.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Painful changes at the miners

Painful changes at the minersNews Mining company Anglo American scrapped its dividend after overtaking commodities giant Glencore as the worst-performing stock in the FTSE 100 this year.

-

Is the gloom overdone on mining stocks?

News As China-related panic spread this week, the mining sector slid. BHP Billiton, Anglo American and Glencore all fell by more than 7% on Monday.

-

Metal prices could be set to bounce back – here’s how to profit

Metal prices could be set to bounce back – here’s how to profitFeatures Metal prices have been battered, and with them mining stocks. But they could both be about to bounce back. Dr Matthew Partridge explains why.

-

The best place to go hunting for value in the UK stock market

The best place to go hunting for value in the UK stock marketFeatures You can still find value in some UK stocks, says Ed Bowsher. Here, he explains where you should be looking, and picks three of the best stocks to buy now.