The best place to go hunting for value in the UK stock market

You can still find value in some UK stocks, says Ed Bowsher. Here, he explains where you should be looking, and picks three of the best stocks to buy now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In my opinion, Alex Wright is one of the best up-and-coming fund managers in the UK. Possibly the best.

So I was interested to see his latest take on the UK stock market in a magazine interview.

Unsurprisingly, Wright was pretty positive about the market fund managers normally are. But I was struck by his view that the best value lies at the top and bottom ends of the market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In other words, Wright thinks there is real value in the FTSE 100,and some value among small cap stocks but he's less keen on mid-cap stocks.

His comments inspired me to have a trawl through the FTSE 100 to see if I could find some bargains and three stocks stand out to me

Who is Alex Wright?

The fund has delivered a 425% return over the last five years, and Wright is the top-performing small-cap manager over that period, according to Citywire.

This year, he's also taken over the Fidelity Special Situations Fund, which aims to go against the pack and invest in unloved shares that look cheap. There's no constraint on the size of companies here.

Wright likes the FTSE 100 at the moment because it's trading at a discount to its historical averages, whereas the mid-caps and small-caps are trading at a premium. In other words, the FTSE 100 is cheaper than usual, whereas the others aren't.

In the interview with What Investment, Wright said: "there is value within the FTSE 100 there are companies there which are undoubtedly unloved, and so don't get examined enough. Only the FTSE 100 is currently trading at a discount to its historical average, a discount of 8.4%."

How to invest in the FTSE 100

The Legal & General UK 100 Index Trust is one of the cheapest passive options. If you invest via the Hargreaves Lansdown platform, the total expense ratio (TER)on this fund is a super-low 0.1%.

However, as an overall platform, Hargreaves Lansdown is more expensive than many of its rivals, so you may prefer to invest via a different platform. If that's the case, take a look at Vanguard's FTSE 100 ETF which has a 0.1% TER. (ETF stands for exchange-traded fund.)This ETF is available on most platforms, including Hargreaves Lansdown.

Now, I'm a big fan of passive investing, but I also enjoy investing in individual stocks. And if you're not quite as enthused about the FTSE 100 overall, you might prefer to pick some of the more attractive-looking companies rather than just investing in the index.

So here are three attractive FTSE 100 stocks that have caught my eye, two of which Wright is also keen on.

First is global banking group, HSBC (LSE: HSBA). HSBC managed to navigate the financial crisis without too much pain and without any government bail-outs. It's been growing its dividend since 2011 and now has a 4.8% dividend yield.It also has a price-to-book ratioof 1.05.

If you're confident that the global economic recovery is set to continue, then HSBC is a good play on that. Indeed, that's why HSBC is one of Wright's largest investments.

If you're interested in reading more about HSBC as well as another UK banking tip, check out James Ferguson's excellent MoneyWeek magazine cover story on the UK banking sector.If you're not already a subscriber, you can get your first three issues free by signing up for a trial here. You'll also get access to the full MoneyWeek online archive, including James's feature on the banks.

Two more great FTSE 100 stocks

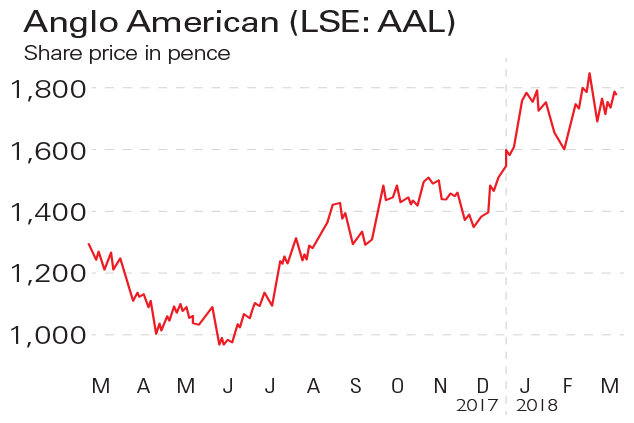

Anglo American (LSE: AAL)

He also points out that the recent fall in the value of the South African rand has helped to make it very competitive.' That's because, while the company sells its metals for US dollars, many of its costs are in rand. So in effect, its costs fall even as the value of its sales rise.

My final company wasn't highlighted by Wright. It's just my personal FTSE 100 favourite at the moment indeed I own shares. It's drugs giant GlaxoSmithKline (LSE: GSK).

The main reason I like is Glaxo is its record as a dividend payer. It currently has a 4.8% yield and it has increased its dividend payout every year since 1996. I'm also impressed by the way Glaxo has coped with the patent cliff' issue.

In the late noughties, there was widespread concern about this so-called cliff. The worry was that large pharmaceutical companies would struggle to replace their best-selling drugs when patent protection for these drugs expired.

However, GSK has done well since then to launch several successful new drugs, which has meant we've only seen modest falls in revenue over the last five years. I'm confident that Glaxo can continue to develop attractive new drugs over the next decade and in the meantime, it's producing a steady and useful income.

Our recommended articles for today

Beware the government's pension grab

Relaxed about the pension lifetime allowance and its implications for your retirement planning? Then it's time for a wake-up call, says James Ferguson.

The Isa revolution 2014

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

If you'd invested in: Anglo American and Northgate

If you'd invested in: Anglo American and NorthgateFeatures Miner Anglo American has seen its share price quadruple, while vehicle-hire firm Northgate has suffered a slide in profits.