Sterling has taken a pounding – but I’m looking to buy back in

Despite a great start to the year, sterling has seen some dramatic falls recently. But, says Dominic Frisby, we may be getting close to a buying opportunity. Here’s why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I want to take a look at sterling in today's Money Morning the currency, not the football player although both have been diving.

I think we may be getting close to another buying opportunity but we are not there yet.

Mark Carney, the great leveller (of sterling)

Sterling had a great start to 2018. It began the year at $1.35 and, thanks chiefly to a weak US dollar, rocketed up to $1.43 by late January. It then went into a period of consolidation before retesting the $1.43 mark a fortnight ago.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But since then it's been a disaster zone. As I write this now, we're back at $1.36.

A large part of this is, simply, down to recent US dollar strength, but, as always, politics, economics and the Bank of England have played their part.

I stumbled across a great line from the former US vice president, Joe Biden, this week. "Don't tell me what you value", he said. "Show me your budget, and I'll tell you what you value." I don't care what you say, in other words I want to see what you actually do with your money.

This is an important principle to apply whenever listening to the utterances of the governor of the Bank of England, Mark Carney. For years now, Carney has been talking about higher rates. Yet for all the talk, Carney has only ever put up rates once by a whopping 0.25% and that was only after he had slashed them unnecessarily following the Brexit vote (a cut which triggered a further sell-off in an already weak pound, setting off a nose-dive which eventually reached its lowest level since the miners' strike of 1985).

In most other walks of life, this kind of talk without action would be bordering on the dishonest, but it has been going on for so long in central banking it has become normalised.

A fortnight ago, on 20 April, Carney did it again. Having said in February that rates would rise "somewhat earlier and to a somewhat greater extent" than expected, thus setting everybody for an increase in May, he declared that expectation for a rise in May was overblown.

In other words, yet again we are not going to put up rates. He also said more interest rate rises more? will be coming over the next few years.

Of course, sterling sold off. That sell-off was exacerbated by the strong dollar, but sterling was weak against all major currencies.

Since then a number of political events have conspired to create a great deal of instability: the dispute over whether the UK will remain inside the customs union, thus fudging a clean Brexit; the Windrush fiasco and the resignation of the home secretary; and finally the House of Lords voting this week, by a considerable majority, against the government yet again on key Brexit legislation (I believe it's the seventh time).

In addition, there is weakening economic data, particularly on the high street, Friday's GDP release was disappointing, the housing market looks weak (especially in the capital), and real inflation marches on, even if core price inflation is only at 2.5%.

Meanwhile, and perhaps above all, the US dollar keeps getting stronger. It never rains but it pours.

Why I've bought back into sterling (a bit)

My sterling targets for the year have long since been hit, so I was waiting for a re-entry point. There's a chance, in my view, we may now be close to it, so I actually bought some sterling yesterday.

It was only a small position and I have to say I think I'm early to the trade. But let me explain my thinking.

Long-term readers will know I am bullish on the currency and bullish on Britain. Analyst Charles Ekins of Ekins Guinness calculates the relative purchasing power parity (PPP) of currencies based on relative inflation, and arrives at the conclusion that that fair value for sterling against the dollar is actually a lot higher, at $1.60. I'm not quite at those levels, but I would venture that fair value is around $1.50.

My hocus-pocus cycle work aka Frisby's flux has led me to conclude that sterling is in the early stages of a long-term bull market which should conclude somewhere in the early part of the next decade.

All the above political setbacks I regard as short-term problems and thus temporary (although I have to say if the House of Lords continues as it is, there is a real risk of some kind of constitutional crisis). Even Carney is temporary he is due to leave in 2019.

In the meantime, sentiment has got very bearish, perhaps excessively so.

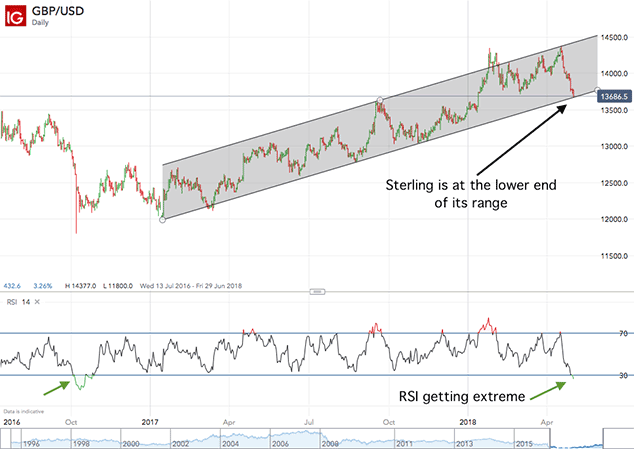

Although the short-term trend is down, the longer-term trend is up, as the chart below shows. So I see this correction as a so-called counter-trend rally.

And if you look at the chart I have drawn below, I have identified a range see the grey shaded area that sterling has tracked since its lows at the beginning of 2017. We're now at the lower end of that range, though I have to say, it's looking rather shaky.

At the bottom of the chart, you'll see the RSI the relative strength index which is a measure of momentum. Sterling is the most oversold it has been since the Flash Crash of late 2016.

$1.35 is probably beckoning, but all in all, I think there's a good chance we'll see some sort of tradable low this week. I'm well aware that I am bottom fishing a bit and it could still go lower hence my not being what I would call "fully invested". Rather, I am dipping my toe in with a "speculative opening position".

I recognise that the speed of this correction is pretty impressive and that I may be "catching a falling knife". Perhaps we need to go to $1.30. But in the longer term I have enough confidence in sterling to make me feel comfortable with the risk of this contrarian trade now.

Maybe I should wait till the outcome of the local elections this week, which, somehow, I doubt will be good for the government. I'm conscious of the fact that, whether left or right, nobody really likes this administration.

Anyway, a small starting position is in place. We'll take it from there.

Fingers crossed.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how