Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

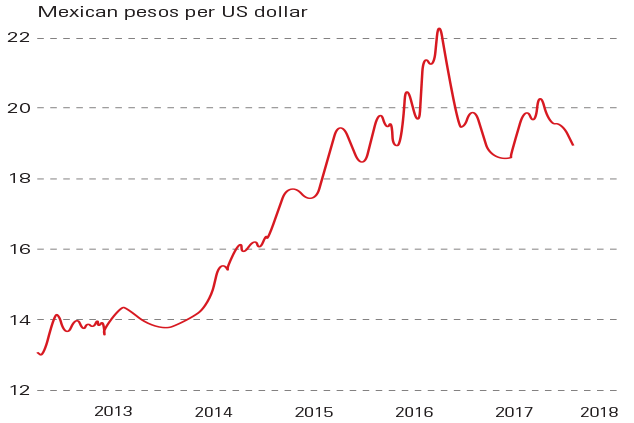

The Mexican peso has gained 8% against the dollar this year. That's "not bad", considering that Donald Trump has threatened to tear up the country's "economic lifeline", the North American Free Trade Agreement, while the likely next president, Andrs Manuel Lpez Obrador, has a reputation as a left-wing populist, says Craig Mellow in Barron's.

Analysts reckon Trump's focus has shifted from Mexico, which accounts for just a tenth of the US trade deficit, to China, which makes up 50% of it. And Obrador, who has surrounded himself with shrewd business people, is not expected to do anything radical in his first year or two. Even if both scenarios pan out, however, most of the optimism appears to be in the price: the peso has already recouped all its post-Trump losses.

Viewpoint

"[EU] trade policy is cumbersomeWithin the EU, Britain has argued strongly for free trade on the economically unassailable grounds that trade barriers raise costs to consumers and protect inefficient industries. Outside the EU, Britain could in principle unilaterally slash or even eliminate tariffs and thereby benefit from the reverse effect, with cheaper import prices. [This] makes theoretical sense but can only be done once. Unilaterally cutting or abolishing tariffs is consistent with WTO rules, provided it applies to every member of the WTO... That would cause hardship and possible closure for significant parts of Britain's economy (notably in agriculture and manufacturing) that would have to compete with an inflow of inexpensive imported goods and produce. It is not politically feasible that any British government would accept such costs."

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.