Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

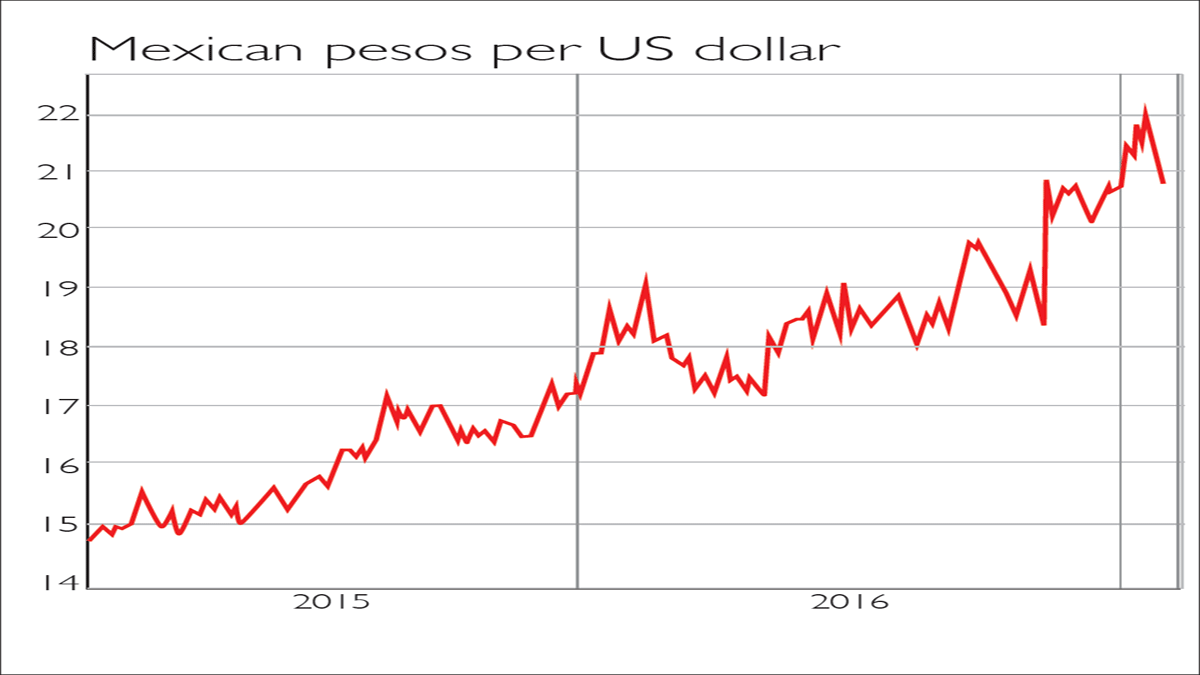

The Mexican peso has bounced by around 5% from record lows against the US dollar in the past few days. But it has still lost 12% in a year, and the respite looks unlikely to last long, says Roger Blitz in the FT.

The dollar's ascent has been tempered by the prospect of Trump's fiscal stimulus being watered down in Congress. But he is still evidently determined to slap tariffs on Mexican imports, and there are other problems pointing to a lower peso.

Viewpoint

"By 2020, small firms turning over as little as £10,000 a year will have to file [their tax returns] online every three months, with some due to begin in April 2018. The Treasury Committee can't see why companies earning less than the VAT threshold of £83,000 need to be captured by the new system initially The switch to digital makes sense but, as currently proposed, all the risk and extra cost is piled onto entrepreneurs while the reward is reaped by HMRC, which believes the Making Tax Digital initiative will bring in extra receipts of £625m. How much more might it earn if the tycoons of tomorrow were not put off from setting up shop?"

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

James Ashton, Evening Standard

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How “support” and “resistance” can help you spot trading opportunities

How “support” and “resistance” can help you spot trading opportunitiesSponsored Technical analysis can help traders manage risk and decide where to enter and exit a trade. One simple form of technical analysis is the concept of “support” and “resistance”. Dominic Frisby explains how you can make it work for you.

-

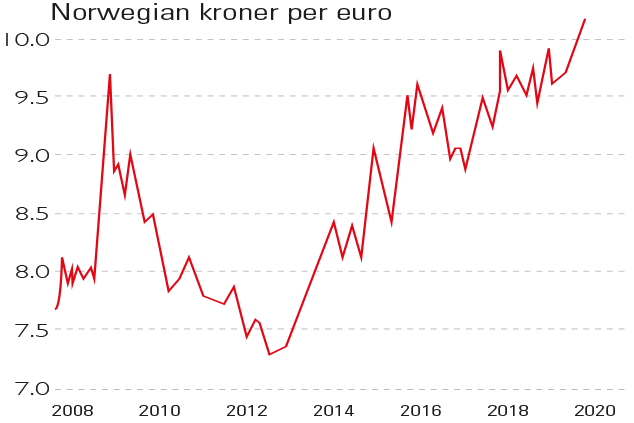

Chart of the week: Norway’s crown has slipped

Chart of the week: Norway’s crown has slippedCharts The Norwegian krone has slipped to a record low of more than ten to the euro.

-

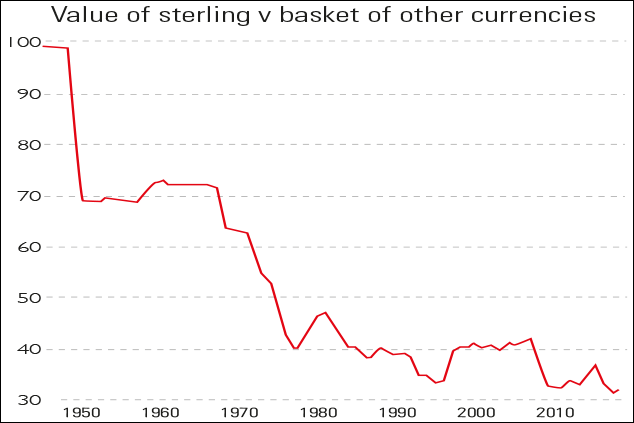

Chart of the week: the pound’s post-war swan dive

Chart of the week: the pound’s post-war swan diveCharts The pound hit a new 20-month low against the dollar this week as Prime Minister Theresa May postponed the Brexit vote.

-

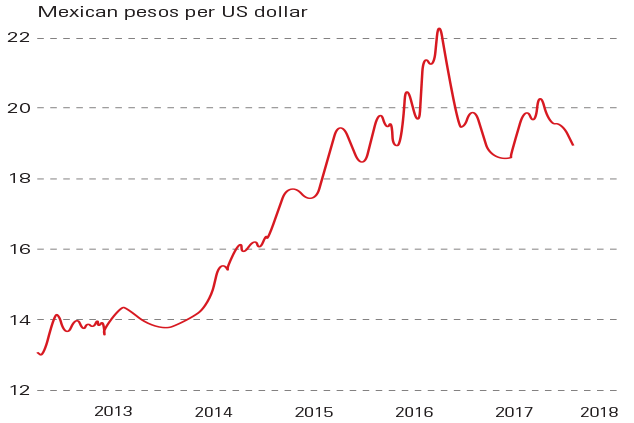

Chart of the week: The Mexican peso has peaked

Chart of the week: The Mexican peso has peakedCharts The Mexican peso has gained 8% against the dollar this year. But that's as far as it is likely to go.

-

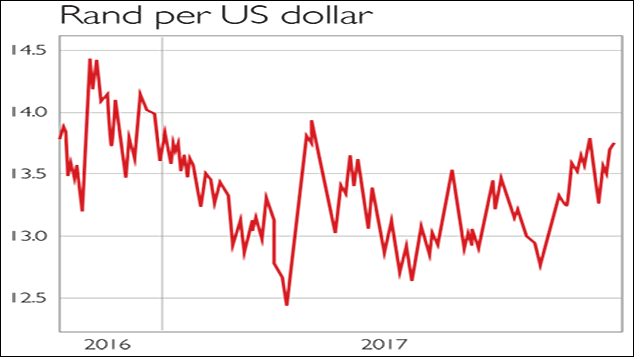

Chart of the week: government splits rock the rand

Chart of the week: government splits rock the randCharts The South African rand slipped by almost 3% last week, its worst five-day showing since August amid worries that President Jacob Zuma may be set to sack his competent and economically literate deputy Cyril Ramaphosa.

-

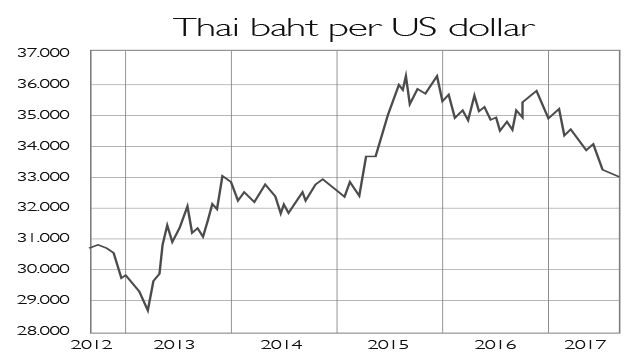

Chart of the week: Thai baht defies gravity

Chart of the week: Thai baht defies gravityCharts Tourism is booming, the current account is in surplus, and the yield on local assets is enticing. No wonder the Thai baht has risen by 8% against the US dollar this year.

-

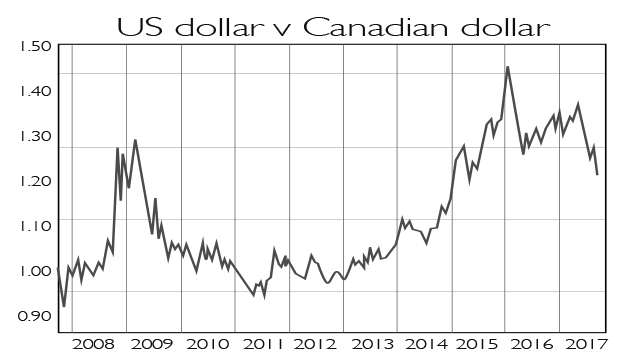

Chart of the week: the loonie takes off

Chart of the week: the loonie takes offCharts The Canadian dollar, nicknamed the loonie, has leapt to a two-year high around $1.21 against its US counterpart as a result of Canada's robust eocnomy and higher interest rates.

-

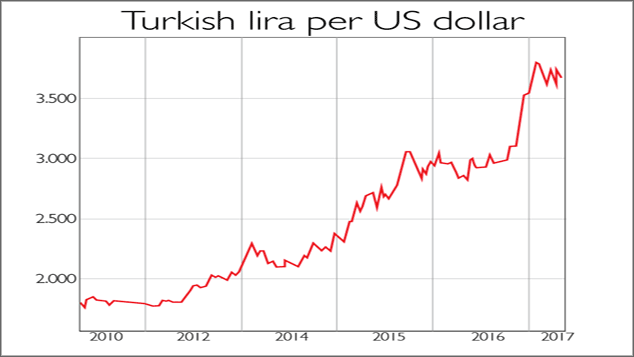

Chart of the week: vote for authoritarianism will crush the Turkish lira

Chart of the week: vote for authoritarianism will crush the Turkish liraCharts The Turkish lira has fallen as Erdogan’s authoritarian tendencies have unsettled foreign investors. It is at near record lows against the US dollar, and is unlikely to rebound any time soon.