Choppy waters on both sides of the Atlantic

The problems facing tech stocks have unsettled the stockmarket in the US, and Britain isn't faring much better. Can investors expect the choppiness to continue? Dominic Frisby investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In today's Money Morning, we consider stock markets, both American and British.

We look at their recent performance.

And we ask what is perhaps the most important question in finance up or down?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

FANG stocks lose their teeth

The backbone of the incredible bull market we have seen in US stocks over the last few years has been tech. Not just the notorious FANG stocks (Facebook, Amazon, Netflix and Google), but also the likes of Nvidia, Apple and Tesla have performed so extraordinarily well that the thought was appearing in the minds of many that these stocks "can't ever go down". The companies are too strong. Little more than a month ago, it did seem that way.

Who or what could possibly challenge the might of Google or Facebook? The market cap of the FANG stocks plus Apple was greater than Britain's GDP.

So even if the overall markets were weak, the Nasdaq index pressed up to new highs in early March.

But then, the bad news started coming.

There was the Facebook/Cambridge Analytica scandal and the threat that Facebook would now face the wrath of governments. A driverless Uber vehicle killed a pedestrian and Nvidia suspended self-driving car tests. A Tesla vehicle was also involved in a fatal accident, and Moody's downgraded Tesla's debt. Meanwhile, Donald Trump seems to have taken it upon himself to bring down Amazon, hurling criticisms via Twitter.

But perhaps most significantly of all, there seems to have been a change in sentiment, particularly in Europe. Governments, regulators and much of the general public want action taken to break up the monopolies and the tech giants and, perhaps most significantly of all, they want them to pay more tax.

And so, the apparently impervious Nasdaq now looks wobbly.

There is a psychology to bear markets. A narrative takes hold during the bull market. This one was all about the strength of tech. Even if the numbers didn't add up now, they would at some point in the future. Once you're set in that belief (and often the more set you are, the better it is to ride the bull market all the way), it is very difficult to you unlock your mind and entertain other scenarios. Bull markets and bear markets are processes of believing.

Rough waters ahead

A few weeks ago we projected the notion that markets would be choppy for the foreseeable future. Choppy is exactly what they have been. Up today, down tomorrow, nobody knows quite what to believe. Is the bull market over? If not, where is the leadership going to come from? Or is this a bear market now?

Below is the S&P 500 index. The chart of both the Dow index and the Nasdaq are very similar.

The red line is the one-year moving average. It's still sloping up. As long as the index can remain more or less with it, and as long as the February low (around 2,525, where I have drawn the dashed blue line) can hold, we should be OK and the bulls should live to breathe another day.

But I can't help thinking that this choppiness will continue for some time yet, scaring both bulls and bears, while the market decides where it wants to go next.

I also can't help but note that this action we are seeing now is very similar to the action we saw in the third quarter of 2015 and the first quarter of 2016 (see the boxed area in the above chart). Many then were declaring the bull market dead. It wasn't. It was pausing for breath, and many got whipsawed out. If we are seeing something similar, my dashed blue line will not hold and we are likely to head back down to the 2,300 area.

In short, my forecast for the next three months remains choppiness and range-trading, rather than a trending market.

A mess in the FTSE

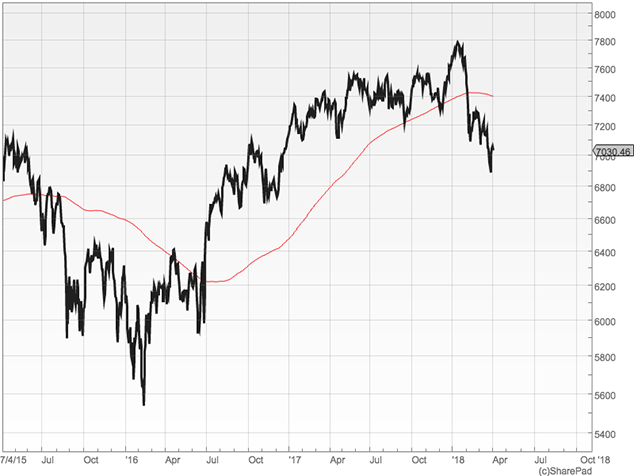

So, on to the FTSE 100 index (below) and I'm afraid this looks like a mess.

The one-year moving average (red line) has been breached and is now sloping down. We are trading some distance below it.

Rather than the range-trading action of the American indices, this one has a much clearer trend to the downside. It's not helped by a strengthening currency, of course, but the omens are not good.

We are only down 12% or 13% from the highs, so we are not in official bear-market territory just yet, but I would venture that we are not far away. It looks like a visit to 6,700 is on the cards, and possibly 6,400, before we can begin to think about resolution.

So not a particularly positive Money Morning for you this week, I'm afraid. Whipsawing action in the US and a movement lower in the UK is the prognosis.

In fact, I don't know what it is, something in the air maybe, but given that our housing market appears to have ground to a halt as well, particularly at the upper end, I rather suspect that UK plc might be running into a few headwinds over the next few months and that the waters of the economy will not be quite as navigable as they were during the plain sailing of last year. It might just be the tawdry circles in which I mix, but people don't seem quite as flush as they did last year. Maybe I need to get out more.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King