If you’d invested in: Softcat and Drax Group

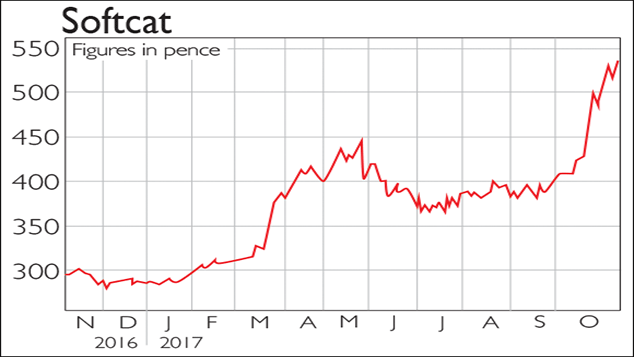

Softcat provides IT infrastructure services to companies and the public sector. Its shares spiked in October as it announced that sales were up by almost a quarter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Softcat (LSE: SCT) provides IT infrastructure services to companies and the public sector. Its shares spiked in October as it announced that sales were up by 24% to £832.5m in its first full year as a listed company.

The results were boosted by growth in public-sector IT contracts, which now represent 31% of its total income. It also reported strong growth in its security business, as firms strengthen their cyber defences and prepare for new data protection regulations.

Be glad you didn't

Drax Group (LSE: DRX) generates and supplies electricity. In July, Drax, which owns the UK's largest power station, reported a pre-tax loss of £83m in the first half (compared with a profit of £184m during the same period a year ago) as the value of coal assets fell. Drax is trying to diversify its business, following news that the UK's last coal-power stations must close by 2025 to meet climate-change commitments.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how