How to shock-proof your investment portfolio

The year has thrown up more than a few nasty surprises for investors, but learn to read the warning signs and you can sidestep potential hits from the market, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The year has thrown up more than a few nasty surprises for investors, but learn to read the warning signs and you can sidestep potential hits from the market, says Phil Oakley.

It's been a calm summer for most investors, with markets somewhere between flat and gently higher, despite the odd geopolitical scare. But some unlucky investors including one of Britain's best-known, Neil Woodford have been left wincing every time they glance at their portfolios. A raft of companies, from doorstep lender Provident Financial to support-services group Carillion and retail chain Dixons Carphone, have seen their share prices hammered after issuing profit warnings, apparently out of the blue. Seeing a company you own lose a quarter or more of its value in one day (Provident lost nearly two-thirds of its value on the day of its warning) will test the resilience of even the most sanguine investor.

The good news is that, while you can't avoid every nasty shock in the market, there are some common warning signs that alert investors could have spotted in all of these cases. Below I'll talk you through six of the biggest red flags, and highlight four companies that you might want to re-examine if they're in your portfolio right now.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

1: High dividend yield

A high dividend yield can be very tempting, and occasionally it's a sign of a bargain share. But more often, a significantly higher-than-average yield simply shows that the market expects future dividend growth to be weak, or worse still, that the dividend is at risk of being cut or scrapped. In the current market, a yield of more than 6% should be viewed as a warning sign. Utility company SSE and oil companies BP and Shell are good examples of big companies which fall into this camp.

2: A changing business model

Problems often occur when a once-successful business model stops working. This can be down to simple management incompetence. For example, Provident Financial had a relatively simple doorstep-lending business that had worked well for decades. Then management tampered with the core of that model the relationship between its customers and its debt collectors causing havoc in the payment-collection process. This has led to the business incurring significant losses, and it's unclear whether the damage can be repaired.

Alternatively, a business model can be rendered obsolete by changes in the wider industry. For example, Dixons and Carphone Warehouse merged in order to improve their competitive position in the cut-throat world of electrical retailing. Yet the Carphone Warehouse business relies heavily on selling mobile-phone handsets. If customers decide to keep their phones for longer or to bypass Carphone altogether and opt for SIM-only plans from their mobile provider, then the business makes less money. This is what seems to be happening, and it has hit the share price hard.

3: Failing to turn profits into cash

Cash is the lifeblood of a company. Ultimately, cash dictates the dividends that can be paid to shareholders, and therefore the ultimate value of the company's shares. Quality companies are good at turning profits into cash. Bad ones aren't. There are three simple checks that can help to reveal whether the company is a good cash converter or a bad one.

Operating profits vs operating cash flow

Be wary if operating cash flow is lower than operating profits. A company can grow profits quickly by offering generous credit terms to customers,such as giving them a longer time to pay their invoices (these are in the accounts as "trade debtors"). The company books the profits when the sale is made, but it may have to wait a while for the cash, reducing its operating cash flow. And sometimes that cash never turns up, and instead turns into a bad debt and has to be written off, which hits future profits.

A company can boost its cash flow by taking longer to pay its own suppliers ("trade creditors"), but equally, cash flow can be squeezed if suppliers demand faster payments. Alternatively, the company may need to increase its stock levels ahead of a big sales push. The cash spent on this reduces the operating cash flow. This is fine as long as the extra stock is sold. But if it's not, profits will take a hit. Together, these factors trade debtors, stocks and trade creditors form a company's "working capital". It's a good idea to compare these numbers in the accounts with the level of turnover. If the proportion of trade debtors or the stocks-to-turnover ratio is rising, that may indicate deteriorating profit quality, while a falling trade-creditors-to-sales ratio can signal a supplier squeeze.

Growing final-salary pension deficits, and the need to fund them, are another drain on operating cash flow. The bigger the deficit, the bigger the drain. Usually, only the pension benefits earned by employees during the year (the current service charge) are expensed in the income statement, but large cash deficit-reduction payments go through the cash flow statement. Carillion, for example, has a very big pension deficit and has been making big top-up payments to plug the hole. Largely as a result, its operating cash flows have been lower than its operating profits for some time.

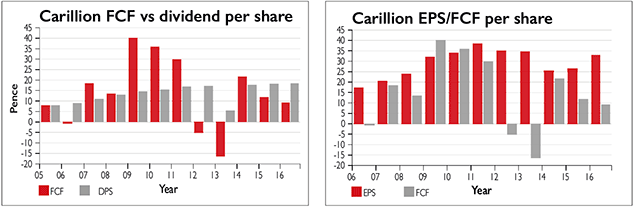

Free cash flow vs earnings

Free cash flow (FCF) is what's left over after all essential spending such as tax, interest on debts and investing in new assets (capex) has been paid for out of operating cash flow. Free cash flow is seen as a more trustworthy measure of profitability, as it is harder (though not impossible) to fudge than profits. When a company's free cash flow per share is much lower than its earnings per share (EPS) as Carillion's has been for years, as the chart belowshows it can be due to poor operating cash flow. Do note, however, that companies can have poor free cash flow for good reasons, such as investing for future growth.

For example, plant hire company Ashtead had negative free cash flows for several years, due to high levels of investment, but this has proved extremely profitable and its shares have increased tenfold over the last decade. Carillion's capex bill, on the other hand, has actually been quite low and is not responsible for its low free cash flow.

Free cash flow vs dividends

You can check how sustainable a company's dividend payout is by comparing free cash flow per share with the dividend per share (DPS). Carillion failed this test in four of the last five years, as the chart, left, shows.

4: Aggressive accounting

Companies prefer investors to focus on underlying profits or "profits before bad stuff". The idea is that this represents a fairer comparison from period to period. However, some companies abuse this by classifying a lot of recurring expenses as one-offs or "exceptionals" in order to make underlying profits look as large as possible. So it's a good idea to compare a company's underlying profit (which excludes one-off gains and costs) with its reported profit (which includes them). If the exceptional costs represent a big percentage of underlying profit, watch out. It may be legitimate, but it can also be a sign of aggressive accounting. As the table below suggests, packaging company RPC should be scrutinised on this basis.

5: Growth by acquisition

Companies buy other companies all the time. This can be good for investors if the acquisitions boost profits and are bought for a sensible price. The problem occurs when a company starts to rely on acquisitions for growth. Carillion was arguably a case in point. Between 2006 and 2011, the company spent £1.2bn in total on three rival companies, Mowlem, Alfred McAlpine and Eaga. By combining them with its existing business, it made big cost savings and boosted profits. But when the savings ran out, Carillion was faced with an underlying business that wasn't growing very rapidly. Its failure to buy rival Balfour Beatty in 2014 (which would have kept the growth-by-acquisition illusion going) arguably triggered the company's fall from grace.

| RPC exceptional costs as % of underlying profit | |||

| RPC plc | Underlying profit (£m) | Exceptional costs (£m) | % of profit |

| 2017 | 308 | 116.2 | 37.73% |

| 2016 | 174.3 | 79.1 | 45.38% |

| 2015 | 131.6 | 48.4 | 36.78% |

| 2014 | 101 | 28.1 | 27.82% |

| 2013 | 89.7 | 36 | 40.13% |

6: Heavily shorted stocks

Some very smart investors specialise in making money by betting against companies that they believe have weaknesses that are yet to be reflected in their share prices. They do this by "shorting" the share borrowing it then selling it, with the hope of buying it back more cheaply when the problems come home to roost. So before buying a share, check if it is a short-selling target. Short positions have to be disclosed to the financial regulator if they are greater than 0.5% of the total shares outstanding. You can quickly check for shorted shares at websites such as ShortTracker.co.uk. (MoneyWeek also updates on this every month in the shares pages.)

Below I've looked at four shares displaying some of the red flags mentioned above. There may be nothing wrong with these companies, or management may have a plan to deal with their current woes. But if you are thinking of buying these stocks (or already own them), then take a good look under the bonnet before you decide what to do next.

Four companies waving red flags

Stagecoach (LSE:SGC)

By and large, this bus and rail operator is well run. But its East Coast Trains franchise is in a bit of bother. Fewer people are using it than Stagecoach expected, which means the company has overpaid for the franchise. It has set aside £84m to cover expected losses for the next couple of years, and hopes to return to profit in 2019. The company is trying to renegotiate the terms of the franchise with the government, but there is no guarantee of this happening. Throw in fears that it might lose its stake in its West Coast rail franchise, and the struggle to grow profits at its bus unit, and Stagecoach's dividend could be under threat. At 157p, the shares have a forecast dividend yield of 7.7% and a forecast price/earnings (p/e) ratio of 7.5, which shows the market's scepticism when a yield is higher than a p/e, it's a classic sign of distress.

STV (LSE: STVG)

At 386p, broadcaster STV trades on a p/e of below 10, and yields more than 4%. It's also expected to return a further £10m to shareholders over the next 18 months, so there are grounds to argue that STV is a cheap share on a solid yield. However, half-year profits fell in the six months to June, due mainly to a weak advertising market. That's a worry, as that's the company's main source of income. Longer term, this is a problem for all commercial TV companies viewers are increasingly paying for advert-free services such as Netflix and Amazon Prime. But a more specific problem with STV is that it has failed to convert its profits into free cash for quite some time. That's mainly due to its whopping pension deficit of £69m roughly 45% of its market capitalisation. The company will have to top up this black hole by around £9m a year until 2026, meaning less cash for dividends. If advertising income falls further and can't be offset by other revenue streams, then STV shares may remain looking cheap.

RPC (LSE: RPC)

Packaging company RPC has one of the best dividend growth records in London. But its recent performance gives cause for concern. Since 2014, RPC has spent more than £2bn on acquisitions, and issued lots of new shares to help pay for them. It has also been investing heavily on top of this. Yet, the extra profits from this spending spree equate to a very modest return on investment. Since 2013, £3.2bn of extra money has been invested, yet trading profits have grown by £216m an incremental return on investment of just 6.8%. The accounts are also littered with exceptional items reported profits are a lot lower than underlying profits while underlying sales growth has been relatively modest. It makes it hard to get a clear picture of RPC's health give the tyres on this one a good kicking before you consider buying.

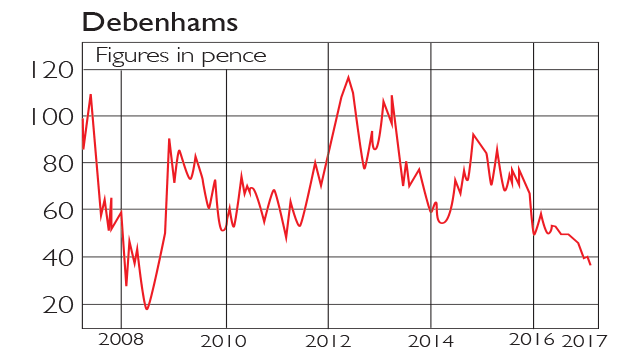

Debenhams (LSE: DEB)

Department store chain Debenhams is one of the most hated stocks in London, with just over 13% of its shares on loan to short sellers. The company is trying to adapt to a tough new retail environment, while it faces rising buying costs (due to the weaker pound) and a potential struggle to exit its rented high-street stores without paying a big bill. The 8.1% yield indicates that the market thinks the payout will either be cut or cancelled. Little wonder Debenhams' fixed charge cover (which measures how many times its trading profits can pay its interest and rent bills) was an uncomfortable 1.3 times last year. With trading profits falling, the chain is under a lot of pressure. I'd avoid it. However, be wary of joining the short-sellers. First, shorting is highly risky and, second, the shares have also drawn the attention of bargain hunters such as Mike Ashley's Sports Direct and US value investor Brandes. If the company can deliver some good news, the shares could surge as short sellers buy back their shares in a process known as a "short squeeze".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King