Can Mario Draghi stop the euro from ruining his gameplan?

ECB chief Mario Draghi would like to pull back on quantitative easing. But the strength of the euro is causing problems. John Stepek explores Draghi’s options.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The most significant news event for investors this week was also a damp squib.

It may seem that there's almost always a central banker prattling about something at some point around the world, and that's because there is.

But the important meetings are not quite daily not yet. Each central bank meets to make interest rate decisions a little less than once a month. The main reason that it seems as though they never leave us alone is that there are a lot of central banks and investors pay a lot of attention to them.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So this week, it was the turn of the European Central Bank (ECB). The ECB has a bit of a problem in its hands right now (just for a change). Unlike most central banks, the ECB actually has quite a significant "hawkish" contingent.

Mario Draghi, the boss of the ECB, is a dove. He promised to do "whatever it takes" to save the euro back in the days of the existential crisis around Greece. Since then, he's fulfilled that promise, but he has to keep convincing the market that he has the leeway and the authority to do so.

Draghi's goal is to keep monetary policy loose to make sure that the eurozone's weaker economies are cut sufficient slack to keep them in the euro. In practical terms, that really means that he wants a relatively weak currency.

Not many eurozone countries have a problem with that. Most of them are a bit like Britain. You have a significant group of people (savers, Austrian economists, people who think that encouraging genuine investment and growth is more important than propping up a dysfunctional property market and a crony banking system) who think it'd probably be healthy to have higher interest rates, even if it hurts some of the zombie companies still roaming around.

But these people of whom I am one are in the minority. There's a bigger group that either benefits from things staying as they are, or has no real understanding of the long-term impact of ultra-low monetary policy. I also sense a vague notion that loose monetary policy is in some way "left-wing", even though it's more responsible for current wealth inequality than pretty much any government policy on the table.

So Draghi shouldn't really have to fight except for the fact that the one country that really doesn't like what he's doing, happens to be the most important one: Germany.

When it looked as though the eurozone was going to fly apart, this was not a problem. Draghi eventually convinced the Germans to allow him to do quantitative easing (QE).

But now the eurozone economy is, by and large, improving. The Germans are having the sort of economic, consumer and house-price boom that the rest of us would scarcely describe as a bubble, but that they nevertheless faintly disapprove of.

So there's a lot of pressure to put QE back in its box to start signalling that it's time for a "taper".

That was the backdrop to Thursday's meeting. No one expected anything to happen with interest rates they don't get touched at major central bank meetings outside of the Fed at the moment. The big issue for the ECB right now is when it plans to reduce or withdraw its current "stimulus".

And in anticipation of that meeting, the euro had been steadily rising. After all, the Fed is becoming more dovish by the minute and the US data is mixed. Europe, on the other hand, is improving strongly from a low base. It's hard to fight that kind of turn in sentiment. Draghi probably knows that.

And in the end, Draghi did pretty much what he did at the central bank shindig at Jackson Hole at the end of last month he gave nothing away.

Oh, he tried his best. He talked a decent game flagging up the strength of the euro as a potential issue (although of course, he reiterated that the central bank does not target the exchange rate I mean, who could believe such a thing?). He also didn't say anything explicit about a "taper". Instead he said that the ECB would be discussing policy "calibration" next month.

Yet it wasn't enough to convince the market (particularly at a point when John Cryan, the CEO of Deutsche Bank, Germany's biggest bank, is vocally warning of bubbles all over the place).

The euro continued to spike against the dollar and that left the US currency heading for its worst weekly performance since May (as we'll discuss in more detail in a moment).

Will it continue? I imagine Draghi will choose his moment to stick the boot in he's very good at playing with the market's emotions. But that'll probably come after the German election. Until then, and until they've voted to put Angela Merkel back in power, he needs to go easy on the German citizenry and their fear of inflation.

But come October, don't expect him to give up on QE or tolerate much talk of the "taper" if he can possibly resist it.

The charts that matter

Partly as a result of that grim week for the US dollar, it's been quite a significant week for most of our "charts that matter". I've put the ten-year charts back in this week in most cases, as several charts have reached the point at which the wider perspective is useful again.

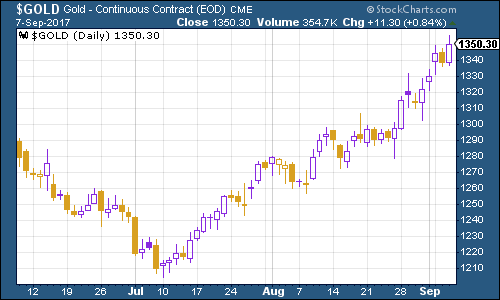

Gold

Gold is a good example. It's really picked up the pace this week. As my colleague Dominic noted earlier this week, that's partly because there's a bit of a "war premium" in there, what with the fear over North Korea.

The weakness in the US dollar and a generally jittery atmosphere in the markets hasn't helped either. The fact that US interest rates keep falling is good for gold gold hates rising "real" (after inflation) interest rates and so the decline has helped the price.

But it's also worth remembering that one of the main drivers behind gold just now is simply that it's been going up. Investors like things that are going up, and now that gold has had a good run, and managed to get above a price level (around the $1,300 mark) that was giving it trouble, people are taking an interest in it again.

(Gold: three months)

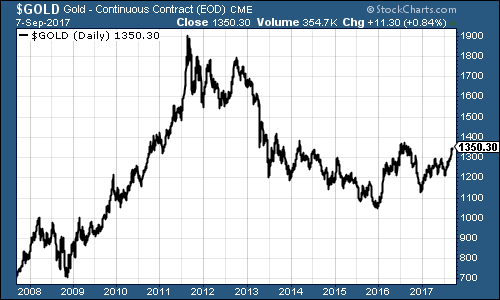

As you can see from the ten-year chart below, the $1,400 area is the big sticking point. When and if it gets above there, there are not that many more hurdles between the yellow metal and its previous record highs of 2011.

But I suspect breaking through that sort of resistance will be time consuming. And if it's not if gold takes off in a dramatic fashion then I'm not sure I want to think about what else might be happening at that point.

(Gold: ten years)

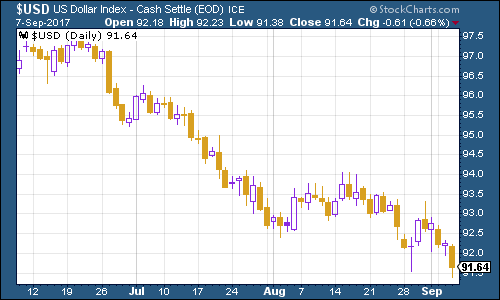

US dollar

As we've already noted, the US dollar index has struggled this week. What's going on with the greenback?

(DXY: three months)

Firstly, there's the general concern that US growth is perhaps hitting a peak, and that the Fed is becoming increasingly reluctant to raise interest rates as a result. That makes the rest of the world look more appealing by comparison.

Another factor has been the storm damage from both Hurricane Harvey and the threat from Irma. If the Fed needs an excuse not to raise rates, it has it.

Then, on top of that, fears over the US debt ceiling being reached were resolved - but in such a way that made Donald Trump even less popular with his party.

What's particularly interesting is that this sell-off has been pretty relentless. It's true that, at the start of the year, lots of people were betting on the US dollar continuing to rise.

But now, it's been falling for sixth months straight. That's the longest slide in 14 years, according to the FT. As a result, a lot of people are now bears on the dollar.

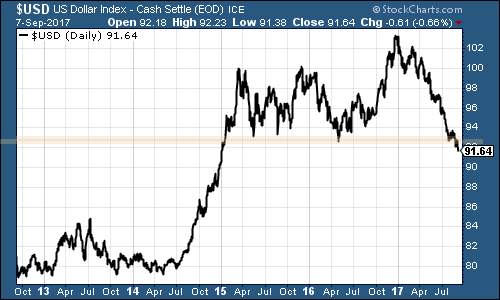

I must admit, that had me half-anticipating a bit of a bounce. But we've seen nothing of the sort. And as you can see from the ten-year chart below, the dollar index has now pretty much dropped through the areas that many pundits had earmarked as significant resistance.

(DXY: ten years)

That doesn't look good for the US currency. And given that it's one of the most important prices on the entire planet, we'll be keeping a very close eye on what happens next.

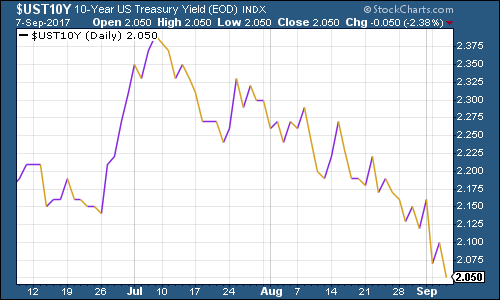

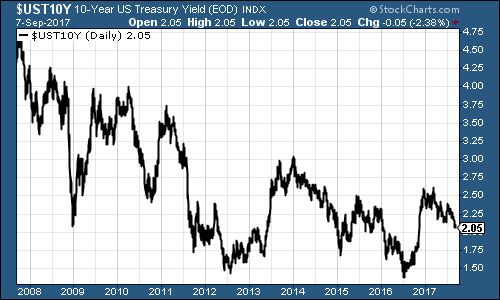

US Treasuries

Meanwhile ten-year US Treasury bonds rose even further (and as a result, the ten-year yield shown in our charts below declined further). Investors are increasingly persuaded that the Fed will not raise interest rates soon and that inflation isn't about to take off either.

They also favour US bonds as a safe haven amid times of strife, and with natural disasters and political dysfunction continuing, you can see why they might be seeking a haven right now.

(Ten-year US Treasury: three months)

Clearly we're still a fair way off from hitting the "generational low" that we saw back in mid-2016 (and I'm still betting that was the top for the bond bull market). However, we're certainly not looking like being in any danger of starting a bond bear market in the near future.

(Ten-year US Treasury: ten years)

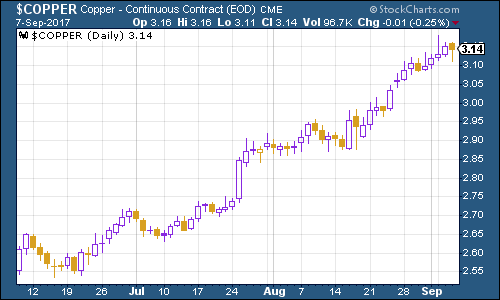

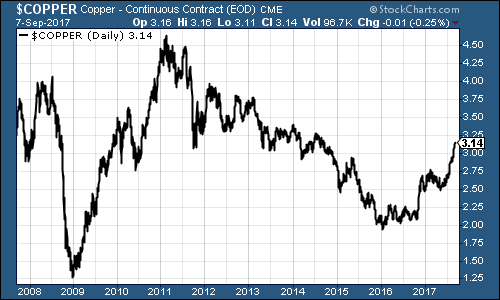

Copper

Copper's blistering run stalled somewhat on Friday, which won't be visible in the chart below (as I write, it's down at around $3.06 per pound). I did mention that copper was probably due a bit of a breather last week (and when you look at the ten-year chart, you can see why it's come a long way in a short time).

I suspect this is it.

(Copper: three months)

(Copper: ten years)

Bitcoin

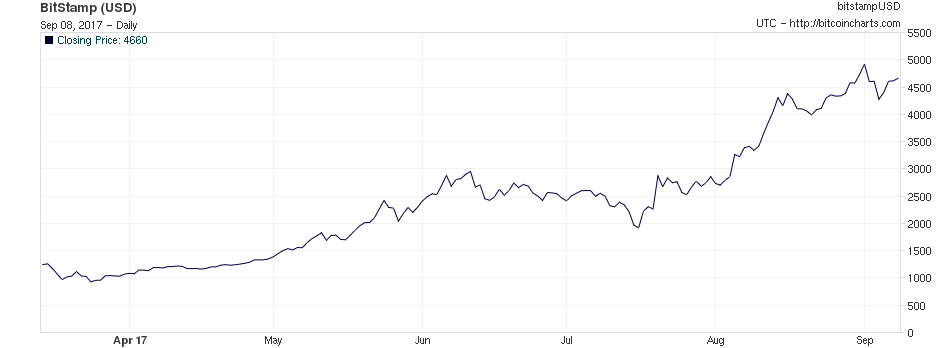

Bitcoin continues to rumble around the $4,500 mark, despite Paris Hilton publicly endorsing yet another new cryptocurrency, plus the Chinese banning initial coin offerings (no doubt the usual ineffective regulatory poke at the sector by Chinese government officials keen to buy in at lower rate I'm only slightly kidding when I say that).

US jobless claims

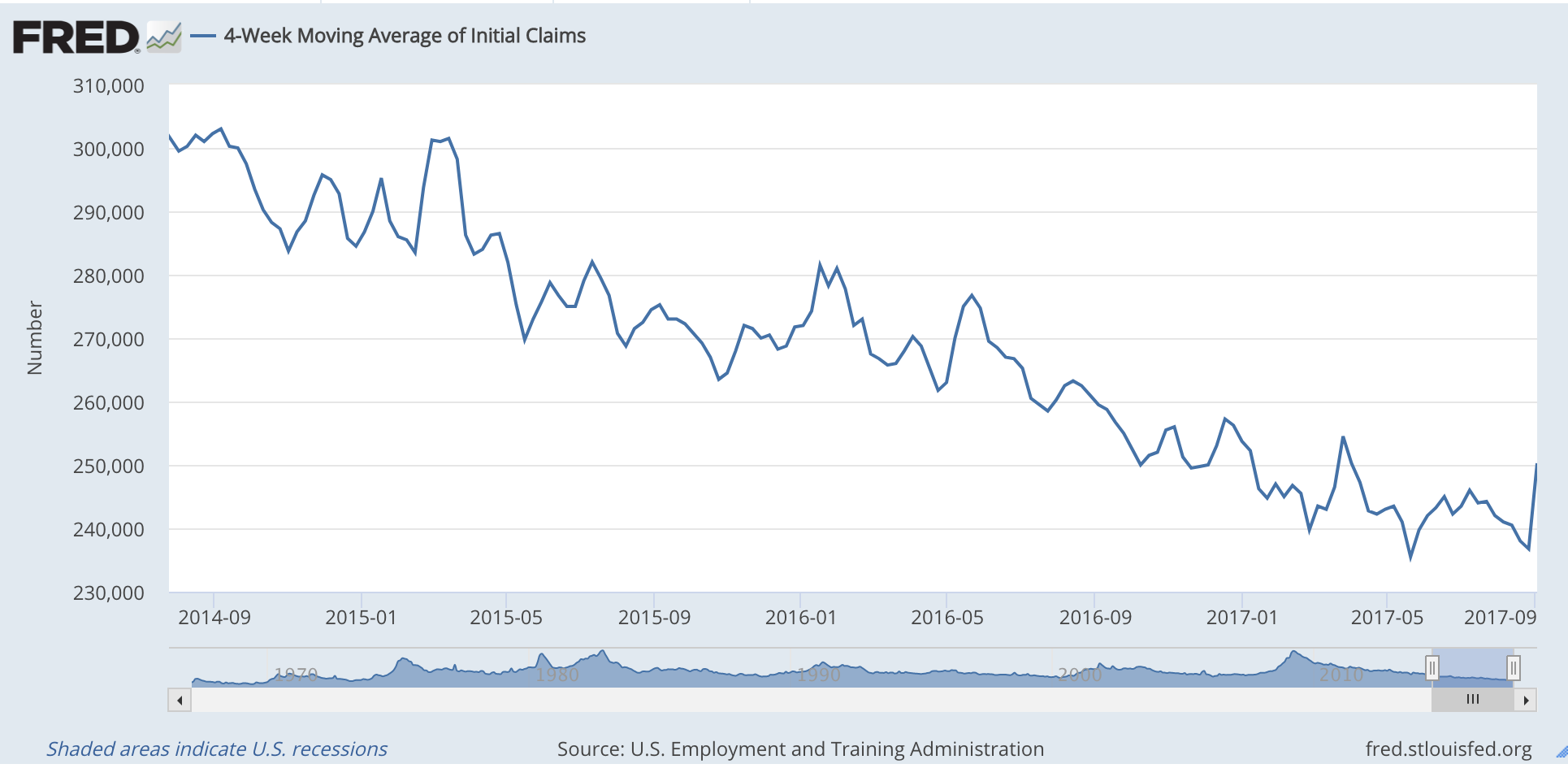

The weekly US jobless claims data soared, but that's as a result of hurricane disruption. That'll make the data rather unreliable for the next few weeks.

Nevertheless, it's worth watching. According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

This week, the four-week average jumped to 250,250 as claims came in at a two-year high of 298,000. That's still low by historic standards and still not that far off the low of 235,500 set on May 20th.

We'll see how the data evolves over the coming months. If 20 May holds as the cyclical trough, then if Rosenberg is right (and to be fair, it's a small data set) we might already have seen the stockmarket peak.

Oil

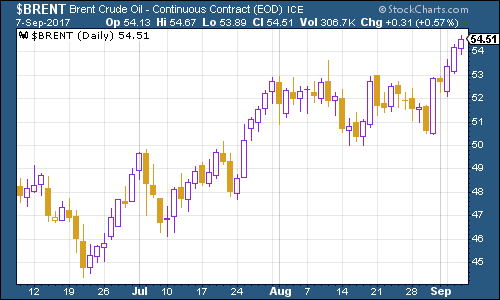

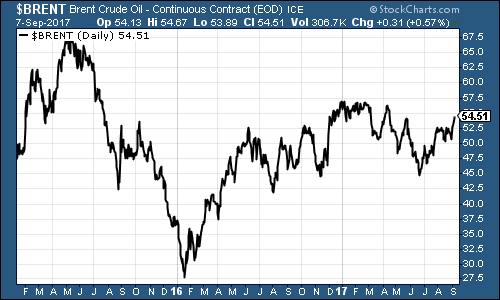

Chart number seven is the oil price (as measured by Brent crude, the international/European benchmark). Oil has headed higher again this week, partly due to hurricane disruption and partly as a side effect of the falling dollar.

(Brent: three months)

(Brent: ten years)

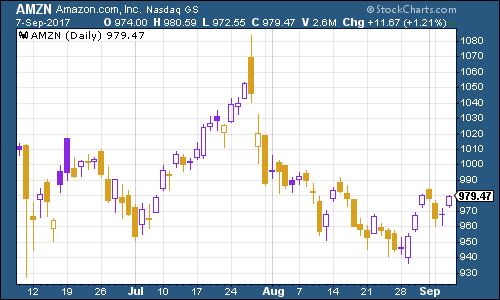

Amazon

Finally there's Amazon. Amid a somewhat uncertain week for the US stockmarket it's not sure of whether it's coming or going the tech giant was little changed.

(Amazon: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up