Why the US jobs disappointment is good news for stocks

The latest US non-farm payrolls report was a bit of a disaster. But that’s good news for stock markets, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Right now, the most important economic data release in the world is the US non-farm payrolls report.

This shows how many jobs the US added in the past month. It's called "non-farm" payrolls, because it doesn't include agricultural jobs. But as no one works in agriculture (it accounts for something like 2% of the workforce in the US), this doesn't matter.

As I've said many times before, the data is pretty flaky from month to month. It gets revised a lot, and the margin of error is huge. There is no real justification for taking it quite as seriously as the market does.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And yet, it's the most-used indicator of US employment health. That in turn means that it really matters to the market.

If jobs growth is healthy, that means there are fewer and fewer spare workers and more and more jobs that they can apply for.

When competition for workers rises, so should wages. After all, if you reduce the supply of something (potential staff) it should increase the cost (their wages).

This hasn't happened as rapidly as everyone had hoped after the financial crisis. Although employment is now high in the US, wages haven't really followed suit yet. There are a number of reasons for that, not least stagnant productivity, but we can look at that another day.

Anyway, the point is, if employment growth is strong, wage growth should follow, and wider inflation should follow that. The US central bank the Federal Reserve is meant to aim for both full employment, and inflation at a manageable 2% a year.

So all else being equal, healthy jobs growth should make the Fed keener to raise interest rates. And the market doesn't tend to like that. It prefers money to be as loose as possible.

The thing I've noticed about the non-farm payrolls report is that it tends to set the market "tone" for the month. That's one reason that it's worth keeping a close eye on. It doesn't matter that it might be revised in the future for the coming month, traders will take it at its word.

So it's interesting to see that the latest non-farm payrolls report the one for May was a bit of a disaster.

Analysts had expected the US economy to add another 182,000 jobs to payrolls last month. Instead, the number came in at 138,000 quite a big miss. Meanwhile, the previous reading was revised sharply lower. On top of that, wage inflation was uninspiring, at 2.5%.

That's a pretty poor report particularly as the market was geared up for a big number.

But by now, you might have guessed what the likely reaction is.

Will this stop the Fed from raising interest rates this month? Almost certainly not. But any moderate economic weakness does make the Fed's likely tightening path that bit longer, which means money stays looser for longer.

In turn, that makes for a weaker dollar, and once they get over the initial panic stronger stock markets.

And as you can see from our the below, the market responded accordingly.

The six charts that matter most

Gold

Last week, gold ended the week at $1,256.40 an ounce. It looked as though it would close the week little changed but then the weak payrolls figures came out, and it surged to above $1,270.

Anything that slows the rise of "real" (after inflation) interest rates is good for gold. So if the Fed stays on hold for that bit longer because of weak jobless data, then that'll push gold higher.

Meanwhile, the prospect of "lower for longer" is bad for the US dollar. The dollar again looked like it was going to turn out to be pretty much flat on last week, at around 97.2, but then the payrolls data sent it sliding below the 97 mark.

A weaker dollar is, broadly speaking, good news for global stockmarkets in general, as it effectively means weaker monetary policy across the globe (because the US dollar is the world's most important currency).

Copper

It's been a tougher week for commodities. The oil price has struggled, as has the wider resources sector. Copper closed last week at around $2.60 per pound, and was on track to end this week at closer to $2.52. The drop in the US dollar helped metal prices, but copper still looked likely to end the week lower, in the $2.55 region.

US Treasuries

Meanwhile, yields on ten-year US Treasury bonds slid sharply below 2.2%, to their lowest point of 2017. Investors have pretty much dumped the idea of the Trump-flation trade, and they're increasingly sceptical that the Fed will need to do much with interest rates.

Will last summer still prove to have marked the generational low for bonds? I think so. But we'll have to keep an eye on what happens between now and the next recession.

Bitcoin

Source: bitcoincharts.com

And what about the current flavour of the month, bitcoin? The cryptocurrency hit an intraday high of nearly $2,780 last week. It had a short-lived correction to below $2,000, but it's come back pretty rapidly again.

US jobless claims

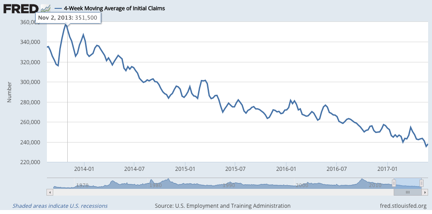

Finally, what about our other US employment indicator, US jobless claims? David Rosenberg of Gluskin Sheff sees this is a valuable leading indicator. When the figure hits a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind, and a recession follows about a year later.

Until last month, it looked as though jobless claims had troughed at just under 240,000 at the end of February. But we hit a fresh low at the tail end of last month.

Claims came in at 248,000 for the week ending May 27.The four-week average is now at 238,000, still near the lowest level since April 1973.

Overall, unless another piece of data comes out to dramatically change the picture, the bias for the next month is likely to be "gold up, dollar down".

Commodities are trickier a weaker dollar is good for them, but a lot depends on demand from China iron ore prices have fallen by around 40% since February, for example.

US Treasuries are likely to hover around the general current area unless inflation looks like rearing its head properly.

As for bitcoin it's charting its own course for now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek news quiz: Can you get smart meter compensation?

MoneyWeek news quiz: Can you get smart meter compensation?Smart meter compensation rules, Premium Bonds winners, and the Bank of England’s latest base rate decision all made the news this week. How closely were you following it?

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb