Billions from boffins: how to profit from university spin-out companies

British universities are teaming up with venture capitalists to create world-beating firms. Back the winners before they leave the lab to make big gains, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When it comes to research, Britain has some of the best universities in the world. The latest World University Rankings from Times Higher Education put Oxford and Cambridge in first and fourth places respectively, while Imperial and UCL also make the top 20. Yet until recently British universities have struggled to exploit their discoveries. While many American institutions have taken commercially promising research and built world-beating companies out of it, British universities have tended to sell their best ideas to outside companies early on, missing out on the profits further down the line.

However, in the last 15 years or so, British universities have been playing catch up. According to Tomas Ulrichsen of Cambridge's Centre for Science, Technology and Innovation Policy, the turnover of active companies spun out from UK universities has quadrupled since 2002/2003, from £466m to £1.84bn now. High-profile success stories include mobile video games company NaturalMotion, which was spun out of research done at Oxford's zoology department. It was bought in 2014 by US gaming giant Zynga for $500m. And in December, gene-sequencing firm Oxford Nanopore made headlines when it raised £100m from investors.

So what's driven this improvement in commercial nous? How do universities and venture capitalists turn ideas into world-beating companies? And most importantly how can you invest in these British success stories before they leave the lab?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How ideas get turned into cash

Most university commercialisation follows a two-stage process. If an academic comes up with an idea that they think could become a product or company, they can approach their institutions' technology transfer office. The office will help them to find a way to exploit it, either by licensing the technology to another company (who will pay for the right to use it), or by setting up their own firm (a "spin-out" company one based on university intellectual property). If they want to go down the spin-out route, the university will try to put them in touch with potential investors, and may also invest itself.

According to the academics and venture capitalists I spoke to for this piece, one of the biggest driving forces behind the increase in spin-out activity and other forms of commercialisation is the Research Excellence Framework, which was set up in 2008 and formally carried out three years ago. This requires universities to demonstrate economic impact in order to secure funding for research. In theory, this can be done in many ways the impact can be social as well as commercial, for example. However, as Adam Stoten, head of technology transfer for life sciences at Oxford, points out, universities that have already set up successful companies are particularly well placed to attract funding because "spin-outs are extremely tangible evidence of impact". This has encouraged universities to back commercialisation more aggressively. Many have headhunted key staff from the private sector and industry. As a result, and while there is still room for improvement, in "the last 15 years university technology transfer offices have become a lot more sophisticated", says Hugh Campbell of investment bank GP Bullhound, which specialises in advising technology firms.

As well as offering logistical support and advice, universities are investing their own hard cash. Seed money and "proof of concept" funds allow researchers to figure out if a discovery has any commercial potential, and in some cases, to produce prototype products. Being able to demonstrate that an idea can be turned into a working product, or that there is a market for the technology, makes it far easier for researchers to approach investors for the funds they need to take a spin-out to the next level. Some universities also offer cheap facilities, such as office space or extended access to laboratories, to spin-outs and start-ups.

Academic resistance to enterprise has reduced greatly too. That's partly a generational phenomenon. While established scientists once saw the idea of profiting from research as "grubby", says Stoten, younger researchers "naturally embrace the idea" of setting up firms to exploit their discoveries. As these scientists "get promoted and move into more senior positions within academic departments" they are opening up their universities to the opportunities in commercialising research and ideas.

Indeed, science students increasingly "expect university support for entrepreneurship and start-ups in the same way that they want better sport facilities", says Simon Bond of SETsquared, an investment partnership between several universities. "Yesterday's students wanted to headline Glastonbury," agrees Gregg Bayes-Brown of Oxford University Innovation. "Today's students want to generate headlines in TechCrunch [a news website reporting on technology businesses]." In short, when it comes to commercialisation, the "winds of change are blowing through campuses".

From idea to spin-out

So how does all of this work in practice? Tony Raven, CEO of Cambridge Enterprise, of Cambridge University, explains that it has three main funds: a seed fund, a later-stage seed fund and a follow-on fund. The seed fund is designed for firms that are just starting out, or are at the proof-of-concept stage. This comes from the university itself.

The second fund, called the University of Cambridge Enterprise Fund, is targeted at companies that are slightly further down the development path, and involves both university and alumni money. The final fund, Cambridge Innovation Capital, uses money from both the university and private investors to target companies that have advanced beyond the development stage, but need a lot more money to expand properly.

The University of Oxford has a similar structure. Oxford University Innovation (OUI) is the first port of call for academics, and offers support and legal help with patenting. If OUI and the academics think the idea is worth pursuing as a spin-out (or a start-up, for discoveries that aren't immediately patentable), then they will be referred to Oxford Sciences Innovation (OSI), an investment company owned by both the university and private investors. OSI provides venture-capital funding that will hopefully get the company to the point where it can be floated on the stockmarket.

Beyond Oxford and Cambridge, while most universities have their own technology transfer offices, not all can afford to have their own dedicated investment funds. But institutions are teaming up to produce investment companies.

The aforementioned SETsquared Partnership is one such collaboration between the universities of Bath, Bristol, Exeter, Southampton and Surrey. SETsquared aims to provide enough funds to incubate companies set up by students, staff and alumni of the five universities. Touchstone Innovations, meanwhile, has grown from its origins as the private arm of Imperial College to fund spin-outs from other institutions.

A key part of this process is to ensure that both the university and academics get a fair share of any spin-out company's equity, although their ownership will inevitably be diluted as other investors put capital into the company. Bayes-Brown notes that, "technically, employment law states that all intellectual property is the sole property of the university". However, enforcing this strictly would give academics little incentive to develop their ideas, so Oxford splits initial ownership 50-50, which is on a par with the US, where the academic typically gets around 45% (Cambridge divides equity on a "case by case" basis).

Patient capital

Despite the great strides that have been made in recent years, there are still problems. The "valley of death" that used to lead to most spin-outs quickly failing for lack of funds "has largely been overcome", argues Raven. However, "we still need to find the sources of capital that will allow firms to scale up into billion-pound companies, without having to leave the UK". This is a bigger problem for some sectors than others. "While some IT companies can become profitable relatively quickly, with one machine learning company breaking even within two years", life-sciences companies can still require venture-capital funding for well over a decade: "some drugs can take up to 17 years to be approved".

"Finding the right investor can be a real problem," agrees Stoten. But one solution is starting to emerge as a major asset class so-called "patient capital". This is essentially longer-term venture capital (VC).Stoten notes that traditional VCs expect to get a return on their investment within three to five years, either via a takeover by a larger company or a listing on the public markets. However, "patient capital" specialists are willing to wait for around a decade before they start to see a return on their investment. One prominent champion of "patient capital" is high-profile fund manager Neil Woodford, who acknowledges that it's tough. "The journey from start-up to a successful scaled technology business is long and often bumpy," he says. So investors "need to work closely with the early-stage businesses they have backed in pursuit of commercial success" and any partnership must have "the resilience to survive the frequent set-backs these companies have on the road to scaled success". Interest in patient capital is growing especially with the government reviewing the various tax incentives for this type of investment but there is still "a distinct lack of appropriate capital".

However, while this lack of long-term investment is bad for British science it is, paradoxically, good for investors, says Woodford. Because "demand for capital from early-stage companies is high, but the supply of it is very low", it means "the returns on capital... are potentially very high". Indeed, his decision to leave Invesco three years ago was partly motivated by his interest in investing in university spin-outs. In 2015 he set up the Woodford Patient Capital Trust, which aims to take stakes in unlisted university spin-outs. We look at the fund plus other promising options below.

Tap the stars of the future with these top spin-outs and funds

Oxford BioDynamics (LSE: OXF) was spun out of life sciences research at the University of Oxford. Its main product is a blood test that can be used by drug companies to determine whether certain drugs will work for an individual patient, or if they could have side effects. Revenues are just starting to grow, and it is yet to make a profit, so it is a risky investment. However, the rewards could be huge consultancy McKinsey reckons the global market for diagnostic products for personalised medicine will reach $6bn by next year.

University of Nottingham spin-out Oncimmune Holdings (Aim: ONC) listed on the Aim exchange last year. Its main product is a blood test that can detect early-stage lung cancers before they spread, greatly boosting the chances of long-term survival.It has already sold 150,000 of these tests, mostly in the US, and expects global sales of this product alone to reach $590m in the next four years. It is currently evaluating similar tests that will enable rapid detection of ovarian and liver cancer, which it expects to launch later this year.

Kromek (Aim: KMK), which spun out of Durham University, develops radiation detection products. These devices have several uses in the nuclear industry, medicine, and airport security. Recently Kromek won a contract to deploy its bottle scanner at an Asian airport, while a baggage scanner containing Kromek components received approval from the US Transportation Security Administration. The US Department of Defence has commissioned it to develop a radiation detector that can be used in harsh environments. Sales are rising, although Kromek has yet to make a profit.

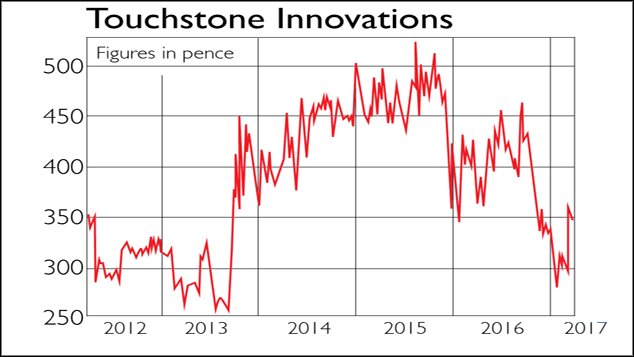

If you'd rather invest in what is effectively a fund of spin-outs rather than individual stocks, consider Touchstone Innovations (LSE: IVO) formerly Imperial Innovations. It invests in spin-outs from Imperial College London, but also in those from other universities in the "golden triangle" including Oxford, Cambridge and University College London. At the end of 2016 it held 107 firms, in areas from engineering to biotech. It's currently loss-making, but if even a handful of its investments succeed, you could enjoy a big payday.

Another option, as noted above, is Woodford Patient Capital Trust (LSE: WPCT), which was set up by Neil Woodford to make money for investors by providing much-needed long-term capital to university spin-outs. The trust owns many small listed and unlisted companies. It focuses primarily on the healthcare and biotech sectors, but also owns a big stake in Oxford Sciences Innovation, the main venture capital fund for Oxford spin-outs, giving investors access to some of the world's most promising start-ups. It has a small ongoing charge of only 0.18%, plus a performance fee of 15% of any returns above a 10% benchmark.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.