A clear signal to sell on satellites

Satellite operator Inmarsat is plummeting back to earth. Investors should eject, says Alex Williams.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Satellite operator Inmarsat is plummeting back to earth.Investors should eject, says Alex Williams.

Telecommunications group Inmarsat is sending a clear signal to investors, says Jillian Ambrose in The Daily Telegraph. "Sell." The FTSE 100 company owns a cluster of satellites, each as large as a double-decker bus, which it uses to sell internet access to customers in remote locations. Key customers include the shipping and oil sectors, both of which are in distress. Oil has tanked and a glut of ships has depressed freight rates, pushing shipping companies under and weighing on Inmarsat's sales.

Profits halved in the first quarter and revenue is due to fall 5% this year from $1.27bn. Its shares are down 28% this year. Inmarsat has also had problems on the launchpad. Its third generation of "Global Express" satellites is facing delays, while a Russian rocket carrying one of its satellites recently crashed, burning up over Siberia. A 25% fall in the firm's shares so far this year is not a buying opportunity, but a warning to "step back", says Ambrose.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The outlook's not that bad, says Caleb Henry in Satellite Today. Inmarsat's new generation of satellites may have been "un-launched", but its long-term trajectory is positive. The next launch is due later this year from California and once delays are overcome shareholders can expect "double-digit revenue growth" from 2018. Inmarsat's airline business is also booming, says Daniel Thomas in the Financial Times, as in-flight broadband becomes more common.

The firm has signed a contract with Deutsche Telekom to supply broadband on flights across Europe. The project is scheduled for testing in 2017 and "all of Europe's leading airlines" are showing interest in the service, according to Rupert Pearce, the chief executive.

Inmarsat's potential market is growing, but so too is the competition, says Barclays. For example, British Airways and Delta Air Lines are adding super-fast broadband to flights, allowing customers to stream films but they have chosen to use Gogo, a Chicago-based firm, which uses ground-to-air technology. And Virgin America uses ViaSat, one of Inmarsat's competitors.

It's clear that rivals are catching up, says Haitong Securities. It believes that Inmarsat will need to spend $500m a year on infrastructure to maintain its industry lead, which is more than most analysts are expecting. The stock has been a strong performer in recent years, but it's time to eject.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

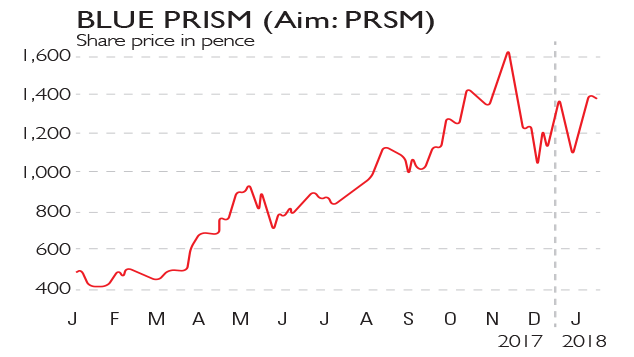

If you'd invested in: Blue Prism and Inmarsat

If you'd invested in: Blue Prism and InmarsatFeatures Software firm Blue Prism has doubled revenue in 12 months, while satellite operator Inmarsat has seen earnings plummet.

-

Three stocks for income

Opinion Professional investor Simon Gergel picks three British income stocks with strong fundamentals.