Three stocks for income

Professional investor Simon Gergel picks three British income stocks with strong fundamentals.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Each week, a professional investor tells MoneyWeek where he'd put his money now. This week:Simon Gergel, fund manager of the Merchants Trust, picksthree income stocks.

Our investment approach is based on building an actively managed, strong-conviction portfolio of attractive, higher-yielding equities. We analyse companies in three main areas.

We look for strong fundamentals: these include the competitive position of the business, the strength of its balance sheet and cash flow, and its corporate governance framework. We have a strict valuation discipline: we look to buy shares that underprice the intrinsic value of the business, and to sell those that are fully priced. Finally, we place a strong emphasis on themes. In other words, we look for companies that will benefit from long-term structural changes or cyclical developments. This analysis also seeks to avoid "value traps" companies that may look cheap, but are structurally challenged.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are three examples. Firstly, United Business Media (LSE: UBM). This company has been radically transformed over the last decade. It has gone from being a conglomerate with lots of exposure to declining print media, such as magazines, to becoming mainly involved in arranging and running exhibitions. Exhibitions and trade shows are attractive businesses (many are "must-attend" industry events) with high barriers to entry. They're cash generative, earn high returns, and there are structural growth opportunities not least in emerging markets, which represent a large part of the group. UBM's shares are currently depressed, partly due to negative reaction to a fund raising put together to buy a US exhibition business. The valuation is modest with a low double-digit price-to-earnings (p/e) ratio, a dividend yield approaching 5% and strong underlying cash flow.

Inmarsat (LSE: ISAT) is a leading provider of satellite communications services. It supplies shipping firms, airlines and government agencies with voice and data links around the world, including in remote areas. The business is currently launching its next generation of satellites. These allow greater bandwidth and will help to develop interesting markets, such as Wi-Fi on aeroplanes, high-speed broadband on ships, and numerous defence-related opportunities. The business has high barriers to entry, including an established customer base, satellite fleets, spectrum, geographic reach and technological capabilities. United pays a dividend yield of over 4%, which it has consistently increased in recent years. Cash flow is expected to pick up in the future as the new services start to contribute sales and profits. This makes the valuation look attractive.

Property company Hansteen (LSE: HSTN) has a large portfolio of industrial assets in Germany, the UK and other parts of Europe. Industrial property is starting to attract investors, who are being drawn in by the low level of new development and the fact that demand from tenants is gradually recovering. This sub-sector has some of the highest property yields around, even though the broad base of tenants diversifies individual customer risk. Hansteen's management team has a strong record of buying cheap assets with a large amount of void (vacant) space, and of working hard to fill that space with new tenants before selling the assets on at a profit. We are currently at an interesting point in the industrial-property cycle. Hansteen's large German portfolio is valued on a rental yield of around 9%, which we believe understates the true worth of the assets. The shares are priced at around asset value, which is attractive, and they carry a 5% dividend yield, which is growing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Simon has been the Chief Investment Officer of UK Equities at Allianz Global Investors for more than 17 years and he has extensive experience in fund management. Previous to that, Simon was the Director Senior Fund Manager at HSBC for four years and a UK fund manager executivedirector at UBS Global Asset Management for 14 years. He has a degree in mathematics from the University of Cambridge. Simon contributes to MoneyWeek, giving his outlook on the stockmarket in MoneyWeek’s share tips.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

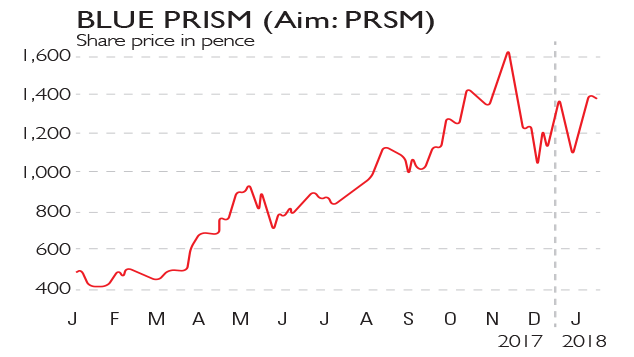

If you'd invested in: Blue Prism and Inmarsat

If you'd invested in: Blue Prism and InmarsatFeatures Software firm Blue Prism has doubled revenue in 12 months, while satellite operator Inmarsat has seen earnings plummet.

-

A clear signal to sell on satellites

A clear signal to sell on satellitesFeatures Satellite operator Inmarsat is plummeting back to earth. Investors should eject, says Alex Williams.