If you'd invested in: Blue Prism and Inmarsat

Software firm Blue Prism has doubled revenue in 12 months, while satellite operator Inmarsat has seen earnings plummet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

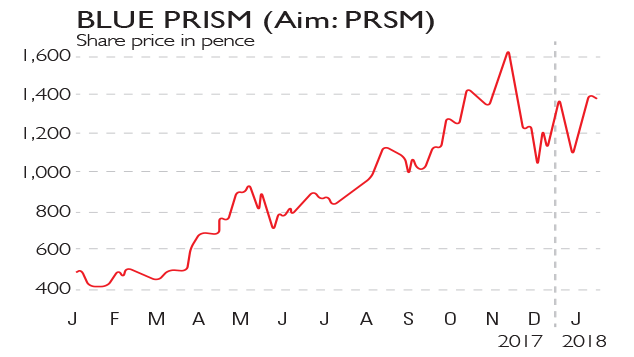

Blue Prism (Aim: PRSM) specialises in providing software that automates repetitive white-collar tasks for accountants, banks, and law firms. Investors who bought on flotation in 2016 have made 1,081%. For the year to 31 October revenue more than doubled to £24.5m from £9.6m. It also secured 609 software deals, a fivefold increase from 189 previously, due to a significant rise in new customers 324 from just 96 the year before.

Be glad you didn't buy

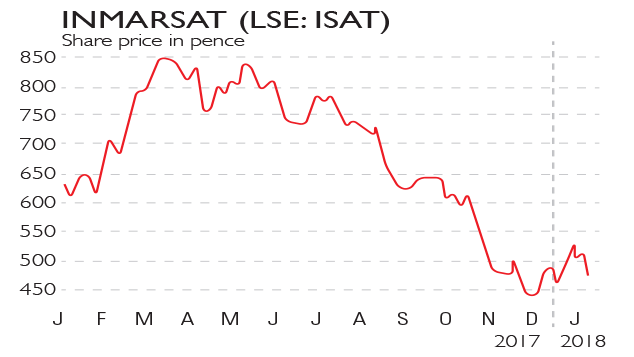

Inmarsat (LSE: ISAT) operates a global satellite network, offering mobile and fixed communication services. Its shares dropped to a five-year low in November when the company cut its revenue guidance for the year and struck a cautious note over its fast-growing aviation business, which has been installing in-flight broadband for airlines. Indeed, the main thing stopping Inmarsat's shares from diving further has been takeover speculation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

A clear signal to sell on satellites

A clear signal to sell on satellitesFeatures Satellite operator Inmarsat is plummeting back to earth. Investors should eject, says Alex Williams.

-

Three stocks for income

Opinion Professional investor Simon Gergel picks three British income stocks with strong fundamentals.