Profit from the oil price crash

The oil price crash continues. But it's not all bad news. Alex Williams looks at how you can use the slump to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The price of oil is heading lower: use the slump to snap up long-term MoneyWeek favourite Japan, says Alex Williams.

Petrol is on the brink of dropping below 90p per litre, as prices on the forecourts follow the oil markets sharply lower, says the RAC. At those prices, notes the motoring group, petrol will be cheaper for motorists than most brands of bottled water. After a difficult 2015, the oil market has started 2016 by going into complete free fall, with crude tumbling below $28 per barrel on Monday, its lowest level for 12 years.

It's all good news for motorists, as well as countries that are net oil importers, including the UK. So why are investors panicking, with global stockmarkets plunging as rapidly as the oil price? Their main concern is that the depressed oil market is acting as a harbinger of hard times to come for the global economy, with the plunging price signalling a looming global recession. The nose dive, from $115 per barrel as recently as 2014 to below $30 today, has not only taken almost everyone involved by surprise, but it has also been accompanied by a collapse in the prices of other key commodities, from copper to iron ore.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tumbling prices for all of these vital resources could indicate a plunge in demand, and "if the oil rout is a mere precursor to a downturn in the global economy", says Peter Spence in The Daily Telegraph, then "all bets could be off". Yet figures suggest that oil consumption remains surprisingly robust. Despite China's volatile stockmarket and its slowing GDP growth, the country's economy is still expanding.

And according to data released on Tuesday, China's oil consumption hit a record level of 10.3 million barrels per day in 2015, up 2.5% from the year before. Over the past ten years, China's oil imports have nearly tripled.

It's not just China. Oil consumption in America is also booming. Earlier this month, carmakers reported their sales figures for 2015, which overtook 2000 as their best year to date. American car dealers sold 17.5 million vehicles in the last 12 months, up 50% in just five years. New car registrations in the UK are likewise sitting at an all-time high.

A global glut of oil

For now, at least, demand for oil isn't the problem. Instead, today's oil-price weakness is mainly about oversupply. The market this week has spent its time focusing intently on Iran, after US sanctions against the country were lifted on Saturday. The sanctions have been in place to varying degrees since the revolution in 1979, but were tightened in 2006 and again in 2011, crimping the country's oil production from nearly four million barrels a day to less than three million.

That could now rebound sharply. Iran is sitting on the world's third-largest oil basin, according to US energy data, trailing only Venezuela and Saudi Arabia in terms of proven oil reserves. Within 24 hours of sanctions being lifted, Iran's deputy oil minister, Rokneddin Javadi, pledged immediately to start pumping an extra 500,000 barrels a day. The lifting of US sanctions clears the path "for an all-out oil war" between Iran and Saudi Arabia, says Jamie Nimmo in The Independent oil investors are merely collateral damage. And in a market gripped by bearish sentiment, the alarm did not stop there. "There is some concern the Iranians can pull a rabbit out of the hat and produce bigger volumes," RBC's commodity strategist Helima Croft told The New York Times. "It's not coming at a great time" for the oil price.

In terms of the overall market, Iran's added supplies don't sound that dramatic amounting comfortably to less than 1% of the global oil market but the flow of Iranian oil could be front-loaded, as unsold inventories that have piled up are quickly released onto the market. At least 50 million barrels of crude oil have been pre-loaded onto 25 supertankers, waiting to set sail from Iranian ports this week, the Financial Times reports. As a result, there will probably be "an up-front spike", Richard Nephew, a sanctions expert from Columbia University told Reuters.

Iraq starts pumping too

Weighing on prices further, oil exports from neighbouring Iraq have also ratcheted up in the last 12 months, from roughly three million to four million barrels per day, putting the country close to its peak capacity, say analysts at PetroMatrix in Switzerland. Led by Saudi Arabia, oil cartel Opec has stubbornly refused to cut production, scrapping its quota system last year, as its members battle for market share.

As if all that was not enough for oil investors to digest, Russia is pumping at its highest levels since the collapse of the Soviet Union. International oil markets "could drown in oversupply", the Paris-based International Energy Agency warned in a bleak report on Tuesday.

But is the global glut exaggerated? The removal of trade restrictions against Iran was so well trailed, notes Reuters, that it should not have come as a surprise to traders. Iran is also barely breaking even at current crude oil prices, according to estimates by consultancy Rystad Energy, suggesting that the country has little incentive to raise its output too aggressively. "Iran has excellent oil and gas resources," says Norbert Rcker, head of commodities research at Swiss bank Julius Baer. But its oil industry is in need of intensive investment. That, of course, costs money, and that's something "for which today's market environment is not exactly supportive".

It's a similar story with Russian exports. They edged higher last year, but are basically flat at around five million barrels a day and do not by themselves warrant a collapse in the price of crude from over $100 per barrel. The pain for Russian producers has certainly been lessened by the rouble dropping in tandem with oil (oil is priced in US dollars, so a weak rouble meansthat Russian producers are cushioned somewhat by the impact of currency exchange effects). But much like Iran, Iraq and even Saudi Arabia, Russia can ill afford a major expansion programme in the current low-price environment.

The real culprit behind the collapse

Market attention should instead be trained on the real swing factor for oil: the rapid expansion of US production in recent years, following the breakthrough of "fracking" (hydraulic fracturing) technology. By dollar value, America still pips China as the world's largest oil importer, spending $247bn on foreign oil in 2014. But the volume of its imports has fallen substantially to 7.5 million barrels per day, down from nearly ten million five years ago. That's because its own domestic production has rocketed from six to nine million barrels a day.

Almost all of this increase has come from fracking, and it has allowed the world's largest oil buyer quietly to back out of the market, leaving the world awash with production. The pattern of American buying has also subtly shifted. Canada has replaced Saudi Arabia as its largest foreign supplier, while imports from Venezuela, Nigeria and Angola have all plummeted. "Saudi, Nigerian and Algerian oil that once was sold in the US is suddenly competing for Asian markets," says Clifford Krauss in The New York Times, "and the producers are forced to drop prices."

So if it's primarily US production that has tipped the market into its current state of chronic oversupply, the question is this: will America's newborn fracking industry get squeezed out of the market itself by tumbling prices? Production in the US has held up so far, but evidence suggests it is coming under severe strain. The shale industry has become ever-more efficient and productive in recent years, but it still depends on prices of $40 to $60 per barrel to be viable, says investor Howard Marks at Oaktree Capital in New York . The number of onshore rigs operating in the US has dropped by nearly two-thirds in the last two years, according to data from oil services company Baker Hughes, as shale operators have reined in activity.

At least 42 oil companies in North America have filed for bankruptcy since the start of 2015, according to Houston-based law firm Haynes and Boone, and American banks could be faced with a wave of bad debts, as an estimated $200bn of loans to the fracking industry begin to come under heightened scrutiny. "There is a lot of distress in the industry," one partner at the law firm told CNN. "There will be a lot of pain."

Opec, for one, is counting on US shale exiting the market. In its first monthly report of the year, published this week, its tone was almost jubilant. Not only did it welcome Indonesia back into the club after a seven-year break, it also predicted that oil supply from America and Canada has already peaked. Output from shale wells typically falls off at a startling rate of 60% a year, the report contends, suggesting that a drop in drill rig activity in America will quickly translate into plummeting production (because with old wells drying up fast, new ones need to keep coming online to maintain the rate of production).

At current prices, Opec also questioned "the viability" of new oil exploration in Russia. "After seven straight years of phenomenal non-Opec supply growth," the report said, "2016 is set to see output decline as the effects of deep capex cuts start to feed through."

The bears triumphant

Even as Opec zeroes in on the endgame in its war against new supply, market sentiment is approaching an all-time low. Bearish bets are at their highest level since 1983, according to analysts at ANZ Banking Group, while banks are competing to issue the most bearish price predictions: Barclays has slashed its crude oil forecast for the year from $60 to $37 per barrel, Morgan Stanley has predicted prices of $20, RBS expects a low of $16, and Standard Chartered says prices could go as low as $10 per barrel. "We are sellers of any and all rallies in days and weeks to come," one New York-based trader told Reuters. For contrarians, this almost unanimous bearish sentiment suggests the market is ripe for a bounce.

Now for the good news...

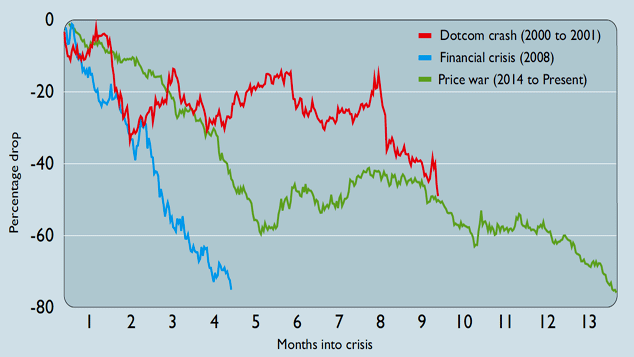

That said, the overhang of marginal supply means oil is unlikely to rebound to $100 per barrel anytime soon. That is bad news for oil investors, conditioned to expect crude to bounce back quickly, as it did in 2009. But it should be good news for the wider economy. "The markets are haunted by the fear of recession", says Larry Elliott in The Guardian, but ever since the early 1970s, a sharply rising oil price has equated to economic shocks, not least in 2008. "Periods when the oil price has been falling", Elliott adds, such as the mid-1980s and the second half of the 1990s, are "associated with booms".

In short, while the shale industry will have some bad debts to admit to, for the world's largest oil importers, including America, China, India and, indeed, the UK, a low oil price could produce some unexpected economic benefits. "The bottom line," says Oaktree's Marks, is that "if you aren't an oil company or a net oil-producing country, low oil prices aren't necessarily a bad thing". Quite the opposite. For motorists, consumers and the manufacturing industry, structurally lower oil prices should instead amount to "an unmitigated boon".

In the slightly longer-term, that's good news for companies and economiesthat benefit from lower oil prices, and we'd continue to use this slump as a buying opportunity for markets such as long-term MoneyWeek favourite Japan (see our interview with Simon Somerville of the Jupiter Japan Income Fund on page 22), although it may take some time for those benefits to come through in share prices while investors fret about deflation and China's slowdown (see page 4 and 21). Meanwhile, what does it mean for the giant oil majors that matter so much to the UK's FTSE 100? We take a look below.

How will the price weigh on the majors?

With oil prices heading lower for longer, which major producers are best positioned to weather a prolonged downturn in prices? Shares in BP (LSE: BP) outperformed on Monday, even as the crude oil price plunged, after investment bank SocGen said the company was well prepared. BP shrunk its portfolio and was forced to start cutting costs, long before the rest of the industry, after its Deepwater Horizon disaster in the Gulf of Mexico in 2010. Its free cash flow may turn negative, SocGen cautions, but BP can sustain its current dividend if prices recover to $60 per barrel by 2017. The trouble is, a doubling of prices by the end of the year is by no means certain. Oil is likely to stay around $30 per barrel for an extended period, BP's former chief executive Tony Hayward told Bloomberg at Davos, a shindig for the global elite, this week. With the shares yielding nearly 9%, the market is expressing understandable scepticism.

Royal Dutch Shell, France's Total and Norway's Statoil will also all struggle to make money below $60 per barrel, says the Financial Times, explaining the relentless round of job losses emanating from the oil sector. Shell dropped 5% on Wednesday after revising its earnings lower and its debt levels higher, ahead of a shareholder vote on its mega-merger with BG Group (LSE: BG). "As a reminder of why Royal Dutch Shell wants to buy BG," says The Wall Street Journal, "an ugly set of figures certainly does the job."

A better option for riding out the storm could be ExxonMobil (NYSE: XOM), the world's largest listed oil producer. CEO Rex Tillerson says the giant can be "successful" at $40 a barrel, better than its peers. It has the best cash-flow margins in the industry, so should benefit as depressed prices "sort out" the market, Tillerson says, increasing pressure on Exxon's rivals.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.