Shanghai surprise: the week that shook global markets

Investors have been scared witless by the plunge in the Chinese stockmarket and currency, the yuan. Andrew Van Sickle explains why you should stay calm.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Stockmarket folklore posits that the first five trading days of January set the tone for the year. In that case, we're in big trouble. America's S&P 500 index suffered its worst first week on record in the five days to last Friday, shedding 6%. The Russell 2000 small-cap index lost almost a fifth.

On this side of the pond, the 5.5% drop in the FTSE 100 marked its worst start to the year since 2000. The pan-European FTSE Eurofirst lost almost 7%, its worst week since August 2011.

Investors have been scared witless by the plunge in the Chinese stockmarket and currency, the yuan. The Shanghai Composite index slumped by another 10% last week, and was open for only 29 minutes on Thursday. Shares fell so fast that a circuit breaker, designed to halt trading for 15 minutes once a 5% decline has occurred, kicked in after just 27 minutes. If shares fall by 7%, the session is over. The last 2% took a mere two minutes. Local traders finished their day before "their coffees had even cooled".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

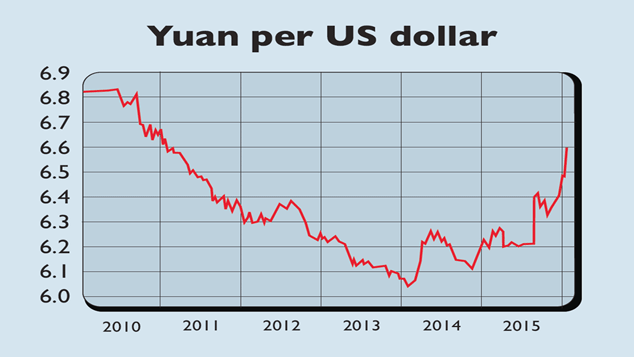

Meanwhile, the yuan fell by 1.5% against the dollar last week, and 1% in just ten minutes at one stage "a sharp move for the still carefully managed currency", says the FT's Tom Mitchell. It was its second-biggest weekly fall since last summer, when we had the first bout of China jitters. Weakness in the currency reinforces ongoing fears that China's economy is ailing, raising the spectre of China devaluing the yuan significantly to boost growth, which in turn could export deflation (see below).

Are investors right to panic?

Sorry, but I just can't see what all the fuss is about, says Ian Bezek on SeekingAlpha.com. The latest problems in China "surely... aren't any more pressing than the August surprise devaluation that started the whole China panic meme in the first place". Nor, for that matter, should North Korea testing a nuke and oil continuing to sink (after over a year of falling prices) cause such a shock.

Huge falls in the Chinese market may be unsettling, but we should keep them in perspective. For starters, with few foreigners invested directly in mainland stocks, the scope for major losses to infect the global financial system is minimal. Moreover, as Martin Waller notes inThe Times, shares were falling before last August's panic, after soaring by 60% between February and June 2015.By Christmas there had been a 30% rise from the August low. "This is a market driven by unsophisticated retail investors" and its gyrations bear scant relation to the Chinese economy.

The rocketing market in the run-up to last summer's rout hardly reflected a soar away jump in China's prospects, says Fidelity's Tom Stevenson in The Sunday Telegraph, so it is "unrealistic to think that the bursting of that bubble should have anything more meaningful to say about the outlook for economic activity".

The latest slide was largely due to the delayed effect of constant meddling with the market. The anticipated end of a ban on share sales by major stockholders appears to have been the key trigger for last week's slide. "The authorities... are learning the hard way that markets work best when they are left to their own devices."

China's economy looks solid

The government's clumsy tampering with the market it has belatedly realised that the circuit breaker worsened the panic because traders rushed to sell before it kicked in compounded scepticism about official economic data. This is distrusted to the extent that "there is a thriving industry in assembling alternative estimates from the available hard data, such as electricity consumption", asthe FT's John Authers points out.

"In such an environment, hard data such as foreign exchange rates and share prices take on more significance." That said, a careful look at the evidence hardly points to disaster. The big picture is one of a structural slowdown from growth of around 7% a year to 4.5% over the past two years, says Capital Economics, but "there is no support in the data for the notion of a deepening economic crisis... Much of the slowdown seems to have occurred a year or more ago."

If anything, the short-term picture appears to be improving. Recent interest-rate cuts and relaxations of lending restrictions have led to a rise in the money supply, which is now climbing at a rate not seen since 2008, notes Ambrose Evans-Pritchard in The Daily Telegraph. The government has also "cranked up fiscal spending" in a bid to boost the economy. Poor manufacturing figures rattled the markets last week, but these data matter less than they did: now that the state is "winding down chunks of the shipbuilding, steel and chemical industries", the key statistic to watch is the Purchasing Managers' index of service sector activity, now at a 15-month high.

As for the long term, the transition from an economy dominated by industry to one driven by consumption and services is on track, says Philip Aldrick in The Times. Industry and property have led the overall slowdown, while the service sector is expanding steadily. It became the economy's biggest sector in 2012. Urban jobs growth in 2015 occurred almost entirely in services such as retail, which the World Bank says is expanding robustly. "The plan is working."

Is the yuan set to slump?

With the Chinese economy weakened, investors reckon the authorities could opt to prop up growth by allowing the currency to fall substantially. Such a "beggar-thy-neighbour push for export share", says Ambrose Evans-Pritchard in The Daily Telegraph, "would send a powerful deflationary impulse through a world economy already on its knees".

The authorities allow the yuan to move around a fixed point every day, and in recent months have adjusted the daily rate downwards faster than usual, so the latest moves have made global investors nervous. In addition, the Chinese central bank has confused investors with its various announcements on exchange-rate policy.

For instance, it said last autumn that there was no reason for a long-term devaluation of the yuan and the yuan-dollar rate was moving towards stability. But it then decided it would henceforth keep the yuan stable against a basket of currencies, showing that it "now has a greater tolerance" for yuan depreciation against the greenback, as the FT'sTom Mitchell notes.

Analysts have also pointed out that money is flooding out of China, depressing the currency. Indeed, the authorities spent $113bn, a monthly record, propping the yuan up in December. What's more, using foreign-exchange reserves to bolster the currency essentially takes money out of the system, thus tightening policy and exacerbating the slowdown.

Nonetheless, fears of an imminent devaluation look overblown. Beijing has enough forex reserves to last over two years at December's rate of expenditure, says Capital Economics. It's also not clear that it would help much. China's global share of exports expanded in 2015, so arguably it doesn't need a cheaper yuan. Devaluing would only delay the transition to a consumption-driven economy, while the political cost would also be high.

Note too that even a 20% devaluation "would not unleash a tidal wave of deflation", as imports from China comprise under 5% of GDP for developed economies. That implies a fall in inflation of less than 1%, assuming that a downward spiral of devaluations from other countries is avoided.

Hence the best guess is that China tries to keep the currency stable in trade-weighted terms, concludes Capital Economics. The yuan has appreciated on this basis by 8% over the past two years. Doing this will require further weakening against the greenback if the latter keeps getting stronger, which is, of course, the rate most closely watched by markets.

Will China's slump affect the rest of us?

A China slump and the deflation that it implies is a horror scenario because central banks all over the world are doing their best to ward off falling prices. But the markets' apparent fears over damage to global growth also look overdone. The eurozone continues to recover slowly, while "instead of further steep plunges in foreign demand for German exporters, it looks as if there is a turnaround", Unicredit's Andreas Rees told Economist.com's Buttonwood blog. In November,new German manufacturing orders rose by 1.5%, a second successivemonthly rise.

Meanwhile, the US economy continues to strengthen, with payrolls expanding by almost 300,000 in December. Wages have yet to pick up and the recovery has been slower than normal, but there is scant sign of a relapse. American and global consumers will also benefit from the latest falls in oil prices. The upshot? "A judicious view might be that global growth is still sluggish, but it will probably need some trigger to plunge it into outright recession."

Absent a Chinese meltdown, what could that trigger be? Perhaps the unexpected return of inflation, necessitating steep interest-rate hikes and pricking stock and bond market bubbles. This may sound far-fetched, but core inflation (excluding energy and food) in America has reached 2% and central banks always end up behind the curve when prices rise.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek news quiz: Can you get smart meter compensation?

MoneyWeek news quiz: Can you get smart meter compensation?Smart meter compensation rules, Premium Bonds winners, and the Bank of England’s latest base rate decision all made the news this week. How closely were you following it?

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb