US interest rates: after the lift-off, the crash?

US interest rates have finally been raised. But years of ultra-loose monetary policy have blown up bubbles all over the place. How long before they burst?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

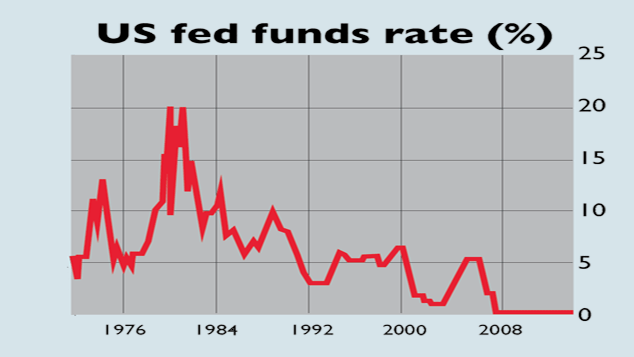

Finally. Ever since the benchmark US short-term interest rate, the federal funds rate, fell to a record low of 0%-0.25% in 2009, the Federal Reserve has "repeatedly made optimistic forecasts about when they would start rising, only to delay the big day again and again", says The Economist. Now we finally have lift-off. Last Wednesday, the US central bank lifted the funds rate by 0.25% to a new range of 0.25%-0.5%. It was the first such rate hike since June 2006.

No tantrum this time

This time, however, liquidity-addicted markets weren't perturbed; indeed, stocks ticked up once the decision was announced. The move had been clearly telegraphed; recent economic data have been positive; and the global-market jitters that had helped persuade the Fed to hold fire in September had subsided, although the turbulence in the credit markets has caused concern. Yellen also placated investors by making it clear that rate rises from here will be very gradual.

Many analysts believed it was high time for the Fed to move. Its mandate is to achieve maximum employment and 2%inflation. Unemployment has slipped to just 5%, below the level at which the Fed last started tightening in 2004. Underlying inflation, which strips out volatile food and energy prices, has already reached an annual rate of 2%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The big picture, however, is that "America's monetary policy has justgone from being astonishingly loose to ever so slightly less astonishingly loose", says Liam Halligan in The Sunday Telegraph. There's miles to go if we are to return to interest rate levels usually associated with "normality" rather than an emergency.

Early signs of trouble

An unexpected surge in inflation could also cause turbulence and cause interest rates to be hiked much faster than currently expected. The inflationary momentum could come from wage growth. In December the annualised rate of average hourly pay growth hit 2.8%, up from 2.4% in September. And core inflation is already at 2%.

The Fed's serial bubble blowing, then, means that getting rates up significantly without endangering the system is going to be a very tall order. The last time the Fed embarked on a similar exercise was in 1947. Back then, it started raising rates from three-eighths of a percent, where they had been for five years, says The Economist. "This time, the wait for another stint near zero may not be nearly so long."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King