A screeching U-turn in South Africa

Last week, the South African president, Jacob Zuma, fired his respected finance minister Nhlanhla Nene. But the market and media furore prompted a major U-turn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

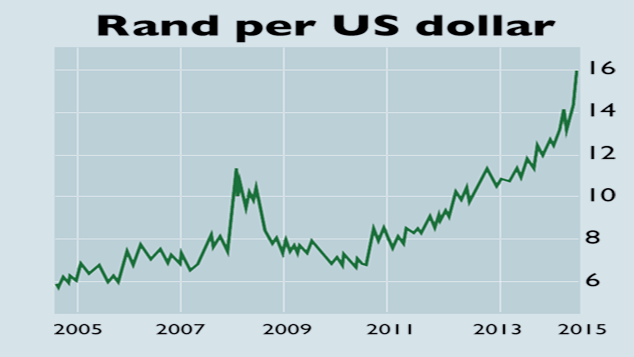

"This is a mess-up of epic proportions," economist Dawie Roodt told Fin24.com. "It is like we're living in Alice in Wonderland." Last week, the South African president, Jacob Zuma, fired his respected finance minister Nhlanhla Nene, sending the rand crashing to a record low against the dollar. Meanwhile, ratings agency Fitch downgraded South African government debt to one notch above "junk", sending bond yields to their highest levels since the global crisis six years ago. Early this week, however, the market and media furore prompted a major U-turn. The obscure backbencher who had followed Nene was in turn replaced by Pravin Gordhan, Nene's predecessor, who also has a solid reputation with investors.

What's going on?

The debt picture is alarming because South Africa just isn't growing fast enough to work it off. Annual growth is likely to be 1% this year and has been stuck around that level since 2012. This is partly due to external factors, says Songezo Zibi on BDLive.co.za. The slowdown in China, South Africa's biggest trading partner, has hit demand for commodity exports, and Europe, its number two trading partner, is stagnating. The current-account deficit has deteriorated, weakening the rand, which in turn has pushed up inflation and prevented the central bank from cutting interest rates.

But there are plenty of home-grown problems too. Underinvestment by the state-owned electricity company has caused widespread, recurring power outages. Red tape, especially for small firms, poor state education and rising cronyism and corruption are common complaints from businesses. There has been "a generalised trend towards institutional decay" in the past few years, says the Financial Times. Assuming that solid pre-crisis growth would endure, the government kept spending the state wage bill has doubled since 2009 due to a civil servant hiring spree and repeated strikes and now that growth has evaporated, the deficit is deeply entrenched and debt has soared.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Will Gordhan's reappointment allay market jitters?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King