Deflation: why TV is depressing the population

Many things are weighing on prices and we’re about to enter a period of deflation. The gogglebox must share some of the blame, reckons Pete Comley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Many things are weighing on prices, and we're about to enter a period of deflation.The gogglebox must share some of the blame, reckons Pete Comley.

This year, Britain fell into deflation for the first time in 55 years. Many have dismissed this as a blip: Bank of England governor Mark Carney thinks we'll be back above the 2% target within two years. He might be right. But I suspect we won't have to wait another 55 years to see deflation again. Although central bankers are trying to fuel inflation with low interest rates and quantitative easing, they are pitted against many deflationary forces: the ongoing impact of the financial crisis, competitive devaluations, China's slowdown and the internet revolution.

The demographic timebomb

However, the biggest deflationary factor is demographics. The birth rate is below replacement levels in almost every developed economy, and is falling in emerging ones. Even in Africa, where the birth rate remains higher, I suspect forecasts underestimate the decline we may see in the coming decades. Why? Research suggests that what has lowered the birth rate most is access to television. Academics debate whether this is due to women's attitudes changing as they become more aware of their options, or because people have something else to do in the evenings. Whatever the case, at some point widespread TV will come to Africa and populations are likely to fall, as they have elsewhere.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We have yet to appreciate the scale of this demographic timebomb. We are all living longer, so populations are still rising in most countries. However, Deutsche Bank predicts that the global population may peak as early as 2050. In most developed countries, it will come sooner. This will have a major economic impact. There will be fewer people around, and on average they will be older. In the UK, the average household headed by those aged 75 or over spends £267 a week less than half as much as a household in the 30-49 bracket. Fewer people all spending less will be a double whammy for demand.

This demographically driven decline in demand fits well with a long-term perspective on prices. In fact, if history repeats itself, we may soon see prices stabilise for the rest of the 21st century.

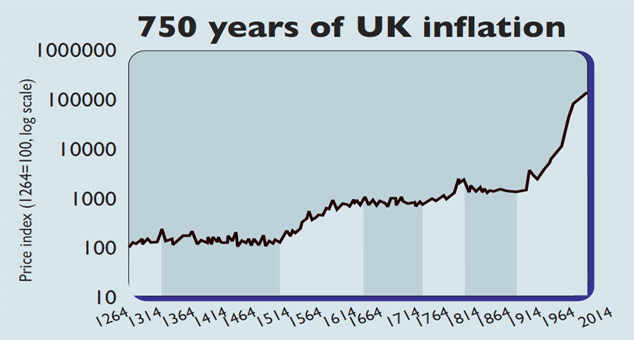

We have estimates of inflation in the UK going back to the 13th century (see chart). This shows that, over the very long term, prices have risen, but not in a straight line they exhibit a wave-like pattern. My research suggests that the UK has typically seen rising prices for a hundred or so years (the light blue sections on the chart), followed by a consolidation period of stable, or slightly declining prices. Each inflationary wave and consolidation has been triggered by different circumstances famine, disease, war or revolution. However, the net effect has been the same to influence core demand through demographic changes.

Inflation in the 16th century

For example, the end of the War of the Roses in 1485 sowed the seeds of the inflation of the 16th and early 17th centuries. Peace returned to England and the population grew from around 2.2 million in 1500 to 5.2 million by 1650. That put huge pressure on resources prices rose nearly tenfold. Then came the English Civil War of 1642-1651, in which an estimated 200,000 people died. Within a few years, prices had dropped by more than a third. The population did not start growing again until well into the 18th century. Even in 1750, prices in 1750 were close to their 1655 low.

The current inflationary wave started in around 1900. Since then, the global population has risen from 1.6 billion to seven billion. But judging by past waves, a turning point is likely to come in the next decade or so. In fact, had it not been for central bankers' efforts, we might have transitioned into the consolidation phase after the 2008 recession.

For us to now switch into full-blown deflation, some key conditions must be met. First, debts need to be made more sustainable, either through default or restructuring. Withoutthis, the pressure on governments to create inflation to relieve them will remain. Second, the excessive money creation of the lastfew decades needs to be resolved.

Asset prices have risen far more rapidly than consumer prices. This has created "latent inflation" in the system. Either the prices of goods and services have to rise to catch up, or asset prices have to fall. Third, there needs to be a credible system to control future money supply growth to ensure it does not create inflation again.

A deflationary shock

It's impossible to predict what will bring these factors into alignment, but one candidate is a major sovereign bond crisis. This would ensure that debts are restructured or defaulted upon, asset prices would crash resolving latent inflation, and it would be likely to result in demands to change the monetary system.

This is going to be a difficult time for investors, but it should still be possible to make money from income-producing assets in the aftermath. After the transition, the following mild deflation is not going to be harmful. Real (after-inflation) wages may also rise for the rest of the century, because the pool of skilled workers will shrink as the working population declines. Inequality will probably decrease as a result, as it has done historically during this phase. This may resolve some of the social issues that concern theorists such as Thomas Piketty.

Pete Comley is the founder of research consultancy Join the Dots. His book, Inflation Matters, is available on Amazon, and a free abridged version can be found at inflationmatters.com/moneyweek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Why Scotland's proposed government bonds are a terrible investment

Why Scotland's proposed government bonds are a terrible investmentOpinion Politicians in Scotland pushing for “kilts” think it will strengthen the case for independence and boost financial credibility. It's more likely to backfire

-

How have central banks evolved in the last century – and are they still fit for purpose?

How have central banks evolved in the last century – and are they still fit for purpose?The rise to power and dominance of the central banks has been a key theme in MoneyWeek in its 25 years. Has their rule been benign?

-

UK to have highest inflation among advanced economies this year and next, says IMF

UK to have highest inflation among advanced economies this year and next, says IMFThe International Monetary Fund (IMF) says it expects inflation to remain high in the UK, while lowering economic growth forecasts for 2026.

-

Is Britain heading for a big debt crisis?

Is Britain heading for a big debt crisis?Opinion Things are not yet as bad as some reports have claimed. But they sure aren’t rosy either, says Julian Jessop

-

'Britain is on the road to nowhere under Labour'

'Britain is on the road to nowhere under Labour'Opinion Britain's economy will shake off its torpor and grow robustly, but not under Keir Starmer's leadership, says Max King

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Why investors can no longer trust traditional statistical indicators

Why investors can no longer trust traditional statistical indicatorsOpinion The statistical indicators and data investors have relied on for decades are no longer fit for purpose. It's time to move on, says Helen Thomas

-

Live: Bank of England holds UK interest rates at 4.5%

Live: Bank of England holds UK interest rates at 4.5%The Bank of England voted to hold UK interest rates at their current level of 4.5% in March, as widely anticipated, after inflation rose to 3% in January