Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Middle Kingdom's newly adventurous middle class is heading abroad. Smart investors are laying on the catering, says Matthew Partridge.

For the past few years China has been undergoing a quiet revolution. Up until now Beijing's version of "state capitalism" involved just enough reform to improve productivity, combined with low wages, high savings and a cheap currency. The aim was to force the population to save, in turn funding huge investment in infrastructure and machinery. Meanwhile a cheap currency and low wages helped Chinese firms to undercut their Western rivals. However, while the state still controls a large (though diminishing) swathe of industry, the rest of the model is being dropped in favour of a "re-balancing".

The idea is to encourage consumers to spend, with the goal of making China less vulnerable to a downturn in the global economy. This is happening just as the pool of cheap labour is being exhausted, which is driving wages higher. As a result, we're seeing a boom in living standards among China's growing middle class. And it's not just domestic retailers that are set to benefit. A growing number of Chinese tourists are taking holidays abroad, something that would have been unimaginable for their parents. According to Bank of America Merrill Lynch (BAML), the overseas spending of Chinese citizens is expected to grow by at least 10% a year for the next few years, from $164bn last year to $264bn by 2019.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Just as China's expansion had a massive impact on demand for commodities during the last ten years, this explosion in visitors from China will transform the tourism business. According to the World Tourism Organisation, the Chinese already make more trips and spend more money than any other country. However, at 11%, China's share of global tourism spending still lags its share of the global population (roughly 20%), or its share of global GDP (17%, according to the International Monetary Fund). This means there is still plenty of room for China's tourist boom to expand further before it begins to level off, especially since fewer than one in ten Chinese people currently travels abroad each year.

This surge will benefit the global tourism industry as a whole. Three sub-groups in particular will do well. Firstly, the increasing number of Chinese gamblers will be losing ever-greater sums of money in clubs and resorts around the world. This includes both those in Asian hubs such as Macau, and more established global resorts like Las Vegas. Next, the army of tourists from the People's Republic will need accommodation, especially as they start to move away from group tours towards more independent travel, which is good news for hotels. Thirdly, after several years of recession, global airlines are also booming, thanks to China.

Taking gambling global

Asian tourists have a reputation for being keen gamblers and the Chinese are no exception. Around a third of tourist spending goes on gambling and related activities. Indeed, spending by Chinese citizens accounts for 70% of the total gaming industry in Asia. This is expected to keeping growing at around 7% a year, rising from $61bn in 2013 to $84bn by 2019. Since gambling is very heavily restricted on the mainland, the former Portuguese colony of Macau, which reverted to Chinese control in 1999, has emerged as a major tourist centre its total revenue of $44.1bn in 2014 was around seven times that of Las Vegas.

As a result of this explosive growth, several international gambling firms have opened casinos and resorts in the area. In 2004 the tycoon Sheldon Adelson entered the market with the $240m Sands Macao. He followed it up three years later with the Venetian Macau, a casino, hotel and convention space complex that totals 10.5 million square feet. The overall cost was a staggering $2.4bn. Around the same time another Las Vegas tycoon, Steve Wynn, built the Wynn Macau, which opened in 2006. MGM has also opened a casino in the area.

As with any sudden boom, some of these ventures have fallen by the wayside. Caesars Entertainment has cancelled one high-profile project. There have been ongoing fears that criminals were using the casinos as a convenient way to launder money. More generally, Beijing was concerned about large sums of money pouring out of the mainland in a form of capital flight. As a result, the Chinese government has adopted several measures to make Macau less attractive both to criminals and wealthy Chinese in general. These range from restrictions on junkets and advertising aimed at "high-rollers" to bans on smoking in casinos.

"Macau took in seven times the revenue of Las Vegas in 2014"

Yet despite a fall in revenues over the past 18 months, most experts see this as a temporary blip, with strong growth set to resume. BAML notes that while one in ten Americans have visited Las Vegas at some point, only 1.3% of Chinese have ever been to Macau. Already there are signs that casinos' efforts to include more general entertainment (encouraged by Beijing) are slowing the decline, and making further measures unlikely. Despite the crackdown, for example, tourist visits to Macau actually went up by 14% last year.

It also looks like the restrictions on Macau are simply encouraging Chinese gamblers to seek out other resorts, accelerating an existing trend. In the second half of 2014 the amount spent by VIP gamblers (the group most heavily targeted by restrictions) in Australia nearly doubled, while the SouthKorean market grew by 20%-30%. The contribution of Chinese tourists toSouth Korean gaming has shot up from 10% in 2011 to around 25% now.While both markets are still relatively small, they are growing fast.

Even resorts in America and Europe are feeling the benefits. Las Vegas has seen the number of Chinese tourists surge by more than 80% in the last five years. They have been credited with single-handedly halting the decline of the card game Baccarat, which now accounts for 25% of all gaming revenue in the city. And they're not just important customers Chinese financiers are also taking a much bigger role in financing casino projects in Las Vegas. This investment has been stoked by US programmes that give investors preferential access to visas.

China's independent travellers

Another big winner from China's tourism boom is the hotel industry. Previously, Chinese tourists have tended to travel in large groups. That was partly because this made it easier to deal with the cultural differences between southeast Asia and the rest of the world (you can rely on a guide to get you through the trickier interactions). Visa restrictions also encouraged group travel. However, from the point of view of hoteliers, group travel is bad news. Groups used their buying power to push down costs, but they also tended to stay in the cheapest accommodation even if it was far from the centre of town.

However, as the Chinese become more familiar with Western culture, and also have more money to spend, they are behaving more like American and European travellers. Many countries have also changed their visa rules to make individual travel easier. As a result, people are looking for a more customised experience. As a report by market research group The Foresight Company puts it: "more and more Chinese people want to be more involved in planning their own trips to Europe and to arrange these trips more independently than they have done so far".

Mid-range and luxury hotels are starting to see more Chinese customers. A global survey of hotel owners commissioned by hotels.com found that 53% saw an increase in the number of Chinese visitors last year (compared with 45% in 2013). They expect this growth to continue, with around a third predicting that numbers will go up by more than 10% this year and that this will be key for their business in 2016. For their part, two-thirds of Chinese visitors now saythat they want to travel on their own, with only 11% saying that they want to spend time in a Chinese-style hotel.

As with casinos, Chinese companies and investors are trying to take advantage of this trend by buying up luxury hotels or taking over the companies that own them. In January, the government-owned Shanghai Jin Jiang International Hotels Group made a bid of up to $1.5bn for the Louvre Hotel Group, which has a portfolio of 1,100 hotels. Billionaire property tycoon Wang Jianlin has also said that he plans to start buying up major global hotel chains. This acquisitions boom should boost the value of individual hotels and the shares of their parent companies.

Watch the skies

China is well known for its massive investment in high-speed rail, which we've covered in past issues. However, this will do little to meet demand for flights between China and other countries. The aircraft manufacturer Boeing expects that the number of passenger kilometres (the main measure of demand) travelled from China will grow from 365 billion in 2013 to1.26 trillion in 2033, an annual growth rate of 6.4%. To carry all these extra passengers, Boeing estimates that Chinese airlines will need to buy nearly 1,500 wide-bodied (multi-aisled) aircraft, like its own 777 or rival Airbus's A380.

The tourism-led growth in international air travel from China will need to be backed by a major increase in airport capacity. Chinese airports are notorious for delays, queues and even occasional riots by angry passengers. As a result, the government is building several additional airports and upgrading and expanding others. The most high profile of these projects is a new $14bn airport in Beijing that was formally approved at the end of last year. It will have a capacity of up to 72 million passengers. That puts it on a par with Tokyo airport and Heathrow when it opens, it will be the world's fifth-busiest airport.

At the same time, airports in Europe, North America and the rest of Asia are making changes in the hope of attracting more Chinese tourists. At the lower end of the scale this means more Chinese-language signs and information desks with staff who can speak Mandarin.

"China's airports are notorious for delays, queues and even riots"

In other cases it means signing deals with airports, like Brisbane International Airport's deal with Shanghai, which means the Australian terminal will give Chinese tourists special support upon arrival. Under this arrangement, Shanghai will encourage Chinese airlines to use it as a destination in return for Brisbane hiring support staff and expanding the shops in its terminal.

Unsurprisingly, Chinese firms and funds are trying to snap up foreign airports. The first Chinese citizen on a tourist visa (as opposed to a business or family travel visa) only touched down in the UK in 2005. However, this didn't prevent China's main sovereign wealth fund, China Investment Corporation, from buying a 10% stake in Heathrow's parent company three years ago. The Chinese government has subsequently lobbied hard for Heathrow to be allowed to build a third runway, with its ambassador publicly backing expansion. A consortium led by China's state-owned infrastructure company, Shandong Hi-Speed Group, bought a 49% stake in Toulouse's airport, while another Chinese group is expected to be the main bidder when Athens International Airport is sold later this year. We look at how to profit from these trends in the box on page 24.

The five stocks to buy now

So how can you profit from China's tourist boom? One way is to invest in the casino business. Wynn Resorts (Nasdaq: WYNN) owns a controlling stake in Wynn Macau, one of the major international players in the former Portuguese colony. While its revenue from the area has been hit by Beijing's crackdown on gambling, experts think the region has bottomed out already and will start to recover. Wynn certainly thinks so and has expanded its presence there significantly, building the 1,700 room Wynn Palace on the Cotai strip. This should help it to gain market share from its rivals. While it trades at a relatively expensive 17.8 times 2016 earnings, its strong free-cash-flow generation enables it to pay a dividend of 4.8%.

Another casino company that has exposure to Macau's boom is Las Vegas Sands Corp (NYSE: LVS). Like Wynn and other casinos, Sands should benefit from Macau's long-term growth. Indeed, two of its casinos, Galaxy and Studio City, are set to open later this year, with the latter resort including retail and TV production space as well as gambling tables.It is also working hard to develop opportunities in Singapore, another Asian resort popular with Chinese gamblers. These efforts have been bolstered by double-digit growth in slot machines. Overall, it trades at just under 17 times 2016 earnings, but has a solid yield of 3.5% and excellent growth prospects.

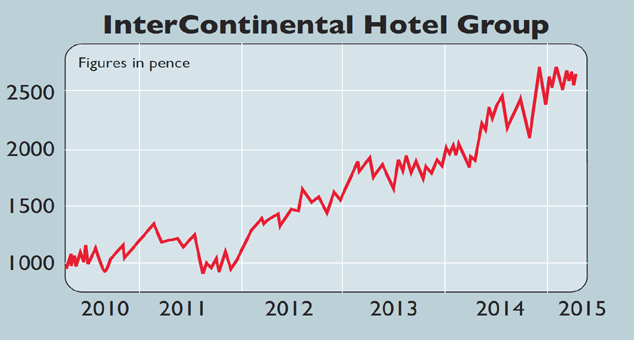

On the accommodation side of things, InterContinental Hotel Group (LSE: IHG) is one global hotel chain that is aggressively courting Chinese tourists. It has launched the "China Ready" programme, based on extensive market research about the needs of Chinese tourists. This includes making sure that the staff at its largest hotels can speak Mandarin and that they can pay their bill via UnionPay, the only bank card system available in the People's Republic. At the same time, the sale of some of its underperforming hotels should provide an infusion of cash, a large part of which will be returned to shareholders through a 9% dividend (though this will fall in future years). This more than compensates for the fact that it trades at 20 times 2016 earnings.

A smaller alternative is PPHE Hotel Group (LSE: PPH), which owns 38 hotels located in the UK and Europe that cater to business travellers and tourists who are willing to pay above-market rates for better-quality rooms. This is exactly the segmentof the market that should benefit the most from the surge in newly independent-minded Chinese tourists looking for quality accommodation. In addition to strong recent growth, the chain is looking to add another 1,000 rooms worth of capacity by the end of next year. It trades on less than nine times 2016 earnings, and has a current yield of more than 2.6%.

One airline that is already reaping the benefits of increased passenger numbers is International Consolidated Airline Group (LSE: IAG), the holding company for British Airways and Iberia. Its Chinese service started only ten years ago. However, it now runs flights to London from three Chinese airports: Beijing, Shaghai and Chengdu. The company has also agreed deals with several major Chinese airlines to provide connecting services from major global hubs. As a result, total passenger kilometres have grown by more than 5% this year. The stock currently trades at 9.6 times 2016 earnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.