Get rich slowly with compounding

The easiest way to get rich is to invest for the long term. And that means reinvesting your dividends, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

To me, investment is all about income. That income might be the coupons from bonds, the rents from property, or the dividends from shares. Wherever it comes from, income can make you rich.

I think too many people are obsessed with the short-term changes in the value of their investments. The media always talks about what level the FTSE 100 ended the day at, or how fast house prices are going up.

Very rarely is there any mention of the dividends that are paid to shareholders, or the rents that landlords receive; this is despite the fact that dividends are where the real money is made from the stock market. So why is this?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Dividends and compound interest

I've never been able to find the source, but Albert Einstein is rumoured to have said that compound interest is "the most powerful force in the world". In another version, he called it "the eighth wonder of the world". When it comes to investing and dividend investing in particular I'm inclined to agree with him.

Compound interest is essentially earning interest on interest that you've already been paid. With shares, you can earn dividends on the dividends you've been paid. Instead of spending the dividend you receive, you use it to buy more shares in the company, which in turn gives you more dividends.

Repeat this process for long enough the longer the better and it's possible to turn a small initial sum of money into a large one. This can be the case even if dividends per share or the share price do not change.

So how does this workin practice?

Let's say that you buy 1,000 shares in Corner Shop plc at 100p per share when it's paying an annual dividend of 4p per share. Over the next 30 years, dividends stay at 4p per share and the share price stays at 100p.

If you had kept your 1,000 shares for all 30 years, you would have received an annual dividend income of £40 (1,000 x 4p), or £1,200 over 30. With your 1,000 shares still worth £1,000, your total investment value would be £2,200. (I'm assuming that your dividend cash doesn't earn any interest at the bank.)

But if you had reinvested the dividends and bought extra shares in CornerShop each year, you'd have ended upwith a much better result. At the endof 30 years, you would own 3,243 shares worth £3,243.

You would also have an annual dividend income of £125 at the end of the 30-year period. This equates to a yield on initial cost of 12.5% (£125/£1,000). (In order to keep things simple, I've ignored the impact of broking commissions here.)

What's more, on many stocks dividends don't stay flat for 30 years. In fact, they can often increase substantially. This makes dividend reinvestment and the power of compound interest even more attractive.

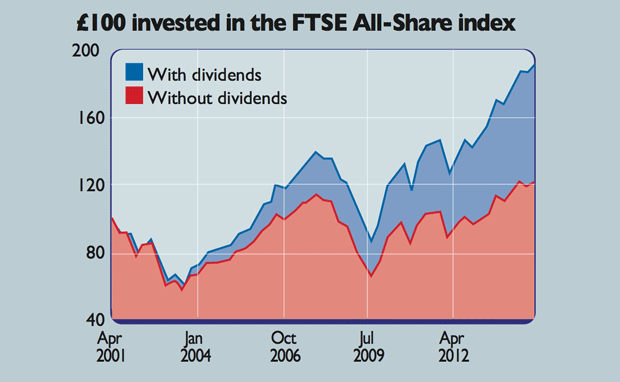

Have a look at the chart below. It shows that £100 invested in the FTSE-All Share index in December 2000 would be worth around £122 now. But if the dividends were reinvested, the original £100 would now be worth £192. The longer the investment horizon, the better the results can be.

A £100 sum invested at the end of 1985 would now be worth £1,520 with dividends reinvested an average annual return of 10%. But if the dividends weren't reinvested, the original investment would now be worth only £532.

The emotional benefits of dividend compounding

I really like this style of investing and use it for my share portfolio. The approach forces me to focus on the performance of a company and its ability to keep paying a growing dividend, rather than on what's happening to the share price.

In fact, with this investment strategy you can actually welcome falling share prices. As long as the underlying business is sound, a falling share price allows your dividend to buy more new shares. That potentially means more dividends in the future and higher returns.

With this mindset, you worry less and concentrate on what's important rather than the short-term whims of the stock market. To me, this is proper investing and more people would be better off financially and emotionally if they put their money to work this way.

How to set up your own compound plan

Reinvesting your dividendsis fairly straightforward. With funds but not exchange-traded funds (ETFs) you can buy what are known as accumulation units that do this for you.

Alternatively, you can set up a dividend reinvestment plan for individual shares with your broker (often restricted to the FTSE 350), who will reinvest your dividends for a small fee.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King