Reap the rewards of ‘factor investing’

One of the biggest buzz phrases in investment today is ‘factor investing’, or ‘smart beta’. Cris Sholto Heaton explains what it is, and why it's become so popular.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

One of the biggest buzz phrases in investment today is factor investing' (or smart beta'). Exchange-traded funds (ETFs) based on this strategy have pulled in huge amounts of money over the last few years and now hold almost $400bn in assets, according to JP Morgan. That's up more than 200% in the last five years and if anything, inflows are accelerating as these funds go mainstream. So what is factor investing and why is it taking off?

Beating the market

Factor investing means looking for specific characteristics (factors) shared by groups of stocks that make them more likely to beat the market. Plenty of factors seem to be linked to investment returns, but five in particular have been widely studied.

1. Value

Stocks with low valuations (using metrics such as price/earnings (p/e) and price/book (p/b) ratios) have tended to beat those with high valuations.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

2. Size

Smaller companies have historically beaten larger ones.

3. Momentum

Stocks that have done very well in the recent past seem to be more likely to keep outperforming.

4. Low volatility

Stocks with less volatile share prices seem to deliver higher long-term returns than more volatile ones.

5. Quality

High-quality' stocks seem to do better than lower-quality ones. Quality means traits such as low levels of debt, stable earnings and high returns on equity.

Not every stock that falls into one of these categories will outperform. And sometimes even a whole group of stocks with these characteristics will do worse than the market for several years at a time. But studies suggest that in the long run stocks with these five factors have comfortably beaten the wider market, and have done so consistently, in different stockmarkets around the world.

A middle ground

This enviable record means investors are increasingly drawn to factor investing as a middle ground between passive investing (tracking an index) and active management. Rather than get involved in the time-consuming process of picking stocks, you just invest in an index that's weighted towards all stocks that have these factors. You get the low costs and simplicity of indexing, but still hope to beat the market. Hence the boom in factor-based ETFs in recent years.

But whenever a strategy becomes trendy, it's sensible to be sceptical especially when it promises a free lunch. You don't need to believe that the stockmarket is totally efficient (ie, that it prices in all anomalies immediately) to find it odd that such simple strategies can keep winning. So why does factor investing work and what might the pitfalls be?

Where's the risk?

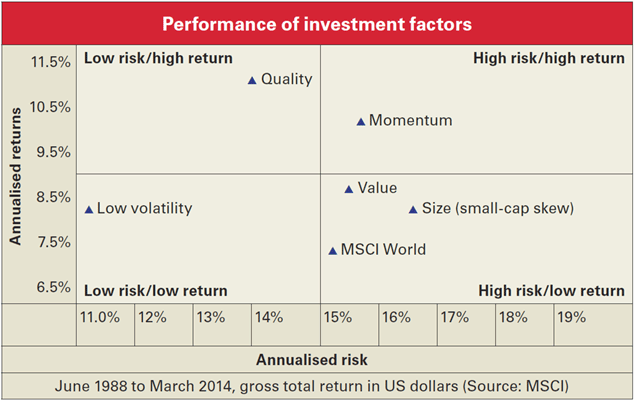

Some researchers claim the higher returns from these factors are due to investors taking on more risk. That makes sense for some factors. The chart above shows annual returns for five MSCI World factor indices on the vertical axis and the risk of each strategy (as measured by its volatility) on the horizontal axis. You can see that value, momentum and size have all beaten the standard MSCI World index, but at the cost of taking slightly more risk.

But elsewhere, this doesn't hold. Quality companies are intuitively less risky: they are more likely to survive whatever the economy throws at them. So if returns reflect the you're taking, you should get lower returns from these. Yet as the chart shows, quality' has delivered outstanding returns at lower volatility than the wider market. That's hard to explain through finance theories, so the most plausible explanations are behavioural ones: for example, investors may prefer excitement and undervalue quality companies because they seem dull.

Whatever the reason, history suggests that investors in quality and low volatility have been disproportionately rewarded, getting more return for less risk. For the other three factors,they may take some extra risk, but the higher returns have more than compensated. If this continues, factor investing looks like a way to earn market-beating returns with little effort.

A factor investing bubble?

The danger is that these excess returns vanish. One possible cause of that would be investors driving up the valuations of these stocks to the point where they can no longer outperform. In other words, the boom in factor investing could destroy the very effects it's trying to exploit.

For now, the number of assets in factor funds is too small to make a difference. But bear in mind that many active investors have tilted their portfolios towards quality and low-volatility stocks in recent years to reduce their risks. A bias towards certain factors seems to be building. If investors continue to favour these kinds of stocks, then the risk of a bubble in certain factors will grow over the next few years. We don't seem to be at that point yet: for example, the MSCI World Quality index is on a forecast p/e of 16.2, only just higher than the MSCI World index on 14.9. But investors who embrace factor investing should bear this in mind and be ready to change course if popular factors start looking overvalued.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again