Shares in focus: Can Dairy Crest pull out of the doldrums?

Milk prices are falling, but Dairy Crest might have an ace up its sleeve. Should you buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The maker of Country Life butter and Cathedral City cheese seems to be stuckin the middle of a tense relationship between farmers and supermarkets.

Dairy farmers have struggled for years to get a fair price for their milk and make a profit from selling it. The supermarkets have squeezed them hard. This has made life hard for the middleman, Dairy Crest. It needs a reliable source of milk for its more profitable butters and cheeses, but also needs to make a profit selling milk.

Unfortunately, it's often found itself on the losing side of the battle as profits from milk have steadily fallen. It's been running hard to stand still; dairy closures and cost cutting haven't improved profits.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Not long ago its dairies were making £30m a year. Last year, they made £10m. Its butters and spreads have fared better, but attempts to expand into Europe failed.

It's now set out a more focused strategy for growing profits. If it succeeds, its shares may be a good buy at current prices. Should it fail, its profits could go down and threaten its ability to pay its chunky dividend.

The outlook

That said, profit margins were only 1.1% last year. Dairy Crest reckons it can get these up to around 3% by selling more premium milk products, such as its Frijj flavoured milk brand. It is also becoming more choosy about whom it sells milk to. Customers will have to agree to paying farmers a fair price for raw milk and allow Dairy Crest to cover its costs.

Big clients like Sainsbury's have agreed to pay up, but smaller ones have been shown the door. It should also be able to get some cash from properties on depot sites that are surplus to requirements for its now declining doorstep milk delivery business.

Dairy Crest's star product is Cathedral City cheese. Along with brands such as Davidstow Cheddar, cheese makes up nearly half the company's profits and has been growing nicely.

In Cathedral City, Dairy Crest has one of the most valuable food brands in Britain. It has been able to grow sales and profits by broadening the brand with mature and lighter varieties and new products, such as Chedds.

It should be able to keep on doing this. Butters and spreads are more difficultat the moment, as consumers are becoming more health conscious and eating less of them. Clover and the spreadable version of Country Lifebutter are holding their own, but sales of blocks of Country Life have fallensharply recently.

The ace up its sleeve

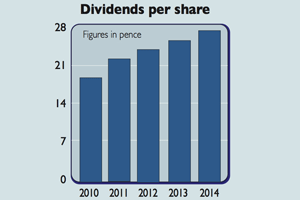

The first batch is due to roll off the production line in the first half of 2015. Dairy Crest reckons that it will get a cash payback on its investment in less than five years and boost its trading profits by £5m per year. That should help keep its dividend growing.

With the sale of its St Hubert French spreads business, Dairy Crest's finances look in reasonable shape. Its pension fund has been topped up and debt should start coming down from next year as investment spending returns to maintenance levels.

This means that the company looks like it has more than enough money to increase spendingon its brands, develop new ones,or buy some of those belonging to competitors.

Growing profits will not be easy, but City analysts expect that Dairy Crest should be capable of delivering higher earnings and dividends for its shareholders. If that's the case, then Dairy Crest shares look quite reasonable value on 12.7 times projected earnings.

The big attraction of the shares remains the juicy dividend, which currently gives a 4.7% prospective yield. With dividend payouts capable of growing more than inflation, new shareholders should be able to get a reasonable return on their investment.

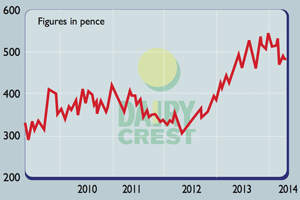

It may not be the most glamorous of companies, but finding reasonably secure sources of high dividend income in today's stock markets is no easy task. Dairy Crest shares have done quite well over the last couple of years, but are still worth buying.

Verdict: buy for dividend income

Dairy Crest (LSE: DCG)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King