Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

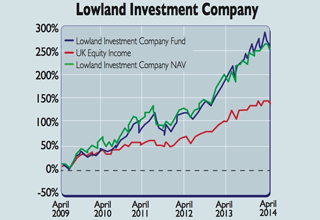

Lowland may be in the name, but lowly in performance it isn't. Lowland Investment Company (LSE: LWI) "leaves its UK equity income peers trailing in its wake", says Leonora Walters in Investors Chronicle.

The trust, which has consistently beaten its benchmark in recent years, has delivered a return of 24.7% over one year, 85.4% over three and 325.2% over five years, albeit after some short-term volatility.

Walters puts this down to manager James Henderson's decision to diversify away from the mega caps' favoured by his peers, which he believes are in sectors facing long-term decline.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lowland's aim is to generate above-average returns of both capital and income over a medium to long-term horizon. It strives to have no more than half of its portfolio value in FTSE 100 stocks, with the rest made up of small and medium-sized firms (SMEs). Around 8% is invested in Aim-listed companies.

The trust has an ongoing annual charge of 0.62%. Around 30% of it is in industrial stocks, such as engineer Senior, while 26% is in financials, 13% in basic material stocks, and 12% in oil and gas.

Touchscreen technology specialist Carclo has proved a recent strong performer for the company, while Henderson has raised its holdings of strong dividend payers, such as BP and Rio Tinto.

| Senior Plc | 3.60% |

| Royal Dutch Shell | 3.30% |

| BP | 2.60% |

| Hiscox | 2.40% |

| GKN | 2.10% |

| GlaxoSmithKline | 2.10% |

| Phoenix Group Holdings | 2.00% |

| Rio Tinto | 2.00% |

| AstraZeneca Plc | 1.90% |

| FBH Holdings | 1.80% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King