Shares in focus: Should you tuck in to Restaurant Group?

The Restaurant Group has enjoyed strong growth. So, are the shares still worth buying for the long run? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Strong growth makes these shares tempting, but wait until the price is right, says Phil Oakley.

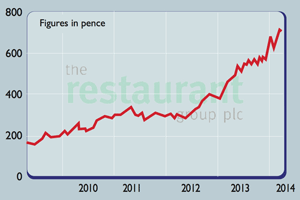

Shares in The Restaurant Group (TRG) have been a very good investment over the last decade they're up seven-fold. The owner of casual eating restaurant chains including Frankie & Benny's, Chiquito, Garfunkel's and a number of pub restaurants has clearly got something going for it.

It has managed to thrive, in spite of the tough consumer backdrop of recent years. As a result, its shares are now richly valued by the stock market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company has certainly benefited from some helpful trends. Busier family lives and an ageing population have seen the number of people eating out enjoy steady growth. But investors haven't always been able to make money from these trends in fact, the opposite has often been true.

During the 1990s and 2000s, pub companies invested heavily in new sites to exploit these trends. But they racked up a lot of debt in doing so, which proved painful when the economy went into a steep recession and business collapsed.

Restaurant Group didn't go down this growth-at-any-cost' path, and so has done very well. But given its stunning share price, we have to ask: is this as good as it gets, or are the shares still worth buying for the long run? Let's take a look.

The outlook

The retail park sites have worked well, especially when the restaurants have been near to cinemas, which bring in lots of customers. More importantly though, competition is less fierce, because it is hard for rivals to get a foothold on the same site. This has helped boost TRG's sales and profits.

And unlike the pub companies, TRG has not been buying lots of expensive freehold sites and racking up debt. It rents buildings instead, which means it doesn't need to put as much money up front into each new restaurant.

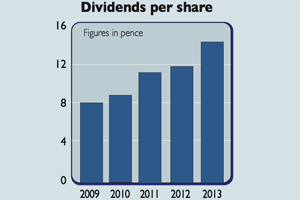

This has helped it make very decent returns on investment (return on capital was an impressive 27% in 2013) and generate lots of surplus cash flow to pay growing dividends and reinvest in the business. The virtuous circle of growing cash flow and reinvestment has sent profits soaring over the last decade.

This business model is not without risks. Future rents payable to its landlords are a form of hidden, off-balance-sheet debt. These stood at £684m at the end of last year, while the annual rent bill was £65m. This adds an extra layer of fixed costs that makes the profits of the business more sensitive to changes in sales (this is known as operational gearing).

This can be very helpful when sales are growing, as they are now (because profits will grow faster than sales), but it can be painfulif business takes a turn for the worse.That said, TRG does not seem to beoverextending itself current profits cover the rent bill comfortably.

So what of the future? The management team believes it can keep growing by finding more good-quality sites over the next five years. These will continue to be dominated by the Frankie & Benny's chain, which specialises in American and Italian food.

On top of that, TRG is looking to open more high-quality food-led pubs, Chiquito Mexican restaurants and to expand its new Coast to Coast brand. It will not sacrifice profits by competing on price, but will focus on value and service a strategy that has worked well so far.

If the economy is indeed improving, and interest rates stay low and wages start to grow faster than inflation, then shareholders could continue to see rapid growth in profits. Yet even if times stay tough, TRG has proved in the pastfive years that it can still do well.Its restaurants offer an affordable treat that won't blow most household budgets.

Why I'm not buying right now

Firstly, at over 20 times projected earnings, the shares are quite pricey. City analysts expect earnings to grow at 10%-12%, but this looks to be already priced into the shares.

Secondly, the chief executive, finance director and chairman all sold a reasonable chunk of their shareholdings during the last year. While they all retain a significant stake in the business, heavy director share sales often coincide with peak share prices.

Finally, Andrew Page, the chief executive who has overseen a fantastic period of success at the company, is retiring.

He's been at TRG for 14 years and has done a very good job. He is staying on as a part-time consultant but there have just been too many chief executives recently who have got out at the top, and I'd see this as a sign to be wary.

Ultimately, good investing is all about buying good companies at the right price. TRG certainly fits the first criteria, but paying up for the shares now leaves little room for hiccups.

You are unlikely to find the shares in the bargain basement anytime soon, given the quality of the business but I'd be looking to pay no more than 520p-550p for them (17 to 18 times forward earnings) at the moment.

Verdict: put on your watch list

Restaurant Group (LSE: RTN)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King