Invest in the 'free energy' revolution

Firms pioneering batteries for renewable energy could profit handsomely from the mass adoption of wind and solar. Dr Matthew Partridge tips the best shares to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Firms pioneering batteries for renewable energy could profit handsomely from the mass adoption of wind and solar, says Dr Matthew Partridge.

Imagine a future with no more electricity bills where all of your energy is generated at home, and stored on tap for whenever you need it. Not only that, but it's completely clean no worries about toxic gas emissions, or anything else you wouldn't really want in your own back yard, such as a nuclear power plant or fracking rig. Instead, your energy comes directly from the sun.

An idealistic green' dream? It's already reality for some. Energy disintermediation', where individuals go off-grid' and bypass utility companies by generating their own power, has always been associated with people living in very isolated rural areas something you did by necessity, rather than by choice.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But author Nick Rosen who writes widely on the topic believes as many as 750,000 families in the US are now off-grid. Even conservative estimates put the figure at a minimum of 350,000. And it's growing every year. John Wellinghoff, chairman of the Federal Energy Regulatory Commission, estimates that the amount of solar energy generated in America doubles every 2.5 years.

You only need to look at the reaction of the big power companies to realise that this isn't just an over-hyped flash in the pan. The number of energy self-reliant American households is growing so rapidly that many utilities are lobbying politicians to make self-generation less attractive.

In Arizona, the largest utility company wants the state government to slash the 'feed-in' subsidies given to households who generate their own electricity, then sell it back to the grid.

Other companies are seriously discussing how the exponential growth of solar will change their business model. The big industry buzzword is 'decoupling', which describes a world where utilities provide various energy-related services, such as the lease of solar panels, rather than just generating and selling energy.In short, if you can't beat em, join em.

That's probably the sensible approach. Lobbying against renewables might slow change a little, but governments and scientists are convinced that the likes of solar and wind energy must play an increasing role in our energy mix if we are to meet environmental targets that they've committed themselves to.

By 2030, the European Union wants to get 27% of its energy from renewable sources by 2030 (up from around 13% today). Germany is even more ambitious: it aims to get 35% of its electricity from renewable sources by 2020 and 50% by 2030.

It's not just in the West either. China wants to combat its horrendous air pollution by cutting its reliance on coal in favour of solar and wind generation.

Even in Britain, where we get even less sunshine than in many parts of Alaska, solar power is taking off. Nearly a quarter of a million homes, mainly in the South West, have solar panels installed.

The government thinks that total solar capacity could reach 20 megawatts (MW) by 2020 (up from 2.4MW today), according to the latest Renewable Energy Roadmap. Despite intense controversy, the number of wind farms is also expanding greatly.

In the four years to 2012, the amount of electricity generated via wind has gone up by 3.8 times, from 5,357 gigawatt hours (GwH) to 20,710 GwH. Wind now accounts for nearly 6% of total electricity use.

This revolution is being helped along by a steep fall in the cost of solar cells (which capture the sun's rays and convert them into electricity). The cost of a solar panel has more than halved since the start of 2011, according to green technology researcher GTM Research.

Scientists at the National Physical Laboratory in Teddington are also developing special solar cells that work particularly well in cloudy conditions (typical British weather, in other words). Overall, the price of solar power (per watt) has fallen by 99% in 36 years, from over $76 in inflation-adjusted terms in 1977 to $0.74 by 2013.

The final hurdle

Sounds great. So why aren't we all off-grid and basking in free' energy? One big barrier is holding back both widespread "energy disintermediation" and the further development of solar and wind power in general.

Energy demand fluctuates throughout the day we use more energy at certain times than at others. So power companies need to find a way to vary the amount of electricity available. This ensures that surges in demand for instance when people come home from work and flick the kettle on don't cause brownouts.

In the case of conventional fuel sources, like gas or coal, the solution is to predict these peaks in advance and raise energy production to coincide with the peaks. Companies can do this to a high degree of accuracy, and raising production effectively boils down to choosing to burn more coal or gas.

This is where wind and solar fall down. You don't just switch them on or off the amount of energy they generate depends on weather conditions. And because sunlight and wind can't be stored in the same way as coal or oil, companies have to find some way to store the electricity produced so it can be used later.

A few solar plants are located close to dams, and store energy by moving water around (in short, you dam up the water using solar energy, then release it as and when you need it in the form of hydroelectricity). But for most commercial solar and wind plants, the energy has to be stored in large batteries.

And these are expensive. In fact, they're so expensive that today's solar plants and wind farms only store enough energy to smooth out small fluctuations that occur from tiny shifts in the weather, such asa cloud appearing on the horizon.

This means that during times of high demand, or low power generation, it is still critical to have a back-up source of power, such as natural gas. This reduces the potential environmental benefits. Even scaled-down versions, designed for residential users who wish to go fully off-grid, still require a heftyup-front investment.

Dirk Uwe Sauer, who works at the Institute for Power Electronics and Electrical Drives at German university RWTH Aachen, thinks that battery costs are preventing solar from reaching its true potential.

He notes that in Germany, even with subsidies, the total cost of capturing and storing one kilowatt-hour of solar energy is €0.33. This is a far above the current German electricity price of €0.25, making solar power uneconomic.

However, if you cut storage costs out of the equation, the cost of solar power is just €0.12, an extremely attractive price. In short, if we could find a cheaper, more efficient way to store renewable energy, it would make widespread adoption far more likely which would in turn be good news for companies in the sector.

Large-scale batteries

So what's the answer? Researchers are taking two main approaches. One is to develop cheaper large-scale batteries for utilities, making it feasible to store energy generated by solar and wind power for use in peak demand periods. The other is to cut the cost of domestic storage.

On the big battery' front, the most promising technology is flow' batteries. Without getting in to the technical details, these effectively store the electrical charge in chemicals in liquid form. Because the liquid is stored in tanks outside the core of the battery, it's relatively easy to scale up the size.

The Japanese who are promoting solar power aggressively through targeted subsidies and government funded research are experimenting with ever-bigger flow batteries. Hokkaido Electric Power Company has commissioned the world's largest.

The battery should be ready by 2015 and will allow the utility to store more of its output the increased storage capacity is expected to be equivalent to boosting production by 10%.

Meanwhile, in California, the Public Utilities Commission will force the state's big three investor-owned utilities to add 1.3GW of energy storage to their grids by 2020.

Of course, it is not enough simply to build big batteries. If they are to be used widely, they also have to be much cheaper than they are just now. The large batteries currently used in Japan cost around $600-$700 per kilowatt-hour (kWh).

The US Department of Energy, which also wants to develop the industry, thinks this will have to come down to $100/kWh to make wind power economical. This has driven efforts to find a cheaper alternative to vanadium, the metal currently used to store energy. Researchers at Harvard think that a combination of bromine and quinones (a type of chemical compound) might cut costs.

Other attempts combine different materials with a reworked design. For instance, start-up company Sun Catalytix has designed a system made from metals combined with ligands (molecules that bind to metal atoms), while EnerVault in Silicon Valley is working on an iron chromium alloy-based system.

Both approaches rely on stacking energy cells together so that current flows from one to the other. The goal is to increase energy density compared to a typical flow battery (so you get more energy from a smaller space), with the aim of cutting costs by more than half.

Domestic batteries

The small scale of most residential systems means that storage costs which rise exponentially with size can be reduced. While flow battery systems designed for houses and small businesses are already available, the big area of interest is the use of lithium-ion batteries.

These are already used extensively in modern consumer goods, such as iPods, mobile phones and laptops. They are lighter than conventional batteries, hold their charge longer, and can be recharged repeatedly.

They are also much more reliable. The problem is that they are also more expensive around $300/kWH.

But further price cuts may be possible in the near future. The success of Tesla's electric cars has prompted the company to start work on a 'gigafactory', which will produce lithium-ion batteries on a huge scale.

While most of these batteries will be used in vehicles, Tesla has promised to use part of the extra capacity to make batteries for use in solar power storage systems.

This isn't pure altruism, in case you're wondering the company already has a close relationship with solar equipment-leasing firm SolarCity, founded by Tesla boss Elon Musk.

The impact on prices could be dramatic. Goldman Sachs reckons that the initial cost of production when the factory opens due to economies of scale will be just $200/kWh. That's already a big saving on the current price. And as production ramps up, Goldman Sachs expects the price to keep falling.

By 2019, a year after the factory's expected opening date, the price will have fallen to $175/kWh. A year after that it will be only $125/kWh, and it will fall by 3% a year thereafter. Goldman estimates that this could mean parity between off-grid systems and US mains electricity by 2033.

Tesla is not the only car company thinking ahead to how electric car technology can be adapted for use in storing solar power. Honda recently showcased a model 'zero-carbon' house that incorporated a ten kWh battery connected to a solar panel and controlled by its proprietaryHome Energy Management System.

This intelligent device manages the distribution of power, choosing the best times to draw downthe battery, and when to recharge it.Ford and Toyota, which also make electric cars, are working on similar devices.

Five solar/wind storage firms to buy now

As noted above, Tesla Motors (Nasdaq: TSLA) plans to drive down the cost of lithium-ion batteries by producing them on a large scale. However, having rocketed from $40 a share to over $200 in the last year, the company now looks too expensive.

Even if the breakneck growth that analysts expect actually takes place, it is still trading at 23 times 2018 earnings.

Meanwhile, SolarCity (Nasdaq: SCTY), the solar leasing firm that Tesla is partnering with, has tripled in value. However, given that it faces rising overheads and declining profit margins, it will also struggle to meet these high expectations. We'd suggest you avoid these two companies.

A more interesting option, which is positioning itself to take advantage of growing demand in this sector, is EnerSys (NYSE: ENS). This company makes industrial batteries (and related accessories, such as chargers), including a range of low-maintenance batteries aimed at the wind and solar energy storage markets.

A recent partnership with ultracapacitor maker Loxus should boost its strength in these areas. To meet growing Chinese demand, and to benefit from economies of scale, it has opened a new plant in Gayou City. It has also made several acquisitions to strengthen its expertise in lithium-ion batteries.EnerSys trades at 15.5 times 2015 earnings.

Another option is Johnson Controls (NYSE: JCI). For now, it mainly focuses on temperature control systems and lead-acid vehicle batteries. However, it is making great efforts to establish itself as a manufacturer of lithium-ion batteries.

The company is a key part of the Joint Center for Energy Storage Research (JCESR), established by the US Department of Energy to cut the cost of energy storage in transportation and the energy grid. It currently trades at a relatively modest 12.2 times 2015 earnings.

Most storage and solar-related shares are priced to reflect high hopes for growth. Tokyo-listed Sumitomo Electric Industries (JP: 8053) is a prominent exception. It trades on just over six times 2015 earnings, at a 30% discount to book value, and on a 3.6% dividend yield.

Its automotive segment, which accounts for 50% of sales, provides stability, but the interesting part for us is that it has branched out into energy storage. It is building the world's largest flow battery for Hokkaido Electric Power Company (mentioned above).

It has also partnered with car company Nissan to build the first large-scale power storage made out of used car batteries.

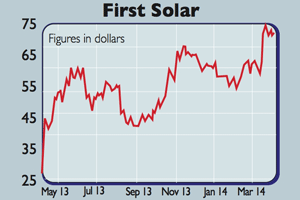

Cheaper battery storage will also be good news for solar firms such as First Solar (Nasdaq: FSLR). First Solar does everything from building panels to running power plants and enabling businesses and individuals to buy and run solar power-based systems.

For now, the key advantage of its systems is that they are the cheapest. But it is also focusing on improving their efficiency, which should help it gain market share from its rivals. It trades on a 2015 price/earnings ratio of 15.

A similar company that is doing well out of the solar power boom is SunEdison (NYSE: SUNE). Not only does it provide a wide range of solar-related services, but it is also one of the leading designers of the semiconductors used in solar cells and one of the five largest manufacturers of solar modules.

The non-solar part of its electronics business has been boosted by partnerships with General Motors and Samsung. While breakneck expansion means it is currently running at a loss, it trades at 13 times projected 2017 earnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.