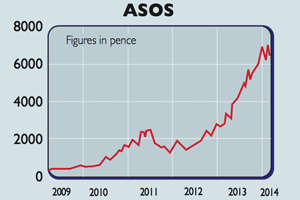

Company in the news: ASOS

Shares in online fashion retailer ASOS have proved to be a lucrative investment, says Phil Oakley. But are they now worth the price?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

ASOS (Aim: ASC), the online-only fashion retailer, is very successful indeed. It sells its own label and branded fashion products to young people across the world. Its website gets 71 millions hits per month and has signed up 8.2 million customers.

The stock market has been very excited about ASOS's prospects for some time. The company, having grown very quickly in the UK, is set on repeating its success in places such as America and China, while continuing to grow. This has led to projections of massive profits in the future and a share price that has exceed 100 times expected earnings.

This is the kind of crazy valuation that was placed on internet companies during the late 1990s technology bubble. Just think about this for a minute. People are buying shares where the earnings yield (profits divided by the share price) or interest rate is less than 1%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

To make money from buying the shares at these prices, you have to believe that profits will grow very quickly and that investors will continue to accept a low interest rate (or high price-to-earnings multiple). This rarely happens.

Yet it seems that ASOS is the UK's equivalent of Amazon. Here, the argument for buying the shares is based upon very fast sales growth. Don't worry about big profits for the moment they will turn up eventually.

On Tuesday this week, ASOS said that it was still growing its sales very quickly, just not as quickly as analysts expected. Sales had grown by 26% during the last three months, compared to 38% in the previous three. Management blamed exchange rates and said that sales had bouncedback a bit in March.

Even so, it looks like analysts are forecasting net after-tax profit for ASOS of about £50m this year. At 5,689p, the company is currently valued at £4.75bn, or 95 times expected profits.

History tells us that very few companies are ever worth this much. This tends to be forgotten when things are going well. When expectations can't be met, pumped-up valuations can go flat very quickly.

ASOS could still make a lot more money than it does now, but the price of its shares takes that for granted (and more), which makes them very risky. They could have a long way to fall yet.

Verdict: sell

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King