Gamble of the week: Russian gas giant

Some businesses look cheap because no one really trusts them. This is probably the case with this Russian gas giant, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This Gamble of the week' column is all about trying to identify cheap shares of depressed companies that can recover. There's always a fine line between getting this right and buying a duff business that deserves to be cheap.

Then there are the types of business that look cheap because no one really trusts them. This is probably the case with this Russian gas giant.

It is the largest producer of natural gas in the world and the supplier of around 30% of Europe's gas needs. It also has a tendency to be used as a political tool by the Russian government to force neighbouring states to behave themselves, as we can see with the case of Ukraine just now. This is a good enough reason for many people to stay clear of the shares.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gazprom(LSE: OGZD)

Maybe there isn't one. I mean, surely a 43.5% earnings yield is enough to compensate most investors for the risk involved.

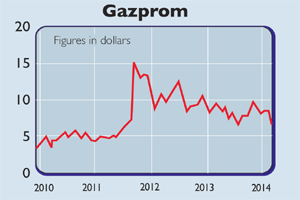

Bulls point out that the last time Gazprom shares were this cheap was at the time of the financial crisis. They then went on to be valued at over ten times earnings after soaring in value. Some reckon that the same can happen again.

It could do, but perhaps the latest goingson in Ukraine will force some countriesto speed up their search for more securesources of gas even if they end up beingmore expensive.Poland is looking into bringing inliquefied natural gas (LNG), withcountries in the Middle East and Americalooking for customers for their supplies.

Back in Russia, Rosneft (of which BPowns just under 20%) is challengingGazprom's monopoly on exportinggas. The end of this could make itharder for Gazprom to make moremoney. Although it could always look tocountries such as China to buy its gas.

Yes, Gazprom looks very cheap anddespite the risks (politics, currencyand competition) is probably worth apunt. The shares can be bought on theLondon Stock Exchange and are pricedin dollars. They should be fairly easy totrade most of the time although maybeless so after 3pm (when the Moscowstock exchange closes).

Verdict: risky punt

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King