Can Aberdeen Asset Management crack America?

Aberdeen Asset Management reckons it is big enough to start selling its funds into the massive American market, which has got some people very excited. Phil Oakley examines whether it's worth a buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The fund manager has done well and is expanding. But the price isn't right, says Phil Oakley.

Aberdeen Asset Management has come a long way in a short time. It started out as a management buyout of an investment trust led by current chief executive Martin Gilbert in 1983. Thirty years later it is a member of the FTSE 100 index, and the biggest listed fund manager in Europe.

It's not all been plain sailing. The company has sometimes courted controversy. It nearly went out of business in a scandal over split-capital investment trusts (trusts split into separate income and capital shares) just over a decade ago, when many investors lost a lot of money and it had to pay compensation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the company has staged an impressive comeback. It has developed a good reputation as a manager of emerging-market and Asia-Pacific investments while piggy-backing a ride on these nations' growth. It has also grown significantly by buying up other fund-management companies, and looks like it has an appetite to keep doing so.

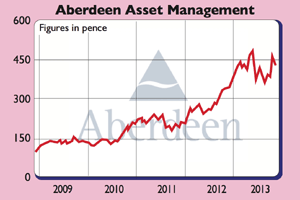

This week Aberdeen agreed to splash out £650m to buy the Scottish Widows investment (SWIP) business from Lloyds Banking Group. The stockmarket seems to like the deal, which sent Aberdeen's shares sharply higher. But is the euphoria justified, or should you give the shares a wide berth?

How is the business doing?

As you can see, the maths is very attractive. You take in people's savings and multiply them by an annual management charge to get your income. As a lot of your costs are fixed, once you reach a certain scale to cover these, any extra money invested by customers starts making you very big profits.

So the business is about getting as big a pile of people's savings (assets) as you can. The best way to do this is by being good at investment. Alternatively, you can benefit from a rising stockmarket. Finally, you could buy another company's assets and add them to the ones you already have. As long as you don't pay too much for them and don't bring in a lot of extra costs to manage them, this can pay off handsomely.

Aberdeen has benefited from all three of these strategies over the years. However, it wants to become even bigger. By buying Scottish Widows, Aberdeen will add £136bn to its assets under management at what is commonly seen as a very cheap price. The firm reckons it can make profit margins of 55% on this business once it's bedded in. This means it could offset the fact that it has issued lots of new shares to buy the business, and increase earnings per share. It also diversifies the company from its reliance on emerging markets and Asia-Pacific, where it currently makes 75% of its profits.

At the same time, Aberdeen has signed a deal with Lloyds to start selling its products to Lloyds' customers, which could boost sales. And Aberdeen now reckons it is also big enough to start selling its funds into the massive American market, which has got some people very excited.

Should you buy the shares?

Some commentators argue that the SWIP deal looks cheap because it has a lot of insurance funds that aren't as profitable as other types of business. There's also the fact that Scottish Widows may not be able to hang on to quite as much of this money as people think, due to its poor past investment performance.

And as far as the American market is concerned, it is way too soon to start pricing in success here. This market is dominated by power houses such as Blackrock and Vanguard, which will be very difficult to dislodge. What is potentially worrying is that Aberdeen, with its appetite for buying companies, may eventually try and do a big deal in America by issuing lots of new shares that might not pay off.

Then there is the fate of emerging-market investments. Who knows what will happen here, but there's no doubt that the fears about the end of cheap money or an economic slowdown in Asia makes Aberdeen a riskier investment thansome other fund managers.

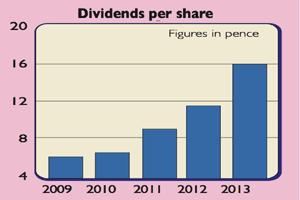

To be fair to Aberdeen, it has done a good job this year and has hiked its dividend by 39%. Its finances are in good shape, with over £400m of cash in the bank. However, the shares trade on 14.5 times next year's earnings, 3.8 times book value and offer a 3.7% dividend yield. That's not horrendously expensive, but it's high enough for a business that tends to grow more by buying companies rather than sweating its existing assets.

Verdict: hold

The numbers

What the analysts say

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how