Keep faith with Japan

Japan's banking system is on the mend and the stock market is set to take off, says James Ferguson. Here he outlines the best ways to invest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Japan's banking system is being fixed, and now its stockmarket is set for a boom, says James Ferguson.

A growing number of commentators gleefully await Japan's fiscal apocalypse. Look at today's situation and you might think they have a point. Government debt reached a staggering 220% of GDP in 2012, according to the OECD, a wealthy nation think tank. Deflation has remained intractable for well over a decade. And as the population ages the number of working-age Japanese is forecast to fall by 40% between now and 2050.This will reduce the ratio of working-age people to the elderly from 2.8 in 2009, to just 1.3 in 2050 (Britain is closer to four but is set to halve in the next two decades).

In other words, Japan's dependency ratio of elderly people (65+) to those of working age (15-64) already the highest in the OECD is set to deteriorate even further.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, markets don't respond to circumstances they already know about they respond to change. While things have looked increasingly bad for Japan since the stock-market peak almost 25 years ago, there is now realistic scope for significant improvement on (almost) all fronts. There is room for taxes to be raised substantially (so bringing down the deficit). A huge amount can be done to bring underemployed workers into more efficient production. But most important, the immediate benefits will come from the efforts to end deflation, led by Bank of Japan (BoJ) head Haruhiko Kuroda.

Ditching the deficit

Let's look at the debt problem first. Take net, rather than gross, government debt (so subtract the value of the government's assets from the debt number). That comes to 136% of GDP. That's bad, but it isn't much worse than, say, Italy (113%). It is also worth noting that Japan spends less money as a proportion of GDP than virtually anyone else. OECD figures show that Japanese government spending amounts to 40% of GDP. That compares to America on 42%, Britain on 47%, and France on 55%. So the cause of Japan's chronic deficit is not overspending, but a shortfall in tax revenue. That's not great, but it does imply that there is plenty of scope for increases in tax revenues as soon as the economy is strong enough to grow again.

Look back to 2007, when Japan was slowly recovering, and you will see that the deficit was half of today's level. The impact of a weaker economy since then has seen tax revenues fall by 1%-2% of GDP, while government spending has risen by 4%-5% of GDP. Any return to growth would have an immediate and significant impact on both the tax take and government spending. We should see an almost immediate halving of the Japanese budget deficit if Kuroda's policy can even return the economy to its pre-crisis growth track, let alone doing anything more substantial.

The workforce doesn't have to fall

What about the perceived problem of ageing? Japan has a relatively high level of social spending, but its composition is quite different to that of Western countries. It spends very little on trying to make the best of its workforce (school-age spending per child is less than half that of global leaders such as New Zealand, for example).

The largest increases in government spending over the last 20 years have been related to the elderly (over half the health budget is spent on the over-60s). Pensions paid to an ageing population are also increasingly burdensome. Fortunately, there are some obvious and not especially painful changes that Japan could make to cut these costs and improve the productivity of those who are still able to work.

Until very recently Japan had a mandatory retirement age of 60. Even now seniority based on length of service still makes elderly employees expensive and difficult to employ. Working towards a more inclusive and meritocratic structure could keep older people in the workforce for longer.

More can also be done to encourage youth employment and to employ women more effectively. At the moment many large firms (still!) force women to leave when they get married. That's a pretty hopeless policy in itself, but it also means that they don't bother to employ them very efficiently before they get married. Women who try to return to work once their children are older then find it hard to gain fully regulated employment (it is expensive for employers).

So in the medium term, Japan has plenty of scope through deregulation to make much better use of its workforce. If it does that, the ageing population will be much less of a big deal than the crisis-mongers hope.

What's different about Kuroda?

However, in the short term, it is monetary policy that will make the relative difference we are looking for. Most people don't get what is so different about Kuroda and his policies, compared to what Japan has been doing for the last 15 years. After all, didn't Japan invent quantitative easing (QE)? And hasn't it been doing it, on and off, ever since?

Well, yes and no. Kuroda's predecessor at the BoJ, Maasaki Shirokawa, invented QE. But by that he meant the continuation of conventional monetary policy (buying government bonds from banks) even after interest rates had reached zero. In an economy where the banks are technically insolvent, this is pretty useless.Instead of feeding money into the economy, all it does is expand bank reserves held at the central bank which is just what happened in Japan between 2001 and 2005.

Western QE was more radical: long-dated bonds were bought directly in the market (rather than simply from the banks themselves). This inflated the money supply, rather than just reserves, and in the process compensated for falling bank lending.

Shirokawa wouldn't do this. He believed (correctly) that Anglo-Saxon QE worked not just as monetary policy, but also as fiscal policy: it redistributed wealth in favour of the rich. He also feared (again correctly) that such QE would perpetuate the misallocation of capital. As such, he believed it was not his job, as an unelected bureaucrat, to introduce such a radical intervention it had to come from an elected politician.

Kuroda clearly disagrees (or feels he has the blessing of enough politicians to be getting on with). Things in Japan have, as a result, been hotting up. M4 (the broad money supply) grew by 2.2% (32trn) in the second quarter of 2013. That's an annualised rate of around 9% four percentage points higher than the 5% seen at the peak of the dotcom bubble in 1999. Those numbers surely make it pretty clear that Japan is shortly going to enter the kind of inflationary territory it hasn't been near for 25 years.

If this keeps up, we can expect to see nominal GDP growth of 4%-5% in Japan by April next year. Real (inflation-adjusted) GDP wouldn't be that high, of course. But nominal growth still generates the money needed to service debts, pay increased taxes and report profits. The transfer of wealth from pensioners (winners in deflation) to corporations (winners from QE and inflation) and to the government (reflation cuts the real value of the debt) has begun.

The banks are back

There's a good case to be made that Japan's banks were returning to something very like normality, if not rude health, by 2006 or so. However, the financial crisis covered this up pretty well: it precipitated another fall in lending that suggested to long-term Japan watchers that the banks were still in some trouble. Look at their behaviour over the last few months, however, and you might not be so sure.

The city banks' holdings of government bonds have fallen by 15trn, or 14%. That's a huge change and one that points to a significant shift in strategy away from holding low-yield Japanese government bonds (JGBs) as deflation protection and towards expanding loan books ie, lending more money.

After two decades or more of flat or declining lending at the city banks (due to hidden losses and inadequate capital), anyone could be forgiven for thinking such a shift unlikely. But lending overseas has already exploded over the past couple of years, growing by 20%-25% a year.

Lending abroad is significantly easier to grow than lending at home, where neither borrower nor lender has had any experience of borrowing for a generation. But this rate of growth in any form of lending at all tells us that Japan's banks are no longer the weaklings they were. Along with the absence of new loan loss provisions (bad debts aren't rising), it suggests that their balance sheets are finally fixed. In fact, according to the US's Federal Deposit Insurance Corporation, the two largest Japanese banks are better capitalised than most international peers and all European banks.

Japanese banks only haven't been lending much at home, because deflation has made it pointless. That's because in a deflationary scenario, a bank doesn't need to pay depositors much above zero. That means that it can keep a large percentage of the deposits it gets in very low-yielding government bonds. If prices are falling, merely receiving the principal back from the government when the JGB matures earns a real return, with the added bonus that such assets cannot default. But now that the BoJ is aiming to double the monetary base, the banks know that merely getting your money back from a risk-free asset isn't going to cut it anymore. Solvent banks which Japanese banks now are need to see where they can earn a higher return.

However, they can't just keep lending abroad: with foreign lending already 50% higher than it was just two years ago, banks have, no doubt, already exhausted many of the best opportunities. At the same time, Western-style QE leaves them with more deposits to deal with than old-style Japanese QE ever did. When the BoJ buys long-dated JGBs, the sellers deposit their money with the banks. So not only do banks have to decide what to do with the assets they were holding as short-dated bonds (which inflation is making unattractive); they also have a new flood of deposit liabilities against which they must decide what the appropriate asset is to hold. This twin attack by the BoJ will force the banks to act and to lend.

There is another key difference between today and 2002-2005. Back then, banks were dealing with potential insolvency, were realising significant loan losses (about 3% of total loans each year), and were shrinking their overall loan books at a rate of 5%-6% a year. This time, loan losses have dried up and overall lending has been expanding for almost two years. Banks are being flooded with liquidity, and for the first time in a long time they are not suffering a lack of capital. The liquidity has to go somewhere the most logical next step has to be domestic loan expansion. And the most obvious geared recipient of a potential new credit boom? Land.

The cheapest asset class in the world

After 20 years of credit drought, there is no cheaper asset class in the world than Japanese commercial property. Land has lost three quarters of its value since its peak in 1992. Prices could double and still be less than half what they were 20 years ago. With 200trn of fully funded deposits in the banking system (100trn in the city banks alone) yet to be lent out, the upside could be vast.

The impact of a new credit cycle on land prices could be huge and there is also the impact of higher land values on company earnings to consider. Not only do higher land values improve corporate wealth, making balance sheets look healthier, but they can also boost profits if the land is sold, or contractors are employed to upgrade or redevelop it.

Japanese firms haven't been idle in the past 20 years of credit contraction. Despite being assaulted by a constantly appreciating yen (rising about 3.3% a year against the dollar over the last four decades), corporations have steadily grown pre-tax profit margins, even as operating margins continue to decline the sign of a maturing economy. The margins on profits before tax in Japan are now higher than at any time since the 1950s (bar a brief moment in 2006-2007). However, at less than 5%, they're still some way behind other mature economies such as America (on 14%).

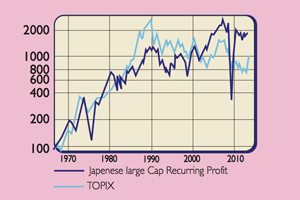

This wouldn't necessarily be so exciting, except that equities have also just come off their lowest levels relative to underlying profits in recorded history. The chart right shows the TOPIX index rebased to large company profits before tax (using Ministry of Finance data).

At the recent lows, Japanese stocks were as far below the profit line as they had been above it at their peak in 1989. The recent rally, while impressive, still has some way to go before it can close the gap even with profits at this level yet if Kuroda stays the course, the profit line is likely to start pulling increasingly ahead.

We know that the kind of QE Japan is now using boosts stocks (and weakens currencies). In Japan's case, however, the effects will not be limited to stocks alone. With a banking system that shows all the signs of being fixed, BoJ stimulus is likely to find its way not just into the stockmarket, but into the real economy too, boosting lending, money supply, land prices, corporate profits and then stocks again.

The two asset classes that will pay the price will be the yen and bonds. Japan's curse and its blessing has always been the positive feedback loops that connect asset values and earnings. For the decade leading up to 1990, this feedback loop was a blessing; for the last 23 years it's been a curse. From now it could easily prove Japan's blessing once more.

James Ferguson is founding partner of The MacroStrategy Partnership.

Five of the best investments

Fund managers make money by attracting savings from investors, then extracting fees from this cash pile. So while you might think that they'd care about beating the market, what they really want is a hot story to sell think endless Chinese growth, or hot social media stocks. That makes Japan their ultimate marketing nightmare. If you want to flog funds to private investors, a 20-year bear market doesn't make for an easy sales pitch.

However, it also suggests that those fund managers who've actually managed to survive in this deeply hostile environment should be pretty good at their jobs. And so it turns out. Simon Evans-Cook of Premier Multi-Asset Funds recently calculated that the average Japanese fund has beaten the FTSE Japan index by 9.9% over the past five years. In other words, it's one of the few markets where active management has beaten holding a tracker fund. So in this case at least, it seems there's good reason to favour those battle-hardened active fund managers who've managed to endure the long Japanese bear market.

James Ferguson likes Sarah Whitley at Baillie Gifford, who manages the Baillie Gifford Japan Trust (LSE: BGFD) (share price up 71%, 107% and 113% over the past one, three and five years). This trust currently trades at a discount to net asset value of 2.7%. She also co-manages the Baillie Gifford Japanese unit trust, which charges an annual fee of 1.5%, and is up 49% (one year), 61% (three years) and 78% (five years).

He also likes Paul Chesson, head of Japanese equities at Invesco, who manages the Invesco Japanese Equity Core (up 87% over one year, charges 1.5%) and Invesco Perpetual Japan (up 36%, 18% and 58%; annual charge 1.5%) funds. Another option is Ed Merner at Atlantis, who manages the Atlantis Japan Growth (LSE: AJG) trust. Annual charges come in at 1.68%, and the fund is up 37%, 71% and 27%. It trades on a discount to net asset value of 8%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

James Ferguson qualified with an MA (Hons) in economics from Edinburgh University in 1985. For the last 21 years he has had a high-powered career in institutional stock broking, specialising in equities, working for Nomura, Robert Fleming, SBC Warburg, Dresdner Kleinwort Wasserstein and Mitsubishi Securities.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.