Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We had another good day for gold yesterday, as it climbed momentarily above $1,150 an ounce. The strength and speed of this move is surprising even me.

They say the hardest thing about riding a bull market is staying on. The bull will always try to throw you off. There are many who have not been as exposed to this move as they would have liked. Some have missed it altogether.

Now the bubble-callers are out once again. So today let's look at a couple of their most recent arguments and see if they carry any weight...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

One of my definitions of a bubble is "a bull market in which you don't have a position". How many of those that say gold is in a bubble are acting out of resentment over the fact that they have missed the move? A fair few, I daresay.

Yes, gold has had a fantastic run and is starting to look overbought. But this is a bull market. Bull markets can stay overbought for long periods of time. Overbought readings show that money is moving into the market at a quickening pace. We have always said that gold is small market and when institutional money moves in it will quickly push things higher. That is what is happening.

Are adverts offering to buy your gold a sign of a bubble?

A number of people have pointed to the proliferation of adverts offering to buy your gold as a sign of a bubble and a top. I had an email from a young man of Essex saying there is one such institution loudly making this offer in his local shopping centre in Romford. I frequently pass a huge hoarding on Wandsworth Bridge.

But these companies are offering to buy your gold. They are buying gold off Joe Ignorant. It is when they start offering to sell you gold that alarm bells should be ringing. Joe Ignorant is selling his gold to them, because he doesn't know its potential. It is when Joe Ignorant starts buying that we are headed into bubble territory.

- Why UK property prices are going to fall 50%

- When it will be time to get back in and buy up half price property

I believe the model of these companies is to buy gold jewellery (which isn't pure, by the way - other metals are mixed in to make it harder. 24 carat gold jewellery is considered too soft). They pay below spot rate for the gold, melt it down and then sell it as scrap at closer to the spot rate which is moving higher every day. (Do please email me if you work for one of these businesses and let me know if I've described that model correctly).

How about a new gold mine in Scotland?

I had another email about Scotgold, an Australian company which is building a gold mine in Scotland, saying that if the gold rush has reached the Trossachs, this points to a bubble. Again I don't agree. Gold is a depleting resource. Like all resources, the easy-to-find stuff has been found and mined. Now it is being discovered in increasingly remote and unexpected locations around the globe. Oil was found goodness knows how many feet under the North Sea off the coast of Scotland. Did this mean oil was in a bubble?

There is (rightly) a lot of excitement about this mine because it's the first gold mine in Scotland for a very long time. But, in the grand scheme of things, it's a tiny mine, with a goal of producing 20,000 ounces by 2011. There was a similar story about a gold mine in Northern Ireland a few years back, owned by a company called Galantas Gold. There was a furore of excitement, the stock price popped and dropped, and the company has had barely a mention since. But they have quietly gone about their business and, having gradually overcome the inevitable problems that strike all miners, are now producing gold at a small profit.

If there's any bubble at all, it was in the press coverage of these mines, not in gold itself.

Gold's headed for a bubble, but it's not there yet

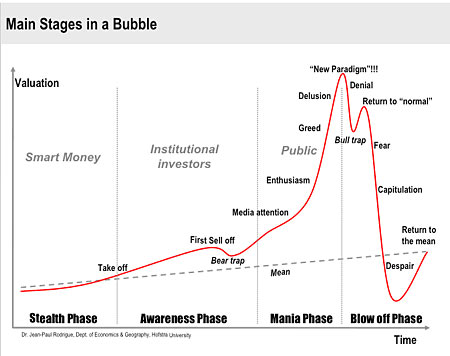

We've heard it all before. Gold was in a bubble two years ago when it hit $650 an ounce, and before at $500. Gold will hit bubble territory one day but we are not there yet. I have a number of long-term price targets, which I shall outline in a future Money Morning. This bull market, which began in 2001, is now some eight years old. We are beyond the stealth phase and into the awareness phase (see chart below from a previous Money Morning).

Institutions have woken up to it, investors have woken up to it but not all of them. We are not at the mania phase yet, there is no "new paradigm". That will come in several years' time - perhaps as governments and central banks start to talk about returning to a gold standard or similar.

Of course we could easily have a correction here. The bull market could easily throw people off yet again, and the US dollar is due a rally which would hurt gold. But gold is not in a full-blown bubble yet unless, that is, you are using my definition of the word: a bubble is a bull market in which you don't have a position.

We've more on gold, and how to buy it, in the current issue of MoneyWeek if you're not already a subscriber, subscribe to MoneyWeek magazine.

Before I go, here's a quick mention about The MoneyWeek Alliance. In case you haven't heard, the service a lifetime subscription to MoneyWeek plus all our best newsletters - reopened just over a week ago, but it's set to close its doors to new members tomorrow. So if you want on board, you need to apply now. If you're interested in test-driving the service for 30 days, find out more here.

Our recommended article for today

Three ways to profit from a high oil price

Increased demand coupled with a shortfall in exploration and production could lead to oil prices spiking, says Dave Fessler. Here, he tips three drilling companies that should profit handsomely.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King