Profit from the Google v iPhone war

With the launch of Apple's iPhone, demand for smartphones has gone through the roof. And now with Google entering the hardware market, things will only hot up. Eoin Gleeson looks at the sector, and tips two companies poised to cash in on the popularity of next-generation mobile handsets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Google is in the mood for an almighty showdown with Apple. This week, the technology giant confirmed its shock move into the mobile phone business with the release of the Nexus One a sleek handheld, which is being described as the "iPhone on steroids".

In the last two years, Google watched the iPhone eat into the hugely lucrative smartphone hardware market, gaining fast on long-time leaders Nokia and Research in Motion, makers of the BlackBerry. At the same time, and despite serious efforts, Google has made little headway in moving its core click-through advertising business onto our phones. It's tried to gain an extra foothold through software, developing the Android operating system, but Android phones still only account for 5% of the smartphone market. So finally, it's gone ahead and built its own hardware, knowing that it can't afford to be left behind anymore.

The demand for smartphones borders on the hysterical. When Apple first shipped the device, they had to hire armed personnel in ports to guard containers as they arrived. And the recession did nothing to dampen enthusiasm. Tech research firm Gartner says that, while global handset sales fell 6% in the second quarter of last year, smartphone sales leapt 27%. By 2014, smartphones will capture 37% of the worldwide mobile phone market, up from 16% in 2009, forecasts telecoms analyst Pyramid Research.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's a bit late to buy Apple or Google; they trade on pretty steep valuations. So how can we profit? There are two ways. First, buy the technology that goes into the phones. When the iPhone was released two years ago, some of the first buyers rushed home to prise the phone apart to see what companies made the parts. Smartphones include a host of technologies that do everything from managing power to improving signals and smooth handover between networks. Companies that create and patent these technologies are paid well by the likes of Apple to license their innovations.

The other angle is to focus on one of the iPhone's problems. Ever since release, US users have been hampered by terrible internet service. That's not Apple's fault it's mostly down to carrier AT&T failing to anticipate the level of bandwidth that iPhone users would soak up when it took on the contract. In the three years since the iPhone's debut, data traffic on AT&T's network has soared 5,000%, notes Peter Burrows in BusinessWeek. Much of that is due to demand for online video, which is exploding everywhere. In the third quarter of last year alone, we spent 35% more time watching clips on the internet than the year before, according to ratings tracker Nielsen.

A short video takes as much bandwidth as 500,00 text messages, so AT&T will invest $7.5bn in its network this year in an effort to keep pace with video demand, according to tech research firm Ovum. But rolling out miles of fibre-optic cables is expensive. By storing large files in a data centre, you can get around the problem of sending huge files over long distances and clogging up your network, says Anders Bylund on Motley Fool. Companies that own these local data centres called content delivery groups will dominate the age of online video, and delivery to mobiles will be a $16bn industry by 2014, says Pyramid. We take a look at one sector kingpin below.

The best bets in the sector

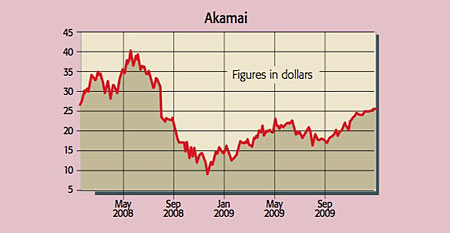

Akamai (Nasdaq:AKAM) has been alleviating bandwidth bottlenecks for over a decade. We've spelled out its qualities several times before. It has a formidable network of servers in 1,500 locations across 650 cities controlling nearly 50% of the content delivery market. Akamai also has a strong balance sheet with $900m in cash. It's up 35% since we tipped it last year. But on a forward p/e of 16 times, according to Bloomberg data, it's worth holding as the video delivery demand booms.

Interdigital (Nasdaq: IDCC) is a world leader in the technology that drives smartphones. In the last two decades, the company has created some of the fundamental building blocks of wireless technology, says Paul Hill in his PGI newsletter from facilitating network handover to managing power and bandwidth. Its 4,800 patents are licensed to the likes of Apple, LG Electronics and Samsung (with whom a $400m deal was announced in January), at near 100% gross margins on each licence. Its products are found in nearly 50% of smartphones on the market.

On the downside, the firm has failed to land a contract with industry leader Nokia, with the International Trade Commission recently ruling that Nokia's alternative technology does not infringe on four of Interdigital's patents. The group is also quite reliant on the mature Japanese market - its three biggest customers based there account for 50% of sales. Nevertheless, the company has 9,000 patents pending, and trades on a forward p/e of nine times.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King