Shares in focus: United Utilities

United Utilities provides water and waste-water services to 3.2 million households and more than 400,000 business premises in England. It's seen revenues rise recently, so should you buy in? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

United Utilities hasseen revenues rise recently, so should you buy in? Phil Oakley investigates.

What is United Utilities?

United Utilities (UU) provides water and wastewater services to 3.2 million households and more than 400,000 business premises in the northwest of England. Its assets include 184 reservoirs, 575 wastewater treatment plants and over 85,000 kilometres of water mains and sewers. These were valued at £8.4bn in September 2011. The company's revenues and profits are regulated by Ofwat, which reviews customer bills and investment levels every five years.

What is the company's history?

North West Water plc was formed in 1989 during the privatisation of the British water industry. In 1995 it merged with electricity distribution company Norweb to create United Utilities. In addition to its regulated activities, the company built a portfolio of non-regulated businesses during the late 1990s with investments in telecoms, support services and international water companies. During the last decade, the utility businesses faced the combined challenges of tough regulatory reviews and high levels of debt. The result was a change in strategy and a cut in dividends. In 2006 and 2007, United Utilities sold its telecoms, electricity distribution and business outsourcing companies. With the remaining support services business sold in 2010, it is now a pure water company again.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Who runs it?

Steve Mogford (a former chief operating officer at BAE Systems) has been chief executive since April 2011. His base salary is £650,000. Former ICI chief executive John McAdam is chairman. Russ Houlden is chief financial officer.

How is trading?

Results for the six months to September 2011 saw revenues rise by 3.9% to £793m, but higher investment costs led to operating profits falling by 1% to £324m. Higher interest costs resulted in a 2.5% fall in underlying earnings per share to 19.9p and the interim dividend was raised by 6.7% to 10.67p per share.

What's the outlook?

Good financial planning and efficiency improvements should allow the firm to increase its annual dividends by 2% more than inflation until 2015. The longer-term outlook is more uncertain. The company faces an Ofwat review of prices in 2015, while the current benefits of its inflation-linked revenues could prove to be temporary. Water companies have yet to demonstrate that they can generate enough surplus cash to cover dividends and have relied on rising asset values and debt to increase payouts.

Our view

The attractions of inflation-linked revenues and a 5.3% yield are already priced into the shares. Hold.

The analysts

Of the 17 analysts surveyed by Bloomberg, seven say "buy", eight say "hold" and two advise investors to "sell". The average price target is 676p 11% above the current share price. The most bullish of the analysts is Exane, with a 770p price target, whereas Socit Gnrale is most bearish of all: it has a 488p target.Asset performance director, Steven Fraser, sold 3,869 shares on 30 September, while chief executive officer Steve Mogford purchased 15,928 shares on 27 May.

Directors' dealings

Executive directors must hold the equivalent of their annual salary in shares within five years of appointment. Dealing transactions are shown in the chart on the left, with management's shareholdings shown in the table below.

R Houlden 47,333

J McAdam 1,837

S Mogford 95,047

The numbers

Stockmarket code: UU

Share price 607p

Market cap: £4.1bn

Net assets (September 2011) £1.8bn

Net debt (September 2011) £5.0bn

P/E ratio (current year estimate) 16.2x

Yield (prospective) 5.3%

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

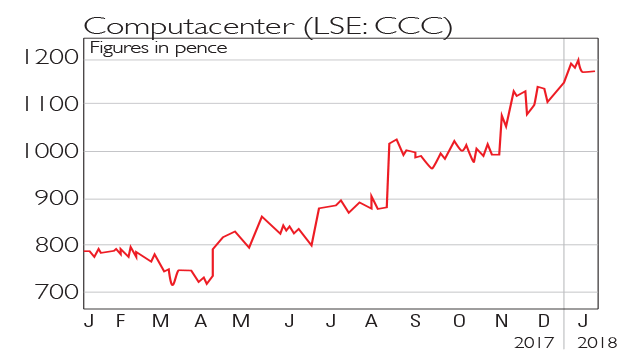

If you’d invested in: Computacenter and United Utilities

If you’d invested in: Computacenter and United UtilitiesFeatures IT support firm Computacenter is trading ahead of expectations, while the UK’s largest listed water company is looking exposed to inflation and political risk.

-

Shares in focus: Water stocks offer no safe harbour

Features Utilities are popular with nervy investors – but you can overpay for safety, says Phil Oakley.