Shares in focus: Water stocks offer no safe harbour

Utilities are popular with nervy investors – but you can overpay for safety, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The shares of regulated utilities, such as water companies, are often seen as safe havens by investors. Demand for water won't change much, even in a recession. So the profits and dividends of these defensive stocks are considered reliable. There's an element of truth to this, but that doesn't mean you can bank on a higher dividend year after year.

UK water companies were sold to the public 25 years ago. For the first ten years investors did well. Profits and dividends boomed and some companies were taken over. But the last 15 years have been more mixed.

The industry regulator, Ofwat, has become a lot tougher, squeezing the amount of money that companies can charge their customers. As a result, the utilities have become less profitable.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet water companies remain popular with investors. Their assets and revenues are closely tied to the rate of inflation, which has made them particularly attractive to long-term buyers, such as pension funds.

Water companies have continued to be taken over or bid for because they can offer better inflation-proofed returns than index-linked government bonds. So even though they've been loaded up with lots of debt, and now have less scope to cut costs, the last five years have seen something of a bull market in water shares.

If you had invested in any of the three remaining listed water companies Pennon (LSE: PNN), Severn Trent (LSE: SVT) and United Utilities (LSE: UU) you would have at least doubled your money and have trounced the performance of the FTSE All Share index in the process.

And in the last 12 months alone the share prices of Severn Trent and United Utilities are up by more than a third, while Pennon has gained 15% better than a stockmarket tracker fund.

This in itself is quite surprising. Water company share prices don't tend to do well in a year like this one, when Ofwat sets a new five-year pricing limit, because markets are concerned about what might happen.

Last Friday, the regulator told water companies that they would have to cut their bills, while still spending lots of money to reduce water leakage, stop flooding from sewers and clean up beaches. Ofwat also lowered the rate of return companies could earn on their regulated assets to reflect the fact that the cost of borrowing remains cheap.

The outlook for water companies

Five years ago, after the last review, both United Utilities and Severn Trent had to cut their dividends before growing them again. Pennon didn't have to, due to its fast-growing, unregulated waste management business.

It's probably too early to say what will happen for the next five years, but my hunch is that Severn Trent's and United Utilities' shareholders might fare a bit better than Pennon's this time around.

Ofwat's website has lots of data on the review, much of which the average private investor would struggle with. But buried in the depths are spreadsheets with details of how much money Ofwat expects each company to make between 2015 and 2020.

I reckon that if all the expected after-tax profits are paid to shareholders, then Severn Trent and United Utilities can maintain and grow their dividends. I don't have the same confidence about Pennon.

Its waste management unit makes a lot less money than it did a few years ago, while Ofwat is assuming that profits at its South West Water division won't grow much. I've looked at this in more detail in the box on the left.

Verdict: hold United Utilities andSevern Trent, sell Pennon

Which water stocks can keep paying their dividends?

This often happens around a price review but it didn't this time. A premium (paying above the RAV) is warranted if a company can make more money than the regulator expects, or if it is being taken over.

| Share price | 865p |

| Market Value | £3,449m |

| Net debt | £2,106m |

| EV | £5,555m |

| Estimated RAV | £3,000m |

| Value of SWW at 1.2x RAV | £3,600m |

| Implied Value of Viridor | £1,955m |

| Peak Profits 2010/2011 | £82.6m |

| EBIT/EV on peak profits | 4.23% |

| EBIT/EV on current profits | 1.45% |

| Last 12m div per share | 30.8p |

| Dividend yield | 3.56% |

Northumbrian Water was taken over a few years ago at a 25% premium, for example not far off the current valuations of Severn Trent and United Utilities, as the table above shows.

Pennon is slightly different given that it has a significant non-regulated business, Viridor. This has been richly valued by City analysts in the past, but its profits have been falling. Valuing Pennon is complicated, but it looks expensive on my ready reckoner (see below).

| Share price | 1,937p | 903p |

| Shares | 239.6m | 681.9m |

| Market value | £4,641m | £6,158m |

| Net debt | £4,383m | £5,684m |

| Enterp. Value (EV) | £9,024m | £11,842m |

| RAV | £7,741m | £9,800m |

| EV/RAV | 117% | 121% |

| Last divi/share | 82.2p | 36.6p |

| Dividend yield | 4.24% | 4.05% |

If I value South West Water at 120% of its RAV then the value of Viridor looks very rich indeed. Even on its peak profits, a buyer would be getting an earnings yield (EBIT/EV) of just 4.2%, which doesn't look appetising and it's current profits are even lower.

Pennon is hoping that its big investments in waste-to-electricity power plants will pay off they just might. But if they don't, a dividend cut is possible.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

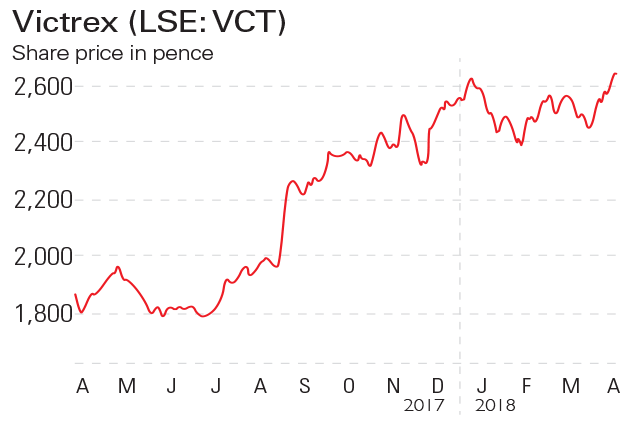

If you'd invested in: Victrex and Pennon Group

If you'd invested in: Victrex and Pennon GroupFeatures Victrex, which manufactures high-performance plastic, has seen it share price soar, while water utility and waste-management firm Pennon group's shares have plunged.

-

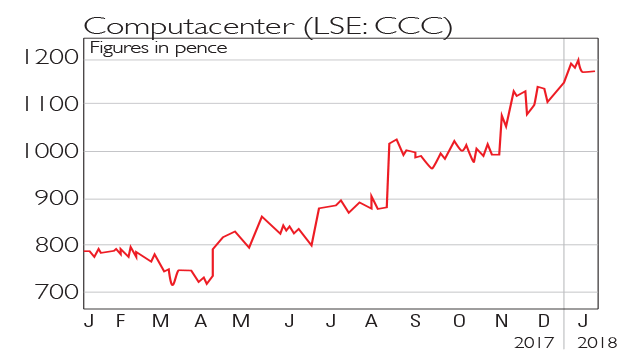

If you’d invested in: Computacenter and United Utilities

If you’d invested in: Computacenter and United UtilitiesFeatures IT support firm Computacenter is trading ahead of expectations, while the UK’s largest listed water company is looking exposed to inflation and political risk.

-

Pennon Group approached for takeover bid for South West Water

News Abu Dhabi Investment Authority is reportedly considering a bid for Pennon Group's South West Water.

-

Shares in focus: United Utilities

Shares in focus: United UtilitiesFeatures United Utilities provides water and waste-water services to 3.2 million households and more than 400,000 business premises in England. It's seen revenues rise recently, so should you buy in? Phil Oakley investigates.