If you’d invested in: Computacenter and United Utilities

IT support firm Computacenter is trading ahead of expectations, while the UK’s largest listed water company is looking exposed to inflation and political risk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

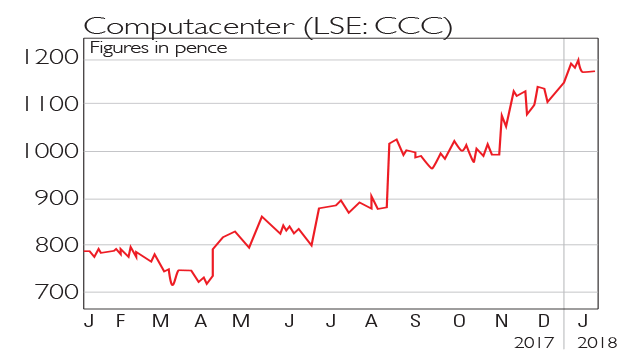

If only

Computacenter (LSE: CCC) provides IT services throughout the UK, France, Luxembourg and Belgium. In the six months ended 30 June, adjusted pre-tax profit rose 65.6% to £41.9m compared with the same period a year ago. In November the firm said its trading results for the year would be "comfortably in excess" of its expectations as it saw a solid start to the fourth quarter and a growing pipeline for the rest of the year.

Be glad you didn't buy

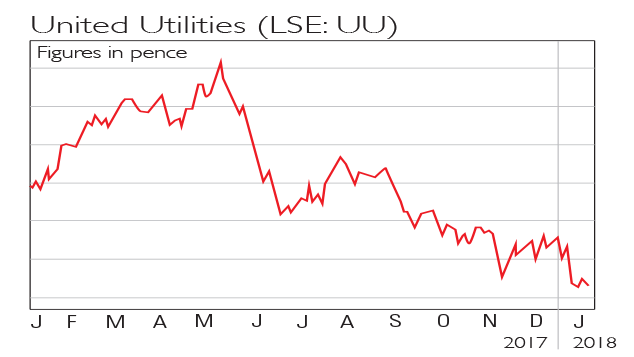

United Utilities (LSE: UU) is the UK's largest listed water company. With the Retail Price Index inflation measure at a five-year high, the firm has endured a turbulent year, despite posting a 10% growth in half-year profits in November. The same month, its battle against rising inflation also drove its shares down to five-year lows after analysts at HSBC raised the alarm regarding its exposure to inflation and increased political risk.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Shares in focus: Water stocks offer no safe harbour

Features Utilities are popular with nervy investors – but you can overpay for safety, says Phil Oakley.

-

Shares in focus: United Utilities

Shares in focus: United UtilitiesFeatures United Utilities provides water and waste-water services to 3.2 million households and more than 400,000 business premises in England. It's seen revenues rise recently, so should you buy in? Phil Oakley investigates.