Commodities

The latest news, updates and opinions on Commodities from the expert team here at MoneyWeek

Explore Commodities

-

Gold price plummets, then stabilises: what’s going on with the price of gold?

A sharp selloff in late January and early February has changed the complexion of the gold rally. Where will gold prices go from here?

By Dan McEvoy Last updated

-

The top stocks and funds to buy according to DIY investors

Nvidia dropped out of Interactive Investor’s top ten most-bought stocks in January for the first time in six months as investors veered away from US megacaps

By Dan McEvoy Last updated

-

Should you add gold to your pension?

Gold price movements have been eye-catching over the past year. Should you put some gold in your pension?

By Dan McEvoy Published

-

Will silver’s record streak continue?

Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

By Charlie Morris Published

Opinion -

Is now a good time to invest in gold?

Gold prices enjoyed their best year since the 1970s in 2025, but does that make now a good time to invest in gold?

By Dan McEvoy Last updated

-

'Investors should brace for Trump’s great inflation'

Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

By Matthew Lynn Published

Opinion -

The state of Iran’s economy – and why people are protesting

Iran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

By Simon Wilson Published

-

How to invest in gold

There are a number of ways you can invest in gold, from buying the yellow metal directly to investing in a gold ETF or buying gold-mining stocks. We look at the pros and cons of each strategy.

By Dan McEvoy Last updated

-

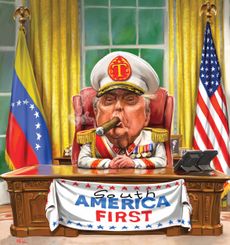

Why does Donald Trump want Venezuela's oil?

The US has seized control of Venezuelan oil. Why and to what end?

By Simon Wilson Published