The simple way to find low-risk trades

If you can spot the trend-change early on, a low-risk trade is yours for the taking. John C Burford explains how it's done.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

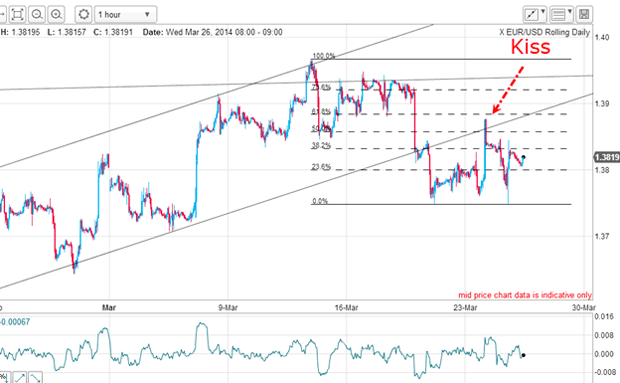

When I covered the EUR/USD last Friday, I noted that the market had rallied to my line in the sand' just above the 1.3950 area on 13 March. Since then, the market has been edging down - but not before making a traditional kiss on my lower tramline.

So today, I want to show you how you can use a tramline kiss to make a low-risk trade. This is especially useful if you have missed the first opportunity.

Keep an eye out for this tradable event

But even before this stage was reached, I had an excellent short entry based on my smaller-scale tramline pair:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As noted, the downward break of the triangle (outlined in green) in conjunction with the lower tramline break combined together to give me my trade signal. And a close protective buy-stop could be placed just above the upper green line, giving a low-risk trade. Remember, I am only interested in low-risk trades.

If I have a possible trade where a logical stop would be too far away, I refuse it. I suggest you adopt the same strict policy.

With the move lower, I then searched for a larger-scale tramline pair. This is what I found:

The tramline pair I found was very satisfactory, with the PPPs (prior pivot points) on the upper line. The gradually sloping line is my line in the sand. Recall this line is two years old and represents major resistance. This is why I expected the trend to change from up to down.

How to know when the trend will change

But if you can recognise a likely trend change early, then you have a low-risk trade. Why low-risk? Because if the trend has not changed, the market will move up and take you out for a small loss.

Remember, I am only interested in small losses.

So is there another low-risk opportunity now that the market has moved lower and has likely confirmed a trend change?

Since Friday, the market stabilised and moved up and made a kiss on the lower tramline. In fact, there was a slight overshoot as the market had a knee-jerk reaction to the news that the European Central Bank was not ruling out instigating a quantitative easing (QE) operation of its own. Such a development would likely be bearish for the euro.

Here's the reason why I trade the spikes

The kiss ended just shy of the Fibonacci 62% level, which is the most common level where turns occur. The market was battling the very strong resistance of the lower tramline with the natural rallying tendency to reach the 62% level.

This tug-of-war action is common at such volatile times. That was why I was not surprised the market missed the ideal turning point.

In any case, the spike up and down was over in just a few minutes and this illustrates my strategy for trading these spikes.

After a tramline break and if I anticipate a kiss, I will enter a resting limit order and my stop level before the hoped-for event. That removes the necessity of continually staring at my screen, which is normally a distracting habit anyway.

And the best part is that now I have a second low-risk entry.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets