Is the euro about to hit a major target?

The euro has been in solid rally mode in recent weeks. But are we now due a trend reversal? John C Burford examines the charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When I last covered the EUR/USD on 3 March, tensions over the Ukraine were only starting to emerge. Since then, these tensions have escalated. And that, of course, has impacted the markets.

The EUR/USD has certainly not been immune to the events that have unfolded in Crimea. With the reported flow of funds out of Russia and into the euro, the EUR/USD has been supported somewhat and this extension of the rally negated my best guess that I suggested last time.

But no damage has been done because I had no position, having been stopped out previously at break-even. I have been looking for a top in the euro for some time, and the Ukraine situation has provided me with an excellent trade and at a better price - as I will show.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Drawing a line in the sand

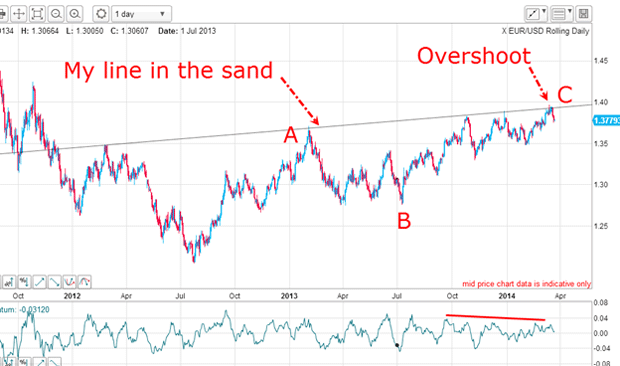

I have drawn in a line connecting all of the major highs since February 2012 a full two years ago. This well-established line of resistance is highly significant. A solid break above it would likely indicate a powerful resumption of the rally.

That is why I considered it to be my line in the sand for my short stance.

But the most recent challenge to this line in the last few days has produced an overshoot. Recall that an overshoot coming at the end of a long trend is very often a sign that the trend has become exhausted and the next major move is very likely down. Overshoots often take out the last remaining weak shorts at their buy-stops, which they place above the line.

That was my first clue that I should be on high alert for a short entry, since the test to push up through the line looked like it was failing.

On top of that, the rally of the last few months has been made on weaker momentum, indicating a relaxing of buying power.

Are we seeing a trend reversal?

The Ukraine rally' off the late February low is contained within the trading channel of my tramline pair. The important tramline is the lower one, since I am anticipating a move down.

And note the small wedge contained by my green lines. A wedge is very often a reliable pattern to indicate a trend reversal.

This lower tramline is a very good line, because it has several accurate touch points. Remember, the more accurate the touch points you can find for your tramline, the more confidence you can have in it. Breaking this line of support would be significant and a likely prelude to a trend reversal.

This rule is especially valid when it comes at the end of a well-established trend, as this one has.

Why I prefer trading the tramline breaks

Somehow, I have grown to specialise in tramline breaks and hence trend reversals.

One reason I like them is that when a trend reverses, you often find very sharp moves against the trend as the overwhelming army of longs (in a bull market) are stopped out. That's when the concerted selling produces a cascade effect. And this results in your trade being in good profit right from the get-go. I like to see that.

So where to place my short entry? The textbook entry is to place a resting sell stop order just below the lower tramline at the 1.39 level. This is slightly ahead of the vast majority of sell-stops. I reasoned that if the market touched this level, the sell-stops would start to be set off, much like a Chinese cracker, but without the bangs!

And right on cue, the stops were run and the market quickly dropped by 100 pips in about 20 minutes, placing my trade in profit right from the start.

It is always satisfying to enter a trade and see an immediate profit. Often, we must endure a period of the market going against us after we have entered. This is when stress levels can build up and that can affect your judgment adversely.

If you are such a trader, I suggest looking for this kind of set-up as your preferred trades.

Why I think the Ukraine rally' is over

I have another tramline pair! This one is terrific with the multiple PPPs (prior pivot points). Yesterday, the first decline hit the centre line, made a small bounce off that support, and then plunged through it and is currently heading for the lower tramline in the 1.37 area.

This plunge looks very much like a small-scale third wave which could end at or near the lower tramline.

Several months ago, I had a major target on the EUR/USD at the 1.28 area (the July 2013 low). Have we begun the journey towards it?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King